- Sandbox has corrected 38% from its all-time high and is retesting crucial support floors, anticipating a move higher.

- A decisive close above $5.5 will confirm an uptrend’s start and trigger a 22% ascent to $6.77.

- If SAND produces a lower low below $3.77, it will invalidate the bullish thesis.

Sandbox has seen a considerable retracement over the past weeks from its record high. The recent pullback after the December 4 flash crash, tagged critical support floors and has triggered a quick recovery. Going forward, investors can expect SAND price to propel higher.

Sandbox bulls face a decisive moment

Sandbox price has dropped roughly 38% from its all-time high at $8.48 to where it currently trades – $5.27. During this descent, SAND price tagged the 70.5% retracement level at $4.28 but quickly moved away from it.

After getting rejected at the trading range’s midpoint and the declining trend line, SAND shows signs of heading higher. Assuming Sandbox produces a higher high above $5.50, it will confirm the start of an uptrend.

In this condition, investors can expect SAND price to retest the $6.77 hurdle. The run-up from $5.27 to $6.77 would constitute a 30% ascent.

SAND/USDT 4-hour chart

Supporting this bullish outlook is Santiment’s 30-day Market Value to Realized Value (MVRV) model, which hovers around -1.7% or in the opportunity zone. This on-chain metric is used to determine the average profit/loss of investors that purchased SAND over the past month.

A negative value indicates that most of the holders are facing losses, and hence a risk of a sell-off is close to zero. Moreover, reversals usually occur after the MVRV resets or is present in the opportunity zone. This development makes the comeback of the bulls more likely.

[09.03.50, 08 Dec, 2021]-637745365274774208.png)

SAND 30-day MVRV chart

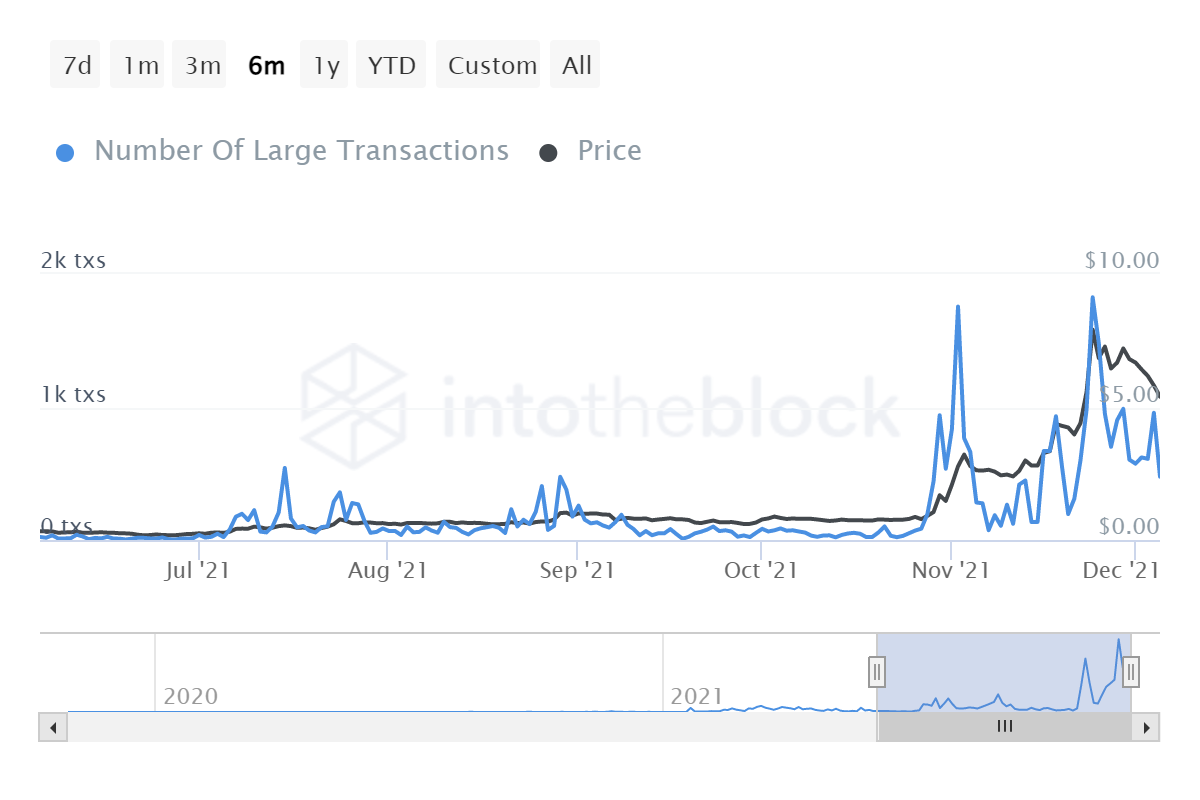

While things are looking good for SAND from a technical and on-chain perspective, investors should exercise caution and beware that large transactions worth $100,000 or more have declined by 79% from 1,830 to 476 since November 24. This downfall suggests that large institutions or whales are not interested in SAND at the current price levels.

SAND large transactions

Therefore, a potential spike in selling pressure that pushes Sandbox price to produce a lower low below $3.77 will invalidate the bullish thesis. In this situation, SAND could retrace to the range low at $2.52, where it will give the uptrend another go.