Review TICKMILL

tickmill.com/ Founded in 2014 Headquarters in United Kingdom Open Demo Account Open Live Account BEGIN item ContentsPros and ConsRegulationAccount typesTrading PlatformsAvailable AssetsEducationSupportConclusion

tickmill.com/ Founded in 2014 Headquarters in United Kingdom Open Demo Account Open Live Account BEGIN item ContentsPros and ConsRegulationAccount typesTrading PlatformsAvailable AssetsEducationSupportConclusion

Quick Look

Tickmill is a CFD and ETD broker that was established in 2014 and operates globally from its headquarters in London. As a global broker it is regulated by several entities, including the Financial Conduct Authority in the UK. This top tier regulation adds an extra level of trust and a perception of safety to the broker.

One reason that active traders like Tickmill is the low spreads and fees it offers with some of its accounts. It is known to be one of the lowest commission brokers for forex traders, and it makes opening an account fast and easy. With many different options for deposits and withdrawals, funding an account is also fast and easy.

On the downside there is a limited number of assets available for trading, including a complete lack of stocks and cryptocurrencies. The trading platforms offered are the MetaTrader 4 and CQG; the former is appreciated by experienced traders since they are familiar with the platform, but new traders sometimes complain that MT4 is outdated in its design and user interface.

Tickmill Pros and Cons

Pros

Regulated by the FCALow spreads and feesMetaTrader 4 is the desktop, mobile, and web platform

Cons

No stock or cryptocurrency tradingNo two-factor authentication for greater securityUnited States citizens and residents not accepted as clients.

Broker Regulation

Tickmill is regulated in a number of jurisdictions, and the coverage for traders depends on their country of residence. In the UK the broker is regulated by the Financial Conduct Authority (FCA) under registration number 717270. Traders here are also protected under the Financial Services Compensation Scheme with provides insurance for deposits up to £85,000.

European traders fall under the regulation of the Cyprus Securities and Exchange Commission (CySEC), with license number 278/15. The broker also complies with the Financial Instruments Directive 2014/65/EU or MiFID II and is covered by the Investor Compensation Fund that protects deposits up to €20,000.

Other jurisdictions fall under the regulation of the Seychelles Financial Services Authority (FSA) under license number SD008. In all cases deposits are fully segregated, and clients also benefit from negative balance protection.

Tickmill is also regulated by the Labuan Financial Services Authority (Labuan FSA) in Malaysia and the Financial Sector Conduct Authority (FSCA) in South Africa.

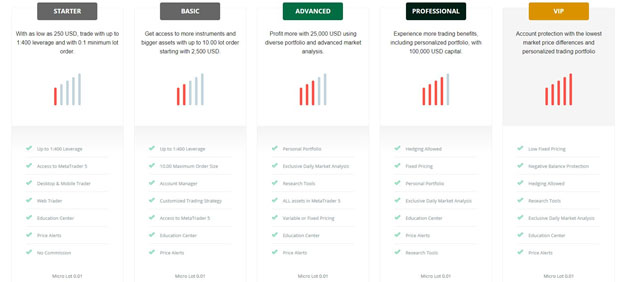

Account types

There are three account types offered at Tickmill for Forex and CFD traders:

Classic – This is the basic level account with a minimum deposit of $100 and access to 62 currency pairs as well as a variety of indices, commodities, and bonds. The Classic account comes with no commissions and variable spreads that start at 1.6 pips. This is the beginner level account.

Pro – This next level is considered more suitable for experienced traders. It still has a $100 minimum deposit, but also comes with a $4 round trip commission, and spreads that begin at 0 pips for forex trading. On indices, bonds and oil there is no commission payable.

VIP – This is the top tier account, made specifically for high volume traders. With $50,000 minimum deposit clients at the VIP level get 0 pip spreads, commissions of just $2 per round trip for forex trades, and no commissions on CFDs on indices, oil and bonds.

Additionally in November, 2020 Tickmill launched also trading in Futures (currently available to clients of Tickmill UK Ltd)

The clients can trade Futures across 5 global exchanges such as CME, CBOT, NYMEX, EUREX, COMEX with wide range of contracts covering commodities, precious metals, currencies, bonds and stock indices.

In addition to the live accounts, Tickmill also has a demo account available where clients are able to test the MT4 and CQG platforms and the trading conditions of the broker without risking losses. Demo accounts are free and anyone is able to open one to see if Tickmill really does have the fastest execution times in the industry. Traders who follow the religion of Islam are also able to take advantage of a swap-free Islamic account.

Trading Platforms

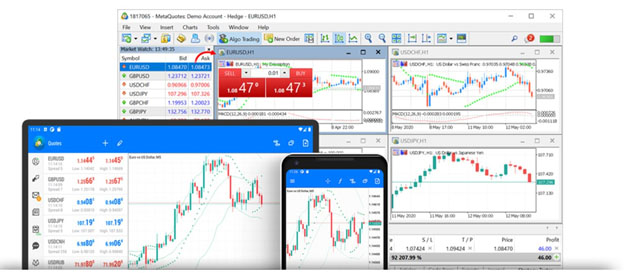

The only platform offered at Tickmill is the venerable MetaTrader 4 platform, long touted as the world’s leading forex trading platform. It is a common choice, although some newer traders claim that the platform is outdated, and the user interface needs to be updated. Whether that is true of not is a matter of opinion, but what isn’t a matter of opinion is the huge range of indicators available with MT4 and the power of its charting capabilities.

CQG Platform

When it comes to trading Exchange listed Futures, Tickmill provides clients with CQG’s industry leading trading solution for access to Global markets. The platform provides fast and reliable order routing via worldwide, co-located CQG hosted Exchange gateways, superior market data visualisation with easy to use features and over one hundred studies for extensive and informed technical analysis trading.

Tickmill developed in-house trading platform profiles created to suit traders’ trading style and save valuable time setting up. Desktop solutions are available for desk-based traders and a mobile app for on-the-go traders needing easy access to the global markets.

Tickmill also offers some upgrades such as one-click trading and social trading via Myfxbook. The downside is the 1.2 pip markup on social trades. Portfolio managers can also take advantage of the MT4 multi-trader terminal, and those who work with automated trading and robots can enjoy a 20% discount on VPS packages through a partnership with BeeksFX.

Tickmill offers all the varieties of MT4, so you can download to desktop, trade through a browser with the Web Trader, or install the mobile app on your phone and trade on the go.

Available Assets

Because Tickmill is primarily focused on forex trading it is great for currency traders, but not so great for trading other assets. While there are 62 different currency pairs to choose from there are just nine index CFDs, four bonds, and three commodities. There are no stocks and cryptocurrencies at all. One can hope that Tickmill chooses to include these important asset classes in the future to provide its clients with the opportunity to diversify their trading.

In November, 2020 Tickmill launched also Futures trading (currently available to clients of Tickmill UK Ltd). Clients can trade Futures across 5 global exchanges such as CME, CBOT, NYMEX, EUREX, COMEX with wide range of contracts covering commodities, precious metals, currencies, bonds and stock indices.

Education and Research

The blog at Tickmill is one of the best educational resources provided by the broker. It is populated by eleven market experts who provide traders with market commentary and research on a regular basis. There are four sections, and including basic Articles clients can also delve into Technical and Fundamental analysis, as well as Market Insights. The addition of this educational resource is well appreciated, and the presentation of subjects is quite comprehensive. Plus the content is regularly updated throughout the day, which we felt was one example of the excellent service provided by Tickmill.

There’s more than just the blog though. Tickmill also offers video tutorials, seminars and webinars, eBooks, and other educational content in several languages.

The video library is particularly comprehensive, and contains material in English, Russian, Spanish, Arabic, and German. The only complaint is that these videos are not arranged by language, which sometimes makes it difficult to find content in your preferred language amidst all the videos.

The education is good, but the best value comes from the insights provided on the blog by the eleven experts.

Customer Service

Customer service is available 24/5 via email or web form. In addition to the webform and email clients are also welcome to use an online chat function or to call directly on the telephone. In addition there is a detailed FAQ on the website that can answer most basic questions. Telephone and chat support from the Seychelles office is available Monday through Friday from 7:00 to 16:00 GMT, while telephone and chat support from Malaysia is Monday through Friday from 8:00 to 17:00 MST.

Phone: +852 5808 2921 (Seychelles) or +6087 504 565 (Malaysia)

Webform: Contact Us Form

Email: support@tickmill.com

In Conclusion

As a well respected and regulated broker Tickmill provides excellent service to its clients. That said, the asset offering is somewhat limited, and those looking to trade something other than currencies may feel constrained by the lack of diverse offerings at Tickmill. Given that the primary offerings are forex pairs it makes sense that Tickmill chose MetaTrader 4 as the platform, since it is well known as the premier forex trading platform.

While the Classic account avoids commissions, many traders might want to consider the Pro account and its commission structure in order to take advantage of significantly lower spreads.

Tickmill stands out for its educational offerings, particularly the market commentary and education provided by the eleven experts that make up its research team.

We really think there’s a huge potential from Tickmill, and forex traders will be very happy with the service offered. Other traders will miss a broader offering of assets, and that seems to be the greatest opportunity for improvement. Traders may want to give the broker a try to take advantage of its incredibly low spreads, and blazing fast execution speeds, but only if forex is your thing. Other traders should keep their eye on the broker for new assets that will make the broker more attractive.

While there is clearly a vast amount of untapped potential at Tickmill, management should find a way to access that potential in an effort to attract new traders and retain existing ones. In the current environment, while traders may be better served at other brokerages, they would be wise to keep Tickmill on their radar as this broker certainly could be a contender for any trader looking for new opportunities.

Open Demo AccountOpen Live Account END latest_news