Review altFINS

altfins.com/about/ Founded in 2020 Headquarters in Slovakia BEGIN item ContentsMain ComponentsDashboardSignalsScreenerChartsWatchlists and AlertsPricingAffiliate ProgramConclusion

altfins.com/about/ Founded in 2020 Headquarters in Slovakia BEGIN item ContentsMain ComponentsDashboardSignalsScreenerChartsWatchlists and AlertsPricingAffiliate ProgramConclusion

altFINS is a cryptocurrency analysis tool where active traders can screen thousands of digital assets to find emerging trade opportunities. The cloud-based platform allows for real-time analysis, using tick data from dozens of cryptocurrency exchanges to calculate over 60 technical indicators over five different time frames. It is a very powerful tool providing traders with the detailed technical analysis that can help to provide an edge in the markets.

The platform is run by a proprietary data management system that keeps all the complex time series data and analysis organized and available at all times. With altFINS a trader can screen thousands of digital assets using technical indicators. The platform also contains a powerful pattern recognition system that can alert traders to technical chart patterns when they occur. This is a huge time savings as it avoids the need to look at each individual chart constantly. altFINS also enables trade execution, portfolio tracking and performance monitoring.

Main Components

Dashboard – quick performance summary of your portfolio (or watchlist), trade signals and Twitter news just for your portfolio (or watchlist)Screener – create and save your custom filtersPatterns – find assets with tradable price patterns (rising wedge, head-n-shoulders, etc.)Curated Charts – technical analyses of top 30 coins by an inhouse analyst teamCharting – quickly review your scan results with grid charts (6, 12 or 24 per page)Alerts – create custom alerts for your filters and portfolio (or watchlist) of coinsTwitter news – Tweets posted by the crypto projects’ management teamsPortfolio and watchlist – ability to track your coin positions, performance, and Twitter newsTrading – trade across multiple exchanges from a single point

Traders using the altFINS platform will find that they are able to more easily identify digital assets in a strong uptrend or downtrend, as well as those that have become heavily overbought or oversold. In addition to that the pattern recognition aspect of the platform helps to find assets that are developing a technical price pattern, as well as those that are breaking out of existing patterns.

Below is a more detailed look at the various components of the altFINS platform.

Dashboard

The dashboard is, as you might expect, the place to go to see an overview of everything. It includes information about your portfolio, and a quick summary of trading opportunities. By simply registering on the platform, which is free, you get to see all the following information:

Portfolio of your coin positions with their market cap, latest price, performance (1d, 1wk, 1mo), short-term trend and oscillator rating (oversold / overbought).Your Watchlist of coins, pairs and assets.Twitter’s latest tweets from crypto projects in your portfolio or watchlist.Tradable patterns – top emerging and breakout trading patterns (wedges, triangles, head and shoulders, etc.).Biggest gainers and losers over the last 24 hrs.Coins trending up/down and overbought/oversold.

Signals Summary

The Signals Summary is a great jumping off place for finding emerging trading opportunities. It lists the cryptocurrency pairs that are displaying either bullish or bearish patterns in some of the most commonly used technical indicators.

As an example, one of the more common trade signals is the “Strong Up/Down Trend” trade signal. This signal shows all the cryptocurrencies tracked by altFINS that are exhibiting a strong uptrend or downtrend. They are also tracked on four different time frames (1h, 4h, 12h, 1d), making them useful for day traders, swing traders, and even scalpers.

Also visible on the Signals Summary screen are any custom screens that you’ve created. The customer screens show up right at the top of the Signals Summary, and links directly to the Screener with the results.

Screener

The Screener is extremely useful in locating new trading opportunities. You will find there are many pre-defined trade signals already included with altFINS, or you can create your own custom trade signals based on the 60 indicators included in the platform, or other variables such as price performance, volume, and market capitalization.

Registered users are able to save any custom screens they create, and can also set alerts based on those screens.

One important consideration when you begin using the Screener is to make sure you are using the proper level between Coins > Pairs > Assets. The platform developers recommend using the Pairs level for screening. That is because the Pairs level pulls in the price and volume data from many exchanges, aggregating it and providing the most complete picture of supply and demand and the price action. This is especially important when analyzing assets with decreased liquidity. Of course, it is also possible to drill down from the Pairs level to the Asset level later.

Screener results are organized into six tabs: overview, charts, scorecards, performance, trend and oscillators. You can add columns (indicators, data) to these predefined columns and the system will save your preferences, if you are logged in as a registered user.

Chart Patterns

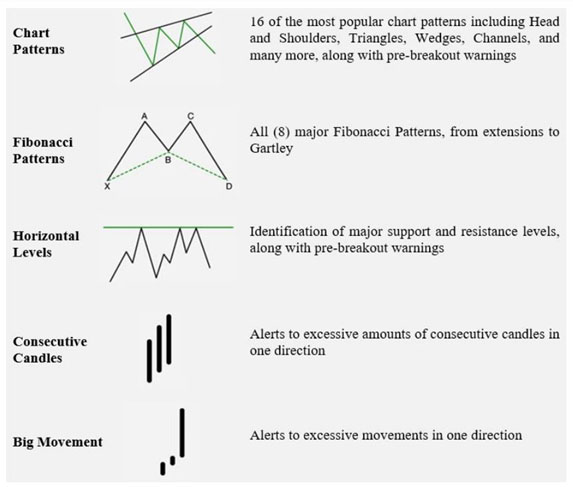

The chart pattern feature is a huge timesaver. Chart patterns appear based on support and resistance levels, and traditionally traders would do their own chart analysis to discover these patterns as they emerge. altFINS saves time for traders because it automatically recognizes 16 of the most common chart patterns and alerts the trader to their presence. This can mean the difference between combing through dozens of charts each day to look for patterns, or simply allowing the platform to alert you to these patterns when they emerge, thus saving hoards of time.

Traders can use altFINS to scan the markets for:

altFINS will also categorize patterns as emerging or complete, which can be another timesaver. Swing traders will be more interested in the emerging patterns and can ignore complete patterns, while trend traders are likely to ignore emerging patterns and focus on the complete patterns.

Curated Cryptocurrency Charts

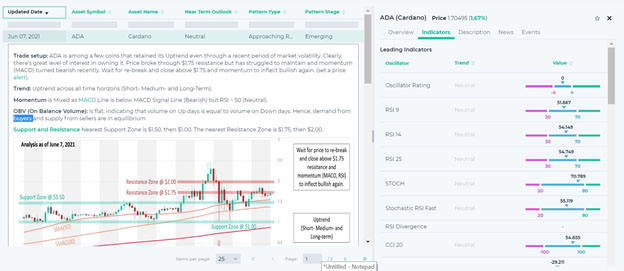

In addition to recognizing chart patterns automatically, the analysts working for altFINS do their own manual chart analysis and provide their feedback. These Curated Charts are provided for 30 of the top cryptocurrencies by market capitalization.

Let these professional analysts provide their feedback based on the key concepts of technical analysis, saving you time and identifying potentially lucrative trading opportunities.

Trend – altFINS uses a proprietary trend scoring system to assess the trend direction and strength.Momentum – using MACD crossovers and RSI indicator, altFINS determines bullish or bearish momentum.Volume – using the OBV (On Balance Volume) indicator, altFINS analyzes demand vs. supply market dynamics.Patterns – altFINS detects price patterns that provide clues about investor psychology and support and resistance levels.Support and Resistance – altFINS establishes clear horizontal support and resistance zones, which become key trading levels (Buy Support, Sell Resistance).

Curated cryptocurrency charts are handy in learning the application of basic technical analysis, or as the basic analysis prior to trading. Traders can consider these charts as the beginning of their analysis when looking for trade setups.

Here is what curated charts will look like in the platform:

As you can see these Curated Charts provide a wealth of useful information, and can dramatically accelerate the analysis process.

Watchlists and Alerts

A watchlist is a list of Assets, Pairs, or Coins you want to keep a close eye on separate from your other analysis. By creating a watchlist you can quickly and easily screen these favorite assets for tradeable situations.

altFINS allows you to add items to your watchlist from Screener results, or directly by accessing the Watchlist tab in the platform. Once you have a Watchlist created you are able to run your screens just against that list.

Alerts can also be used with your Watchlist, or they can be created for simple signals, such as an Asset, Pair, or Coin reaching a certain price, or for more complex scenarios such as combinations of various technical indicators.

Alerts are a very powerful feature on the altFINS platform.

Pricing

Given the powerful features of altFINS the pricing structure is extremely attractive. The Basic package begins at just $14.95 a month, and I’m sure you can imagine that it would take just one trade to easily pay for the monthly cost of the platform.

The chart below will give some idea of the pricing and the available features.

Affiliate Program

altFINS also offers a generous affiliate structure that could pay for your own monthly subscription or even generate passive recurring income. It’s easy enough to get started in this affiliate scheme.

Sign up and generate your own unique referral link.Share your link on social media, blogs, and websites.Get 20% lifetime recurring commissions for every payment your referrals make.

In Conclusion

As you can likely already tell from the information above, we found the altFINS tool to be extremely useful and powerful in the technical analysis of the huge universe of altcoins. Because it includes so many different indicators, automated tools, screeners, and watchlists it can literally save hours every day. Those are hours that can be put to much better use, theoretically increasing a trader’s returns in the process.

With a low basic cost that starts at $14.95 a month this is a tool that can quickly and easily pay for itself.

altFINS is a unique trading tool and quite possibly the most advanced crypto analysis platform that is currently available. Give it a try and you are likely to be just as impressed as we were.

END latest_news