Review Infinox

https://infinox.com Founded in 2009 Headquarters in United Kingdom Open Demo Account Open Live Account BEGIN item ContentsPros and ConsRegulationAccount TypesTrading PlatformsAssetsEducationCustomer ServiceConclusion

https://infinox.com Founded in 2009 Headquarters in United Kingdom Open Demo Account Open Live Account BEGIN item ContentsPros and ConsRegulationAccount TypesTrading PlatformsAssetsEducationCustomer ServiceConclusion

Infinox Capital is no newcomer to the forex industry, having started operation from its headquarters in London in 2009. Since that time, it has grown to become an award-winning CFD broker with over 100 employees placed all around the world. As a result, the broker also has clients from Australia to Portugal, and from Vietnam to Dubai.

Infinox is a broker that has something for every level of trader, from beginners to professionals. With offerings in forex, commodities, stocks, and futures there is always an opportunity to be found at Infinox. And thanks to the broker’s focus on customer service, it is more than just an on-ramp to the financial markets for its clients.

Infinox Pros and Cons

Pros

Regulated by the U.K. Financial Conduct AuthorityRegulated by the Securities Commission of the Bahamas Regulated by the Financial Sector Conduct Authority of South AfricaRegulated by the Financial Services Commission of MauritiusLow spreadsSocial trading available (IX Social App)Trading on industry leading platforms Metatrader 4 & Metatrader 5

Cons

Swap rates are higher than averageLimited educational resources availableU.S. residents not accepted as clients

Broker Regulation

Infinox is regulated by the Financial Conduct Authority (FCA) in the U.K. Remaining fully compliant with all the regulations put in place by the FCA means traders can enjoy a safe trading experience, with a broker that has their best interests in mind. Client deposits remain fully segregated as demanded by FCA regulations, providing protection to clients in the unlikely event that the broker would default on its financial obligations. Infinox is also part of the Financial Services Compensation Scheme (FSCS), which covers client deposits up to £85,000. It also provides negative balance insurance so that clients can never lose more than they have deposited. As an added security Infinox has taken out an additional insurance policy that covers each client for up to £500,000.

INFINOX is also regulated by the Securities Commission of the Bahamas (SCB). Under the SCB, INFINOX offers $1,000,000 USD Insurance. The insurance policy became effective 1 May 2020 and will continue until 30 April 2021. Up to USD $1,000,000 per Claimant. The company is also regulated by other entities such as the Financial Sector Conduct Authority (FSCA) of South Africa and by the Financial Services Commission (FSC) of Mauritius.

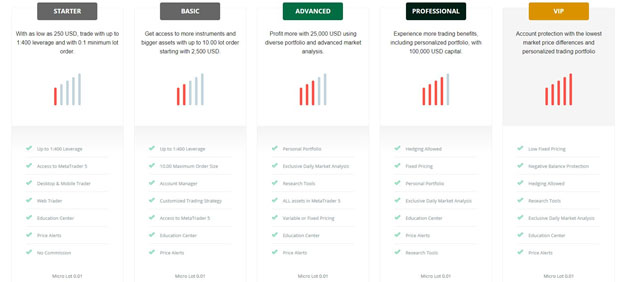

Account types

Infinox keeps things simple with just a pair of basic accounts to choose from. Traders can either sign up for the STP (Straight Through Processing) account that has no commissions, but higher spreads that begin at 0.9, or the ECN (Electronic Communication Network) account that has the lower spreads starting at 0.2, but also charges a commission of £5/€5.5/$7.5. Traders can get started easily with a minimum deposit that is only £1 (or the equivalent EUR/USD/AUD).

On top of the basic accounts’ traders can also choose an Islamic account that adheres to Sharia Law by removing any overnight swaps.

And those who wish to test the platform before trading are free to register for a demo account that comes with virtual money to try out trading with Infinox before committing to a deposit.

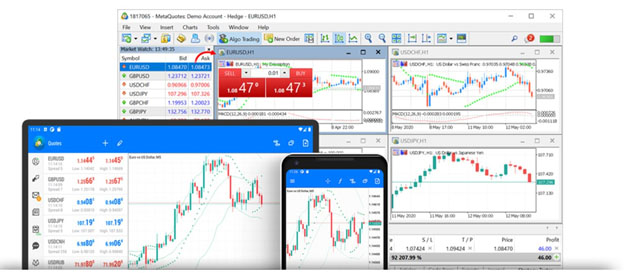

Trading Platforms

Infinox offers both the original MetaTrader 4 platform that is designed for forex trading, and the newer MetaTrader 5 platform that has been optimized for CFD trading. Both are available in the desktop, mobile, and web trader versions of the platform. In either case traders enjoy a minimum of all the following features:

30+ built-in technical indicators & multiple chart typesExpert Advisors (EAs) for automated tradingReal-time price quotesOne-click tradingHistorical data9-time frames

For those wishing to trade equity CFDs the MetaTrader 5 platform is required. In addition to the basic platform traders can also take advantage of the premium Autochartist add-on.

Autochartist

Autochartist is a popular market analysis tool that can be used as a standalone app or can be used as an MT4 plugin. The app constantly scans price charts throughout the trading day, looking for patterns that present trading opportunities. When one is located an alert is sent to the trader so they can open a trade if they choose. It can save loads of time by removing the need to constantly analyze the charts yourself. It is fully customizable to your own needs and has a built-in risk calculator to assist with risk management.

IX Social

IX Social is the social trading platform offered by Infinox where you can provide your own trading service and make some extra money, or you can follow the trades of expert traders in hopes of adding to your profits effortlessly. It is a cutting-edge social trading platform designed for the 21st century and encourages traders to not only copy the strategies of experts, but to observe and learn from them in order to create their own powerful trading strategies.

Available Assets

There are five primary asset types offered at Infinox:

Forex – Trade over 49 of the most popular currency pairs with leverage up to 300:1, including EUR/USD, AUD/USD, and EUR/GBP

Indices – Trade more than 15 of the world’s most popular indices, including the FTSE100, the S&P 500, and the Nasdaq.

Commodities – Trade on hard and soft commodities such as gold, silver, and oil

Equities CFDs – Buy and sell stocks in the world’s biggest companies, including Apple and Amazon

Futures – Trade on futures such as gold and oil

Education and Research

Infinox provides its own in-house research and education for traders through the IX Intel section of its portal. There are categories for news, education, and research, however all are rarely updated and are quite sparse, which is a shame. The research section looks as if it was updated daily at one point, but the most recent pieces are from November 2020. The same is true for the news updates, and the education section has just three items. It does look as if Infinox has long-range plans for the IX Intel offering but has not yet made good on those plans. Given the overall strength of the broker in other areas this could be a great offering if they choose to put more resources towards it in the future.

Customer Service

Customer service is available 24/5 and is offered in six languages that include English and Arabic. Customer support can be contacted via email, telephone, and through live chat on the website itself. There are many toll-free telephone numbers for contacting the broker in countries across the globe which can be found on the Contact page of the website.

Phone: 800 060 8744 (UK)

Webform: Contact Us Form

Email: support@infinox.com

In Conclusion

Infinox is a CFD broker with FCA regulation as well as being regulated from the SCB, FSCA and FCA and having a long history of trustworthy service. The broker holds to all the necessary regulations, making it a safe and secure broker. In addition, they provide clients with access to both STP and ECN trading in many assets. This is ideal for any trader.

The award winning MetaTrader 4 and MetaTrader 5 platforms give clients access to an excellent range of tools, and social trading is enabled via the IX Social app. The broker also provides access to the Autochartist analysis tool as a great time saver for finding trading opportunities.

The research and education center were disappointing, but we hope to see it updated in the future. In the meantime, traders would need to get their education, news, and market research elsewhere.

Overall, we found Infinox to be a solid global CFD broker suitable for all levels and types of traders.

Open Demo AccountOpen Live Account END latest_news