Review FinMarket

https://finmarket.com/ Headquarters in Cyprus Open Live Account BEGIN item ContentsPros and ConsAccount typesTrading PlatformsEducationCustomer SupportConclusion

https://finmarket.com/ Headquarters in Cyprus Open Live Account BEGIN item ContentsPros and ConsAccount typesTrading PlatformsEducationCustomer SupportConclusion

Quick Look

FinMarket is a Cyprus-based online broker that has been operating since 2015. It is known for providing its clients with investment opportunities in financial markets through its offerings of CFD products on the major market assets. While it may not have the largest number of assets to offer, it does well with the most popular and traders can avail themselves of more than 30 currency pairs, as well as the newer cryptocurrencies.

The broker is owned and operated by K-DNA and while it isn’t considered one of the older brokers it still has had years of experience and has positioned itself as a leading broker, particularly among those looking for the tightest spreads and accurate real-time market pricing. It is able to do this thanks to its direct link to the interbank markets and a unique policy regarding margin that maximizes the trading potential of its client’s capital.

Their transparent pricing model is appreciated because it allows them to deliver exact prices when executing their client orders.

While that is all well and good, the real question is how trustworthy and excellent is the brand for actual traders? That is what we discovered and put down in the following review.

Finmarket Pros and Cons

Pros

Regulated by the Cyprus Securities and Exchange Commission, including segregated funds and deposit insuranceTight spreads and commission-free tradingMetaTrader 4 desktop platformBroad selection of account types

Cons

Limited product portfolioVideo tutorials are lackingMobile and web platforms not MetaTrader 4

Broker Regulation

We know how much weight traders put on the regulation of their brokers in this industry. It makes them feel more secure and it’s widely believed that regulated brokers are more trustworthy than those which are unregulated. Well you can rest easy when considering Finmarket because they are regulated by the Cyprus Securities and Exchange Commission (CySEC) under license number 273/15.

Because of this regulation clients of Finmarket also enjoy the protection of the Investor Compensation Fund, which offers up to €20,000 in compensation in the event the broker fails financially. It also ensures that the broker keeps their operating capital separate from investor funds. And of course, CySEC regulation permits the broker to operate all across the European Union.

Account types

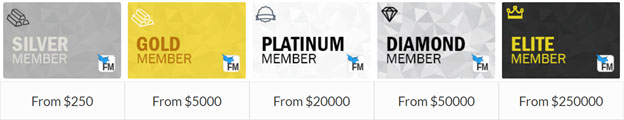

There are five account types at Finmarket, which is more than some brokers offer, yet less than others. It seems to be right in the sweet spot. The account types are set apart by their minimum deposit amount and each higher level confers additional benefits.

The base account is the Silver account, which requires a minimum deposit of $250. Next is the Gold account with a $5,000 minimum deposit, followed by the Platinum and Diamond levels with $20,000 and $50,000 minimum deposits, respectively. Finally, there is the Elite level which requires a $250,000 minimum deposit.

All of the accounts offer the STP execution method, and each higher level lowers the average spread paid by the trader. Where the basic Silver account has a 4.0 pip average spread on the EUR/USD, by the time you reach Elite level that average spread has dropped to 0.8 pips.

Leverage for all the account types is set to 1:30 per the ESMA guidelines. There are also commissions charged on each trade, and those commissions are discounted based on the account level, which saves traders in the higher account tiers even more money.

Of course, there are also Islamic versions of each account type that offer no-swaps. And anyone can register and open a demo account that allows trading without risking any actual money.

Trading Platforms

Finmarket has several trading platforms that their clients can choose from. For those who want the power afforded by desktop charting and analysis the world-class MetaTrader 4 is the option most in demand. But others who prefer a web-based platform or a mobile platform can also use the proprietary web and mobile platforms offered by Finmarket. Below are more details regarding each of the available platforms:

MetaTrader 4 Platform

MetaTrader 4 is quite likely the most popular and most downloaded charting and analysis platform there is, so it is good to see Finmarkets offer this powerful application for their clients use. For those who are not familiar with the MT4 platform it includes dozens of indicators and has a powerful scripting language that allows anyone to craft their own indicators and automated strategies without any programming knowledge. It also comes preloaded with dozens of languages, allowing traders from across the globe to use it in their own native languages.

One of the most powerful aspects of MetaTrader 4 is the inclusion of Expert Advisors (EAs), which are basically automated trading robots. Traders can create them or download EAs that others have created.

Proprietary Web Trading Platform

The web trading platform offered by Finmarket is basically a proprietary platform that was created in-house. It is an acceptable option for those who don’t want to or for some reason cannot download the MT4 platform. Plus, it allows users to trade from any internet connected device with a web browser. It can be a quick way to access one’s account and open or close a position.

The Web Trader has a host of convenient features included, such as real-time charts, one-click trading, social trading, and trading cubes. Plus it has plenty of news and analysis delivered right to the platform to ensure you won’t miss anything that could help your trading.

Proprietary Mobile Trading Platform

For those who are always on the go the mobile trading platform is ideal. It even includes the features found in the Web Trader, so you will have plenty of analysis power right at your fingertips. The mobile app is available for download to both iOS devices and Android devices.

Available Assets

Finmarket honestly does not have the largest number of tradeable assets, but what it does have to offer is what most every trader is looking for anyway. It includes more than 30 currency pairs, major global indices, over 160 stock CFDs, commodities like gold, silver, coffee, and crude oil, as well as the most popular cryptocurrencies. See the asset classes available:

CurrenciesetalsEnergiesSoft CommoditiesDigital CurrenciesStocksIndices

Education and Research

Finmarket includes an education and training portal, and while they do not create the materials themselves, it’s provided by a third-party company, that doesn’t mean it isn’t an excellent resource for all levels of traders. In fact, getting the training material from a company that specializes in creating such is smart, and allows Finmarket to focus on providing their broker service. Basic training and daily analysis is available to everyone, as well as basic educational materials. Higher account tiers get access to more in-depth training modules.

Customer Service

When it comes to customer support, the firm provides support via email, through a contact form on the website, or via telephone, with the account managers available from 9:00 AM to 9:00 PM (local time), Monday to Friday. The company also maintains social media accounts on Facebook and Twitter, giving customers extra channels to get in touch with them.

Phone: +357 25254070, +44 2031500106, +44 8455280218

Webform: Contact Us Form

Email: support@finmarket.com

In Conclusion

Finmarket has been providing its financial services for over a half decade already and in that time, they’ve built up a solid reputation as a trustworthy broker. As a regulated broker with an excellent platform and useful tools for their clients there is little that can be said about then that isn’t positive. Safety and security of funds are guarantees, and the training materials can help anyone learn to be a better trader.

No matter what level of service you begin with, Finmarket is a broker that can allow you to grow into a better trader. No wonder they bill themselves as “Your gateway to the financial market”.

Open Live Account END latest_news