Review NAGA

https://naga.com Founded in 2015 Headquarters in Germany Open Demo Account Open Live Account BEGIN item ContentsPros and ConsRegulationAccount TypesTrading PlatformsAssetsEducationCustomer ServiceConclusion

https://naga.com Founded in 2015 Headquarters in Germany Open Demo Account Open Live Account BEGIN item ContentsPros and ConsRegulationAccount TypesTrading PlatformsAssetsEducationCustomer ServiceConclusion

NAGA is a modern exchange that is focused on social trading, but also provides a good experience for all types and experience levels of traders. Traders can access over 950 different assets from stocks and forex to crypto and ETFs, all as CFDs. The copy trading experience is helpful, especially for new traders, as is the broker’s signals. You will find competitive spreads, low commissions, and blazing execution speeds. Plus, there are a few account tiers that provide increasing benefits.

Clients can take advantage of a wide number of methods for funding their accounts, and benefit from the segregation of all client funds as required by the FCA regulation. There are also a number of trading platform offered, suitable for trading on your mobile device, via a web browser, or through a stand-alone desktop application.

NAGA Also features several unique social trading aspects that will appeal to active traders. These include Auto-copy, a Leader Board, NAGA Feed, NAGA Academy, Popular Investor program, NAGA Messenger, and NAGA Pay.

Below we go into more details regarding the broker, which should make it clear why over 1 million clients call NAGA their broker.

Naga Pros and Cons

Pros

Good regulation through CySECSegregated client fundsExcellent copy trading system

Cons

No U.S. clients accepted$250 minimum depositWithdrawal fees

Broker Regulation

NAGA is a brand of Naga Markets Ltd., a Cyprus investment firm. The parent company over all is The Naga Group AG, a FinTech company based in Germany and listed as a public company on the Frankfurt Stock Exchange. In addition to its public listing, Naga Markets Ltd. is also authorized and regulated by the Cyprus Securities and Exchange Commission (CySEC) under license number 204/13.

With the combination of CySEC regulation and operating as a publicly traded company, Naga is heavily regulated, and clients can feel safe, knowing they are trading through a reputable and trustworthy broker.

Since Cyprus is part of the EU any companies operating from there (including Naga) must abide by the MiFID II requirements, which provide for increased financial transparency and protection for consumers. It also promotes fair competition and improves the efficiency levels in dealing with the broker.

As part of the regulation, all client funds are held in segregated accounts at tier-1 European banks. Plus, NAGA is a member of the Investor Compensation Fund, which can offer compensation to clients if the broker is unable to fulfill its financial obligations.

Account types

NAGA offers an array of six account tiers that go from their basic Iron account to the VIP Crystal account. Account minimums start at just $250, making the broker available to any level of trader, even beginners. Below is a breakdown of the account types and their features:

Iron

Minimum Deposit – $250Standard spreads (EUR/USD 1.7 pips)Copy bonus $0.12 per copied tradeWithdrawal fee = $5Access to webinarsTrade alerts

Bronze

Minimum Deposit – $2,500Standard spreads (EUR/USD 1.7 pips)Copy bonus $0.15 per copied tradeWithdrawal fee = $4PI Dashboard

Silver

Minimum Deposit – $5,000Standard spreads (EUR/USD 1.7 pips)Copy bonus $0.18 per copied tradeWithdrawal fee = $3One-on-one education (2 per month)

Gold

Minimum Deposit – $25,000Improved spreads (EUR/USD 1.2 pips)Copy bonus $0.22 per copied tradeWithdrawal fee = $2One-on-one education (4 per month)Access to premium contests

Diamond

Minimum Deposit – $50,000Platinum spreads (EUR/USD 0.9 pips)Copy bonus $0.27 per copied tradeWithdrawal fee = $1One-on-one education (8 per month)NAGA Profile awareness boost

Crystal

Minimum Deposit – $100,000VIP spreads (EUR/USD 0.7 pips)Copy bonus $0.32 per copied tradeWithdrawal fee = $0One-on-one education (unlimited)

Trading Platforms

NAGA offers a few different platforms for its clients, which includes both MetaTrader 4 and MetaTrader 5, as well as a proprietary web-based platform, and proprietary mobile apps. The decision over which platform to choose is going to be dictated by which features the trader wishes to access, since many features are only available on specific platforms.

So, with the MetaTrader 4 and MetaTrader 5 platforms a trader will have access to CFD trading on all markets, copy trading, and support for the MT4 and MT5 mobile platforms. Those who wish to access the real stock trading feature can only do so with MT5, it is not available with MT4. All in all, a very basic set of features, and it does not take advantage of the many unique features that NAGA offers.

To access those features you need to go with the proprietary platforms. When you use the web trader, or the Android and iOS mobile platforms you can have access to auto copy trading, NAGA Messenger, signals, the newsfeed, and Leaderboard. The NAGA Radar feature, which helps local traders connect with one another, is only available in the Android and iOS platforms.

Available Assets

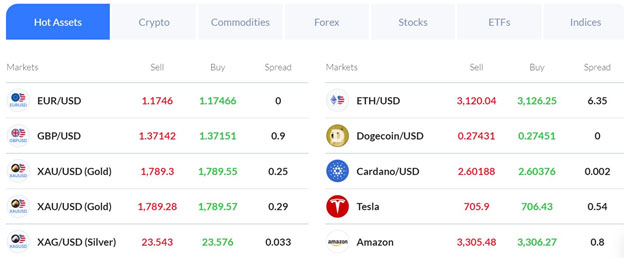

NAGA offers over 950 different assets, which means there is plenty of opportunities for every type of trader. Those assets span the following classes:

Forex: 11 of the most popular forex pairs are available.Cryptocurrency: CFDs on 22 different cryptocurrencies and 27 pairings.Indices: 6 major indices are available, including the S&P 500 and the DAX 30.ETFs: Invest in 17 of the world’s top exchange traded funds.Commodities: 9 different commodities, including popular metals and energies, in addition to agricultural assets like wheat and corn.Shares: Trade on hundreds of the top global company shares with low spreads, competitive fees, and no commissions.

Education and Research

In addition to the useful blog, economic calendar, and regular webinars, clients can also access the NAGA Academy to increase their trading knowledge. The Academy includes over 60 videos on forex, technical analysis, basic trading strategies, and tutorials on how to use all the platforms and features offered by NAGA.

In addition to the videos, you will also find articles, eBooks, and tutorials, as well as the links to register for upcoming webinars. As of the writing of this review the coming week was featuring all the following webinars:

Relative Strength IndexRisk management in ForexCrude Oil Inventories Live Market AnalysisNFP Live Market AnalysisTrading JournalLive market analysisPrinciples of Technical Analysis & The Breakout Strategy

Customer Service

NAGA’s customer service team is top-notch and the representatives are knowledgeable and professional. Support is available Monday through Friday from 9:00 to 24:00 EEST and the team can be easily contacted via telephone or email. There is also live chat available, and a knowledgebase that will have the answers to many basic questions.

Global Support (English):

+44 20 3318 4345

+44 33 0808 8867

Local Number:

+357 25 057336

Email: service@naga.com

In Conclusion

With a history stretching back to 2015 and strong regulation, NAGA is a good choice of broker for those who prefer a social trading experience. The wide range of unique features offered by NAGA can give both new and experienced traders an edge in the markets, and everyone needs an edge.

We also liked the large number of assets available, and the range of account tiers. Educational materials are top notch, and while we could not actually attend a webinar, the fact that they are held every day indicates that NAGA knows what they are doing when it comes to providing traders with excellent information and training.

If you love the social aspects of trading and copy trading, you should take NAGA for a spin and see how they can help you.

Open Demo AccountOpen Live Account END latest_news