Review Windsor Brokers

https://en.windsorbrokers.com/ Headquarters in Cyprus Open Demo Account Open Live Account BEGIN item ContentsPros and ConsRegulationAccount TypesTrading PlatformsAssetsEducationPartnership ProgramsCustomer ServiceConclusion

https://en.windsorbrokers.com/ Headquarters in Cyprus Open Demo Account Open Live Account BEGIN item ContentsPros and ConsRegulationAccount TypesTrading PlatformsAssetsEducationPartnership ProgramsCustomer ServiceConclusion

Windsor Brokers is a long-standing online broker that has been operating in the global markets since 1988. The structure of the broker’s business is distinguished in three different entities, the Windsor Brokers Ltd based in Cyprus and regulated by the Cyprus Securities and Exchange Commission (CySEC), the Windsor Brokers (BZ) Ltd which has offices in Belize and is regulated by the International Financial Services Commission of Belize and the Jordan-based entity that is regulated by the Jordan Securities Commission.

By having three combined business entities the broker is able to offer its services all across the globe to clients in over 80 different countries.

The broker keeps things simple on the account front by offering just two types of accounts. There is the Prime account for less experienced traders who might just be getting started, and there is the Zero account which is designed for experienced traders. It is also possible to take advantage of a demo account to test the trading platform and conditions.

Trading is done via the world-class MetaTrader 4 platform, and Windsor Brokers makes this available for desktop, web-based, and mobile (Android and iOS). The broker rounds things out with a solid education center, and generous partner programs.

Windsor Broker Pros and Cons

Pros

Regulated by the Cyprus Securities and Exchange CommissionMetaTrader 4 is the desktop, mobile, and web platformNegative balance protection

Cons

Commission on Zero account is higher than averageNo cryptocurrencies offeredU.S. residents not accepted as clients

Broker Regulation

With its three separate business entities Windsor Brokers has quite a few regulators keeping an eye on them. Windsor Brokers Ltd is regulated and licensed by the Cyprus Securities and Exchange Commission (CySEC) under license number 030/04. This branch primarily offers its services to clients in the European Union via the website WindsorBrokers.eu. As a CySEC regulated broker it offers negative balance protection and is a member of the Investor Compensation Fund.

Windsor Brokers (BZ) Ltd. is regulated by the International Financial Services Commission in Belize it accepts clients globally, with the exception of the EU, the US, and Belize.

The third business entity is also licensed and regulated by the Jordan Securities Commission under Company National Number 200168191. They accept clients from Jordan and Arabic regions primarily and have an office in Amman.

Account types

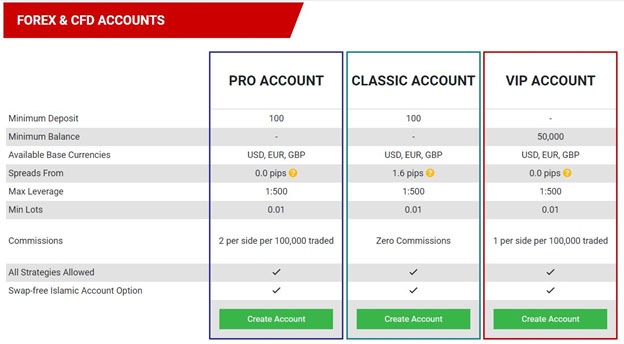

Windsor Brokers breaks from the trend towards offering various tiers and levels of accounts by having just two types of accounts: Prime and Zero.

The Prime account can be considered as an entry level account for newer traders. It has a low minimum deposit of just $100, no commissions, and spreads that start at just 1.0 pips on major forex pairs. It also comes with an account manager and provided training. Traders can also take advantage of leverage that goes as high as 1:500.

The Zero account comes with a $2,500 minimum deposit and was designed with more advanced traders in mind. It has no spreads, but there is an $8 round trip commission on trades. And while there is still a personal account manager provided, there is no training provided to Zero account holders, presumably because the broker has found that these more experienced account holders do not need such training.

Zero account holders can also apply for a VIP Zero account, which is an exclusive trading account specifically tailored for high-net worth individuals. It features three major advantages:

Dedicated Personal Account ManagerOne-on-one sessions with one of our experienced technical analystsLower commission round turn

Note that traders in the EU who trade through Windsor Brokers Ltd. are held to leverage of just 1:30 according to ESMA rules. Professional clients can apply for a professional account, and if they meet the requirements, they can enjoy increased leverage up to 1:500.

In addition, Prime accounts are able to take advantage of Islamic rules that make them Sharia compliant by getting rid of overnight swaps. This is not available for Zero accounts.

Furthermore, there is a demo account available that can be used to test the broker platform and trading conditions.

Trading Platforms

Windsor Brokers offers the tried and tested forex and CFD trading platform – the award-winning MetaTrader 4 (MT4) platform, that is used by millions of traders worldwide. The MT4 platform has all the following features:

In-depth price analysis with 30 built-in technical indicatorsThree execution modes including instant and pending ordersExpert Advisor programs for automated tradingA signals service that allows copy tradingStraightforward and secure loginAnd far more.

Clients can take advantage of all the flavors of MT4, that is the desktop application, the web-based trading platform, or the mobile trading platform. The web-based version works in all modern web browsers and offers all the power of MT4 without the need to download and install software. It also synchs with the other two platforms, which is very convenient.

The MT4 mobile trading experience is also excellent. While the mobile platform is not as powerful as the desktop and web-based platforms, it is a great way to open and close trades while on the go. And it is available for both iOS and Android devices.

One further offering is the MT4 Multiterminal, which allows clients to trade on multiple accounts. The MT4 Multiterminal will allow for trading as many as 128 accounts at the same time, making it the perfect choice for professional traders, or for money managers who are handling many different accounts simultaneously.

Available Assets

At Windsor Brokers it is possible for clients to trade on a broad variety of assets:

Forex – Over 45 forex pairs, including majors, minors, and exotics.Indices – 16 indices offered including the Dow Jones 30 and the FTSE 100.Shares – More than 30 of the world’s largest companies such as JPMorgan and Walmart.Commodities (BZ only) – Five energy and six soft commodities.Treasuries (BZ only) – Four bonds are available including three US treasury notes, plus German Bunds.Metals (BZ only) – Gold and silver against several currencies.

While this is a good selection of assets, and most traders will have plenty of opportunities from this group, it would be nice to see cryptocurrency trading added to the mix.

Education and Research

Windsor Brokers offers a pretty good section on education and research.

There is a blog with a news section and technical outlook for markets that posts articles multiple times daily detailing market moves, world events, and potential trade setups. There is also an economic calendar and a forex calculator, plus a section advising of upcoming market holidays.

In terms of education, clients can take advantage of all the following resources:

A library of 70 educational videos on trading strategies, market analysis and other useful topics.A glossary of financial terms with translations in 12 languages.eBooks on how to succeed in trading forex, stocks, and CFDs.Regular forex webinars for clients.

Windsor Brokers’ Partnership Programs

Those who are interested in referring others to the Windsor Broker platform can benefit greatly from the partnership programs the broker offers. There are a number of ways to take advantage of these programs, including as a Web Affiliate and as a Business Introducer. They even offer White Label services for those who want to start their own CFD broker brand. Look at all the advantages of joining the Windsor Broker Partnership Programs:

Cooperation with an Award-winning broker with 33 years of experienceHigh networking opportunitiesQuick and easy implementationZero capital riskRewarding packages, with up to $20 per lotDaily payment of commissions and rebatesFast and reliable processing of deposits/withdrawalsAccess to a dedicated BI PortalDetailed Tracking Report for easy monitoring of performancePersonal Account Manager24/5 Support

Cooperation with an Award-winning broker with 33 years of experienceHigh networking opportunitiesQuick and easy implementationZero capital riskRewarding packages, with up to $20 per lotDaily payment of commissions and rebatesFast and reliable processing of deposits/withdrawalsAccess to a dedicated BI PortalDetailed Tracking Report for easy monitoring of performancePersonal Account Manager24/5 Support

Customer Service

Customer support at Windsor Brokers is provided via email, telephone, online chat, and a web form. It is not clear from the broker’s website, but it does appear that support is offered on a 24/5 basis, with no support available over the weekends.

Belize

Phone – +44 3301280930

Email – support@windsorbrokers.com

Jordan

Phone – +962 6 550 9090

Email – support.jo@windsorbrokers.com

Windsor Brokers Ltd (EU)

Phone – +357 25 500 700

Email – support@windsorbrokers.eu

In Conclusion

We found the offerings at Windsor Brokers to be acceptable for both new and experienced traders alike. While it would be nice to see cryptocurrencies added to the available assets, we do understand it is a very new asset class and not one that all brokers are interested in. Likely Windsor Brokers will be adding support for cryptocurrencies in the near future.

With a history spanning over 30 years the broker does know what they are about, and the customer service, education and research, and trading conditions are all quite good. The MetaTrader 4 platform that is offered is one of the best in the industry too, and traders should be quite pleased to have this platform available.

The combination of the long history of the broker, and the various regulations and licenses applied to the broker are also inspiring of trust.

Beginners will especially get value from the educational materials and the basic Prime account, but there is plenty to attract more experienced traders too. Overall, it seems as if all levels of traders can benefit from Windsor Brokers professional and developed approach to CFD trading.

Open Demo AccountOpen Live Account END latest_news