Review MFM Securities

https://www.mfmsecurities.com/ Headquarters in Vanuatu Open Demo Account Open Live Account BEGIN item ContentsPros and ConsRegulationAccount TypesTrading PlatformsAssetsEducationCustomer ServiceConclusion

https://www.mfmsecurities.com/ Headquarters in Vanuatu Open Demo Account Open Live Account BEGIN item ContentsPros and ConsRegulationAccount TypesTrading PlatformsAssetsEducationCustomer ServiceConclusion

MFM Securities is a Vanuatu based forex and CFD broker that was formed recently and is aiming to become a top broker by offering clients the best execution, spreads, and service. The broker is focused on the Asian region but has also grown to service clients all across the globe. They have even been selected as the best new forex broker in southeast Asia for 2021 by Global Banking and Finance Review.

MFM Securities offers Contracts for Difference (CFDs) on 5 asset classes: Stocks, Indices, Forex and Commodities. They provide each client with access to top-tier liquidity and advanced trade execution with no dealing desk intervention. They also allow for trade in over 100 of the world’s top large-cap stock CFDs.

MFM Securities offer many different platforms to suit your trading needs. Industry leading trading platforms, MetaTrader 4 and MetaTrader 5 are available, as is the award-winning Trading Central for research and education. Each can be added directly on your PC, mobile or tablet so that you can trade at your convenience whenever you like.

Trade and invest in top financial instruments, including a wide selection of stocks. Enjoy near-instant execution of market orders and no daily withdrawal limits. Invest in various markets on an intuitive trading platform.

MFM Securities Pros and Cons

Pros

Various trading platforms availableVery low minimum depositExcellent selection of assets

Cons

Tier-2 regulationcommissionsHigher than average commissions

Broker Regulation

MFM Securities is located in Vanuatu and is fully authorized and regulated by the Vanuatu Financial Services Commission (VFSC) under license number 700451. This means that the broker needs to follow all the relevant regulations of the VFSC, many of which are directed specifically towards the protection of broker clients. However, unlike the more developed regulators there is no compensation fund for investors, nor are there other protections that are common with European regulators.

Account types

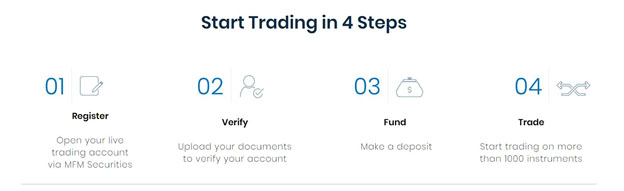

MFM Securities provides four different types of accounts: Micro, Standard, ECN, and Prime. These account types are pretty similar, with the difference being the minimum deposit requirements, the leverage available, and the spreads/commissions.

Here are the account types at MFM Securities and their features:

Micro

Minimum Deposit – $15Floating spreads as low as 1.8 pips (EUR/USD)Maximum leverage 1:1000No CommissionsAssets included: FX and CommoditiesTrading Central included (Market Buzz, Analyst Views, Featured Ideas, Economic Insight, Daily Market Analysis and Web TV)

Standard

Minimum Deposit – $25Floating spreads as low as 1.8 pips (EUR/USD)Maximum leverage 1:500No Commissions, except for shares ($10/lot round trip)Assets included: FX, Commodities, SharesTrading Central included (Market Buzz, Analyst Views, Featured Ideas, Economic Insight, Daily Market Analysis and Web TV)

ECN

Minimum Deposit – $100Floating spreads as low as 0.0 pips (EUR/USD)Maximum leverage 1:500$10/lot round trip commissions on all assetsAssets included: FX, Commodities, SharesTrading Central included (Market Buzz, Analyst Views, Featured Ideas, Economic Insight, Daily Market Analysis and Web TV)

Prime

Minimum Deposit – $100Floating spreads as low as 0.4 pips (EUR/USD)Maximum leverage 1:500No Commissions, except for shares ($10/lot round trip)Assets included: FX, Commodities, SharesTrading Central included (Market Buzz, Analyst Views, Featured Ideas, Economic Insight, Daily Market Analysis and Web TV)

Clients can also take advantage of a demo account to test the platform, and Muslim traders are able to access an Islamic account which is swap-free.

Trading Platforms

MFM Securities gives clients two options for their trading platform. The first is the well-known MetaTrader 4 platform, used by more than 10 million traders worldwide. And the other is the equally well-known MetaTrader 5 platform, which is the latest version in the MetaTrader family of trading platforms.

MetaTrader 4 (MT4)

Trading on MT4 has become as popular as it has for one simple reason: Flexibility. No matter where or when you need to access your MT4 platform, you know that you will always have your forex charts at your fingertips.

The MT4 platform offers forex traders the most powerful charting platform on the market. Widely accepted as the industry benchmark in retail forex trading platforms, MT4 is by far the most popular platform for charting out there today.

Using chart studies and indicators is unmatched, with literally tens of thousands of options for forex traders to choose from. This means that no matter your trading style or system, the MT4 platform has a custom charting option exactly for you.

Reliable data protectionAll types of trading orders and MetaTrader 4 execution modesOne Click Trading30 indicators and 24 graphical objects for technical analysis9 time-frames, from one minute to one monthReal-time quotes in Market Watch

MetaTrader 5 (MT5)

MetaTrader 5 is an institutional multi-asset platform offering outstanding trading possibilities and technical analysis tools, as well as enabling the use of automated trading systems (trading robots) and copy trading. MetaTrader 5 is an all-in-one platform for trading Forex, Stocks and Futures.

Millions of users around the world choose MetaTrader 5, attracted by the platform’s exceptional advantages. MT5 allows traders to use more timeframes on an unlimited number of charts in their watch list. Have you ever wanted to see how your trading strategy would run off the 12-minute charts, but been restricted by MT4’s limited timeframe capabilities? With 21 timeframes and one-minute history of quotes available on MT4, moving to MT5 is the smart choice for flexibility.

Available Assets

MFM Securities gives its clients access to a portfolio of over 300 different assets across 5 asset classes. The broker offers stocks, indices, forex, and commodities.

42 indices, including major equity indices, leveraged gold and oil indices, the VIX, and more.Over 200 of the most popular global stocks12 Commodities including crude oil, gold, and silverA dozen different global indicesTrade on over 80 forex pairs, including major, minors, and exotics

Education and Research

MFM Securities provides access to Trading Central for all its active clients. This means clients have access to award winning financial markets research and education. Trading Central is a fusion of automated AI analytics and senior analyst expertise spanning fundamental, technical, news, sentiment and economic analysis. Trading Central tools include all the following:

Fundamental and Technical NewsDaily Market Outlook Newsletter24 hr Multi-asset coverage of global marketsIntuitive Research ToolsActionable Newsroom Information and Trend AnalysisSupport in 32 LanguagesWeb TVExclusive Trading Central Plugin for MT4 and MT5

Customer Service

MFM Securities has a multilingual customer support team that’s available from 9 am – 9 pm (GMT+3), Monday to Friday through live chat, email and telephone.

Email: support@mfmsecurities.com

Telephone: +44 13161 888 32

In Conclusion

Although MFM Securities is a fairly new broker, it seems to be off to a great start, winning awards and growing its client base significantly. It also has a solid online reputation, and regulation from the Vanuatu Financial Services Commission provides its clients with safety, reliability, and transparency.

Plus, clients get the great education and research from Trading Central, as well as access to two of the top-rated trading platforms – MetaTrader 4 and MetaTrader 5. And if that’s not enough, the broker also provides traders with access to the assets that are most in demand, from stocks to forex.

The low minimum deposit requirements are a breath of fresh air in the industry, and it makes the broker accessible to all. And the broker is still able to keep spreads low, although we thought the commissions were a bit high.

Taken all together it seems clear that MFM Securities is a trustworthy broker, with plenty to offer traders of all experience levels and trading types. If you’re looking for a pleasing broker, why not give them a try?

Open Demo AccountOpen Live Account END latest_news