CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 79% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. This content is intended for information and educational purposes only and should not be considered investment advice or investment recommendation.

Traders choose Admiral Markets (Admirals) for its excellent investor education and advanced MetaTrader features — such as the Supreme add-ons — alongside an extensive range of shares, forex and CFD markets, and premium research content.

Minimum Deposit:

100

Trust Score:

84

Tradeable Symbols (Total) :

8425

Admiral Markets pros & cons

Pros

- Admiral Markets stands out among the crowded field of MetaTrader-only brokers who offer few — if any — supplemental platform features.

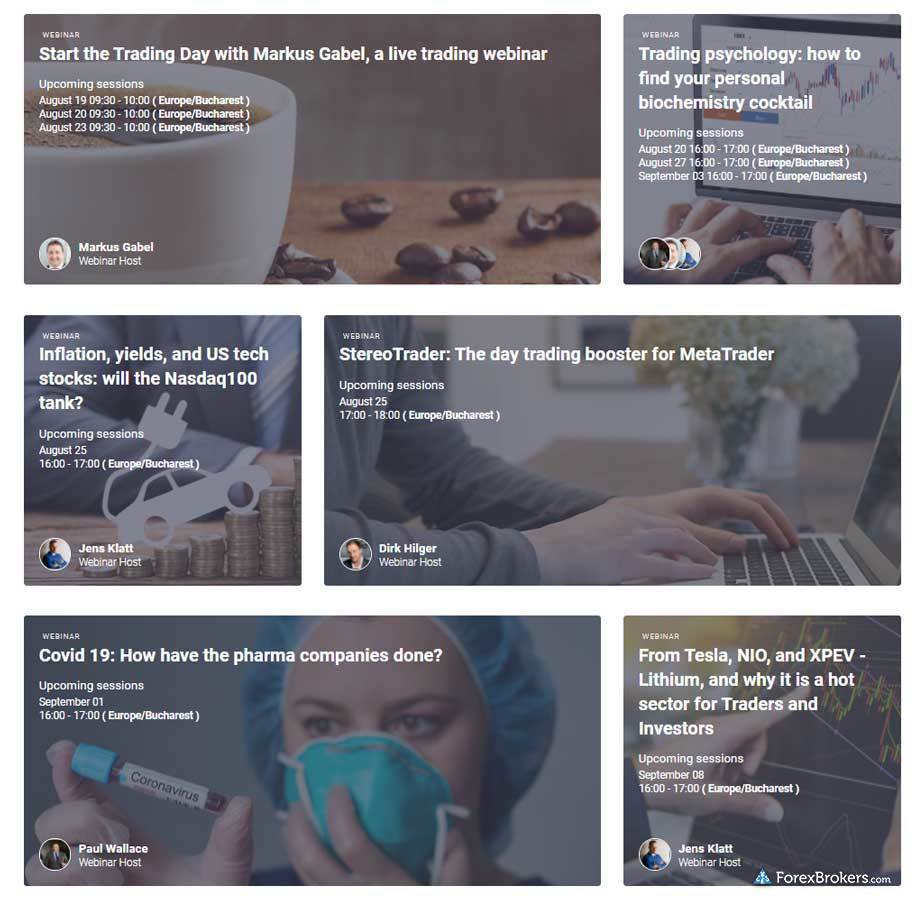

- Offers StereoTrader dashboard for MetaTrader and Supreme suite of custom indicators.

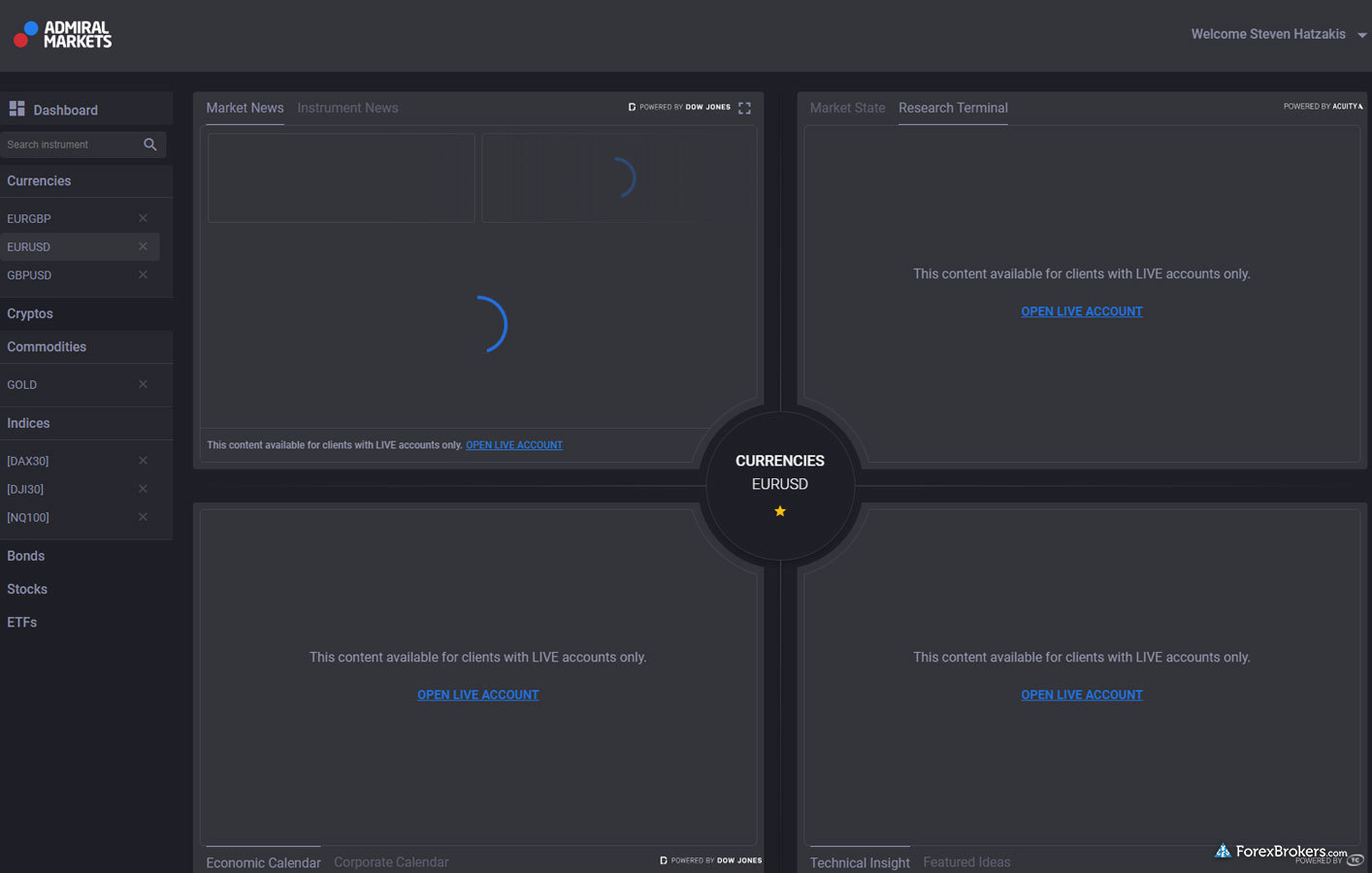

- Premium Analytics features Dow Jones News, sentiment analysis from Acuity Trading, and Trading Central signals.

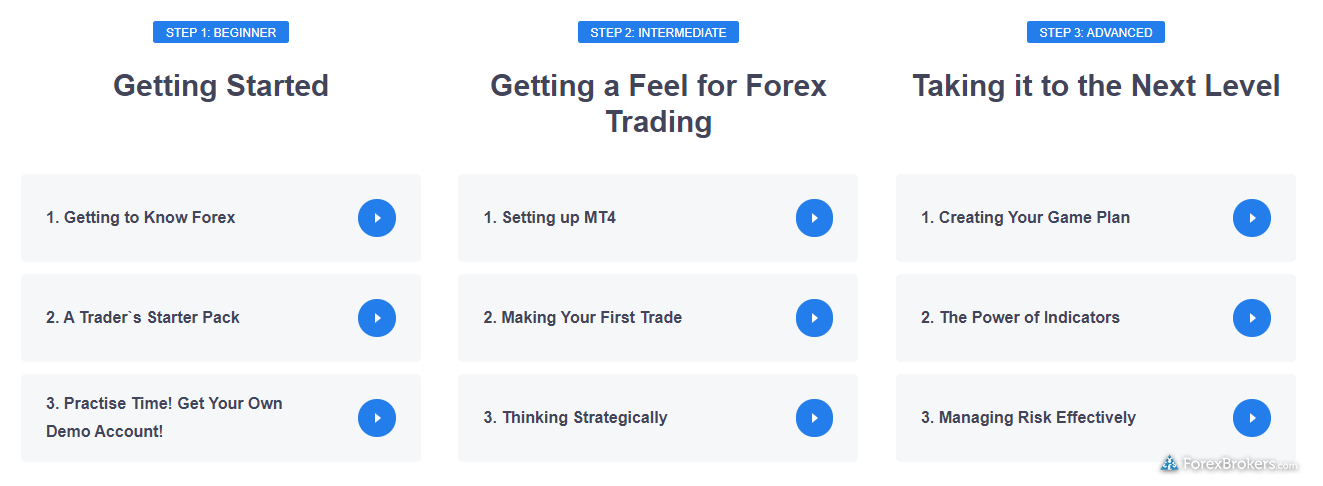

- Outstanding educational content — Admiral Markets is a top contender in this category in 2022.

- Regulated in Australia by ASIC, Cyprus by CySEC, the U.K. (by FCA), and Jordan (by JSC).

- 340 Admiral Markets staff serve over 48,000 clients, with more than $82 million in clients assets.

- Offers 8,425 tradeable symbols: 3,827 CFDs and 4,598 exchange-traded securities (non-CFD).

- Provides a unique set of volatility protection tools for managing risk.

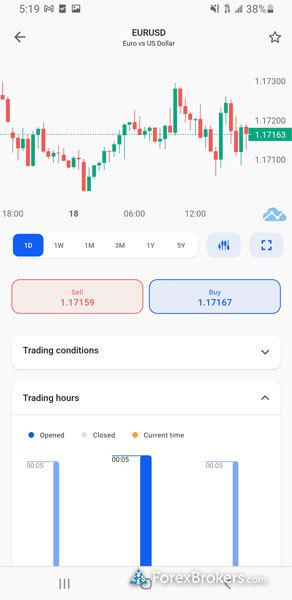

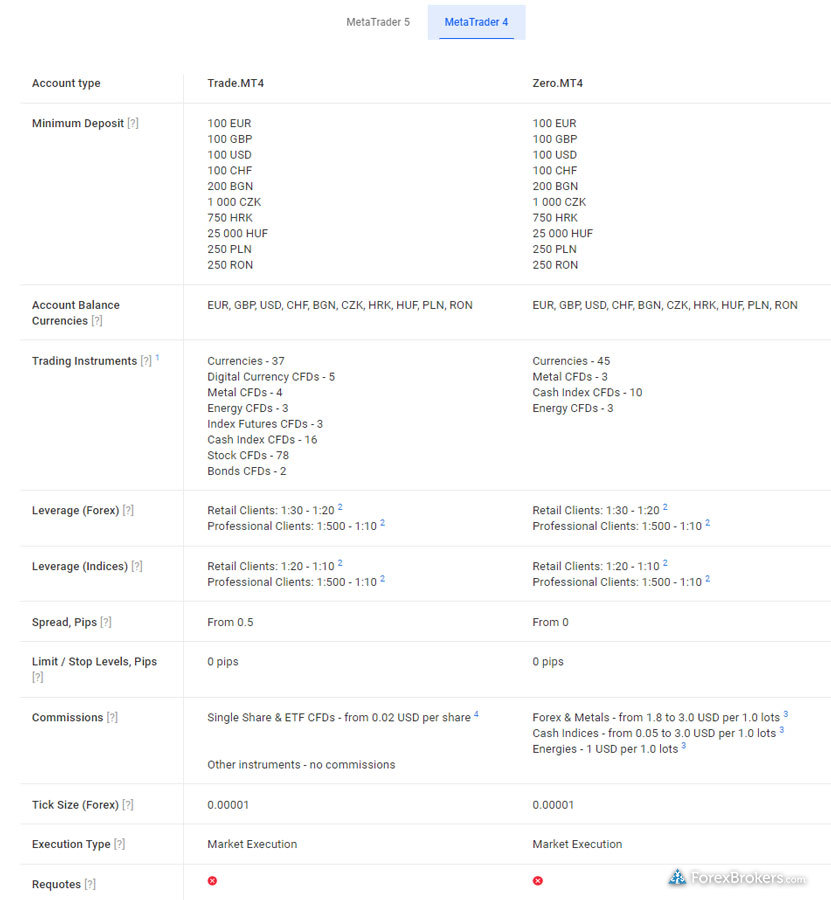

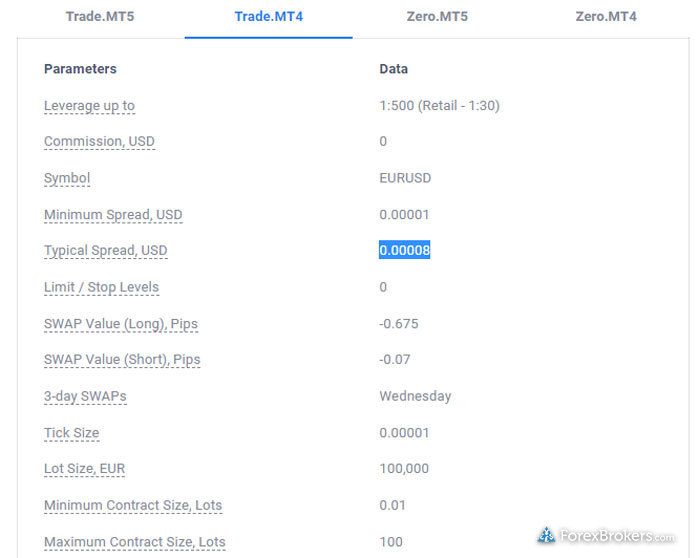

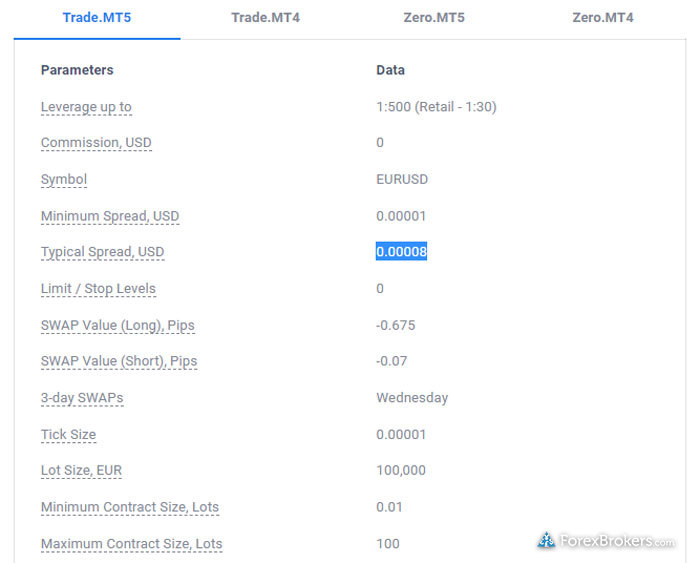

- Competitive pricing for EUR/USD; the all-in cost for its commission-based account is 0.7 pips (after $6 fee).

Cons

- Admiral Prime account for MT5 offers a significantly narrower range of tradeable symbols.

- Admiral Markets AS is the sole liquidity provider (market-maker) for all its group companies.

- Spreads on the commission-free Trade account are in-line with the industry average of 0.8 pips for EUR/USD (based on July 2021 data).

- Maximum contract size limited to 100 lots on MT5 accounts — compared to 200 on MT4.

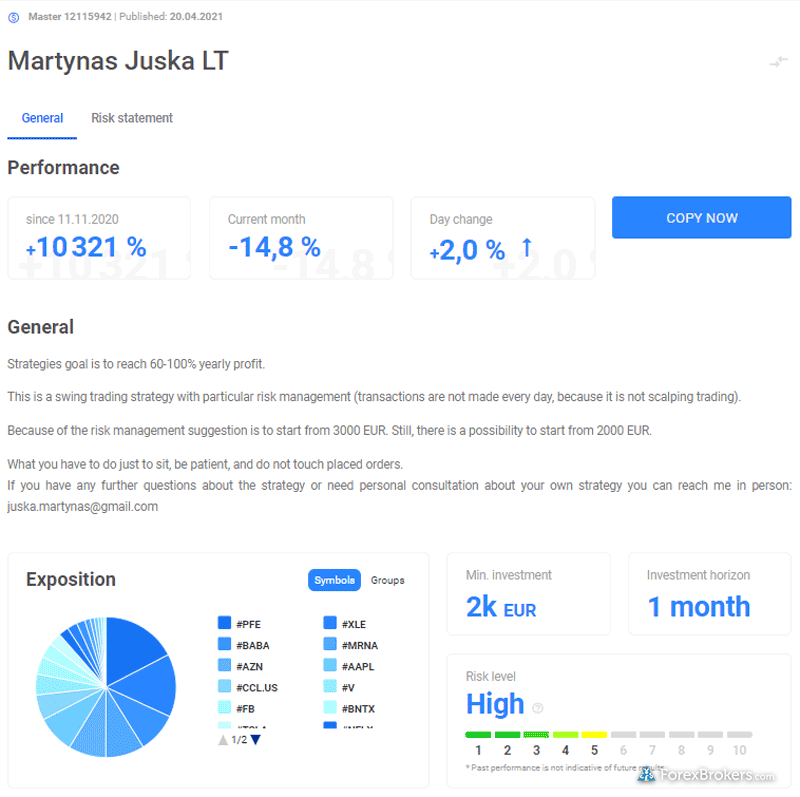

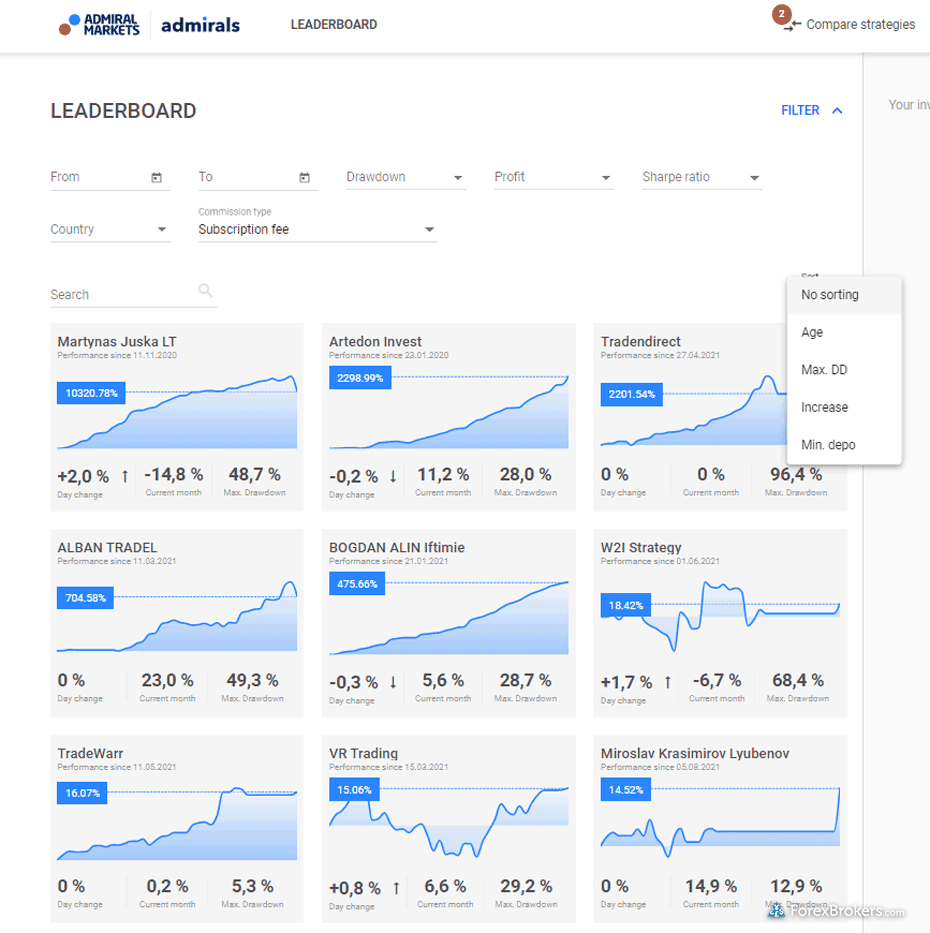

- The social trading feature is new to Admiral Markets, but doesn’t yet stack up against competitors like eToro and ZuluTrade.

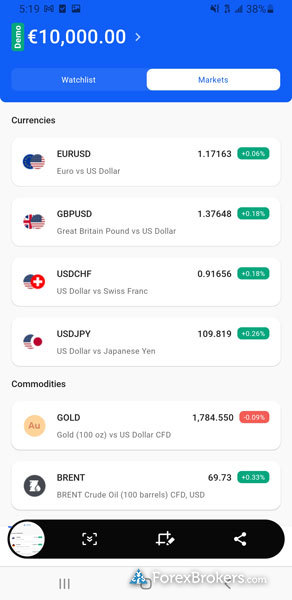

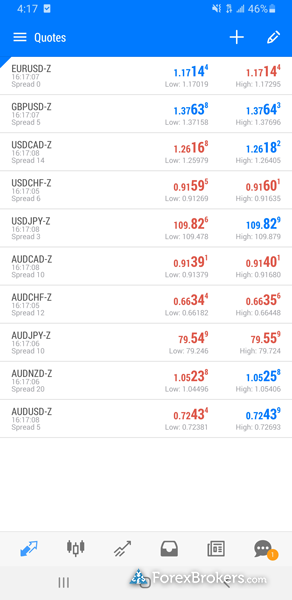

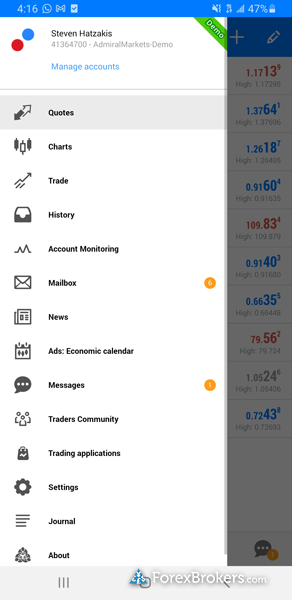

- Admiral Markets App is still relatively unsophisticated.

Overall Summary

| Overall | |

| Trust Score | 84 |

| Offering of Investments | |

| Commissions & Fees | |

| Platforms & Tools | |

| Research | |

| Mobile Trading Apps | |

| Education |

Is Admiral Markets safe?

help

84

Trust Score

Admiral Markets is considered average-risk, with an overall Trust Score of 84 out of 99. Admiral Markets is not publicly traded, does not operate a bank, and is authorised by two tier-1 regulators (high trust), two tier-2 regulators (average trust), and zero tier-3 regulators (low trust). Admiral Markets is authorised by the following tier-1 regulators: Australian Securities & Investment Commission (ASIC) and the Financial Conduct Authority (FCA). Learn more about Trust Score.

Regulations Comparison

| Year Founded | 2001 |

| Publicly Traded (Listed) | No |

| Bank | No |

| Tier-1 Licenses | 2 |

| Tier-2 Licenses | 2 |

| Tier-3 Licenses | 0 |

| Trust Score | 84 |

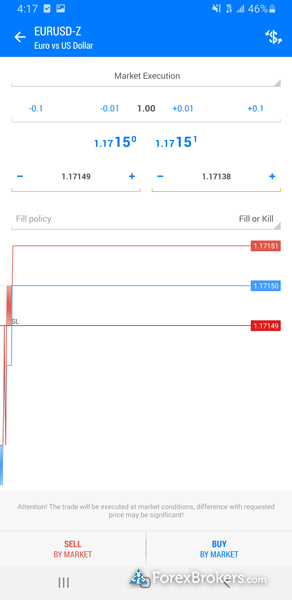

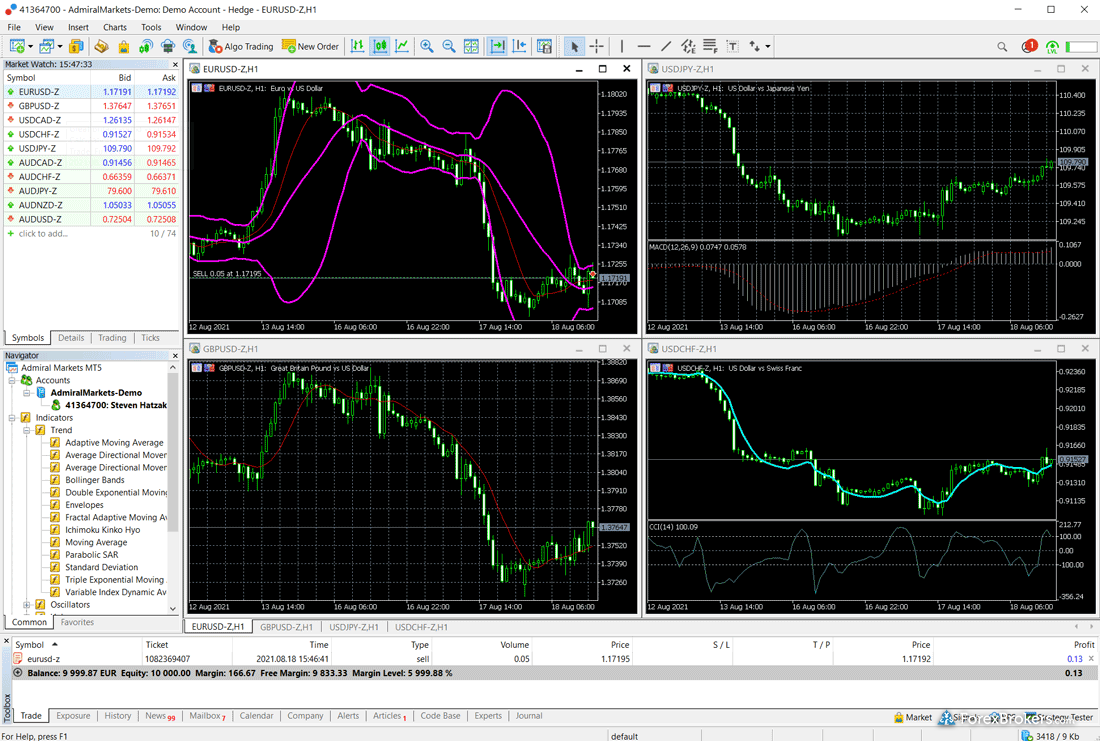

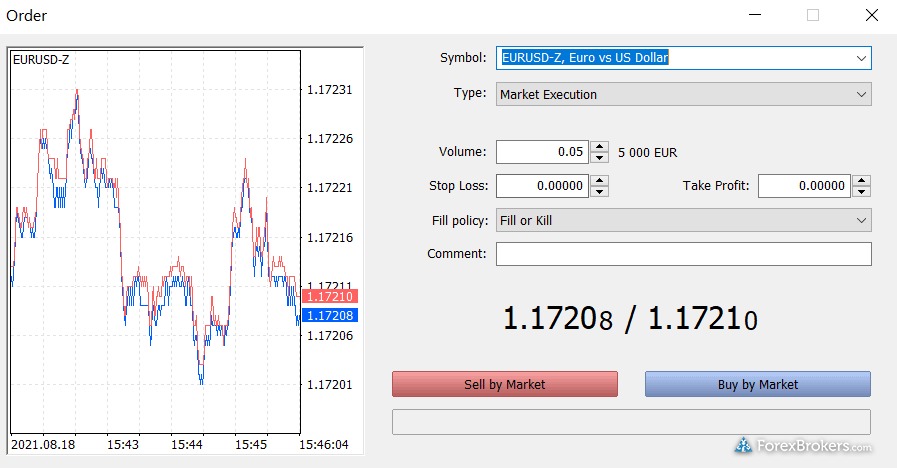

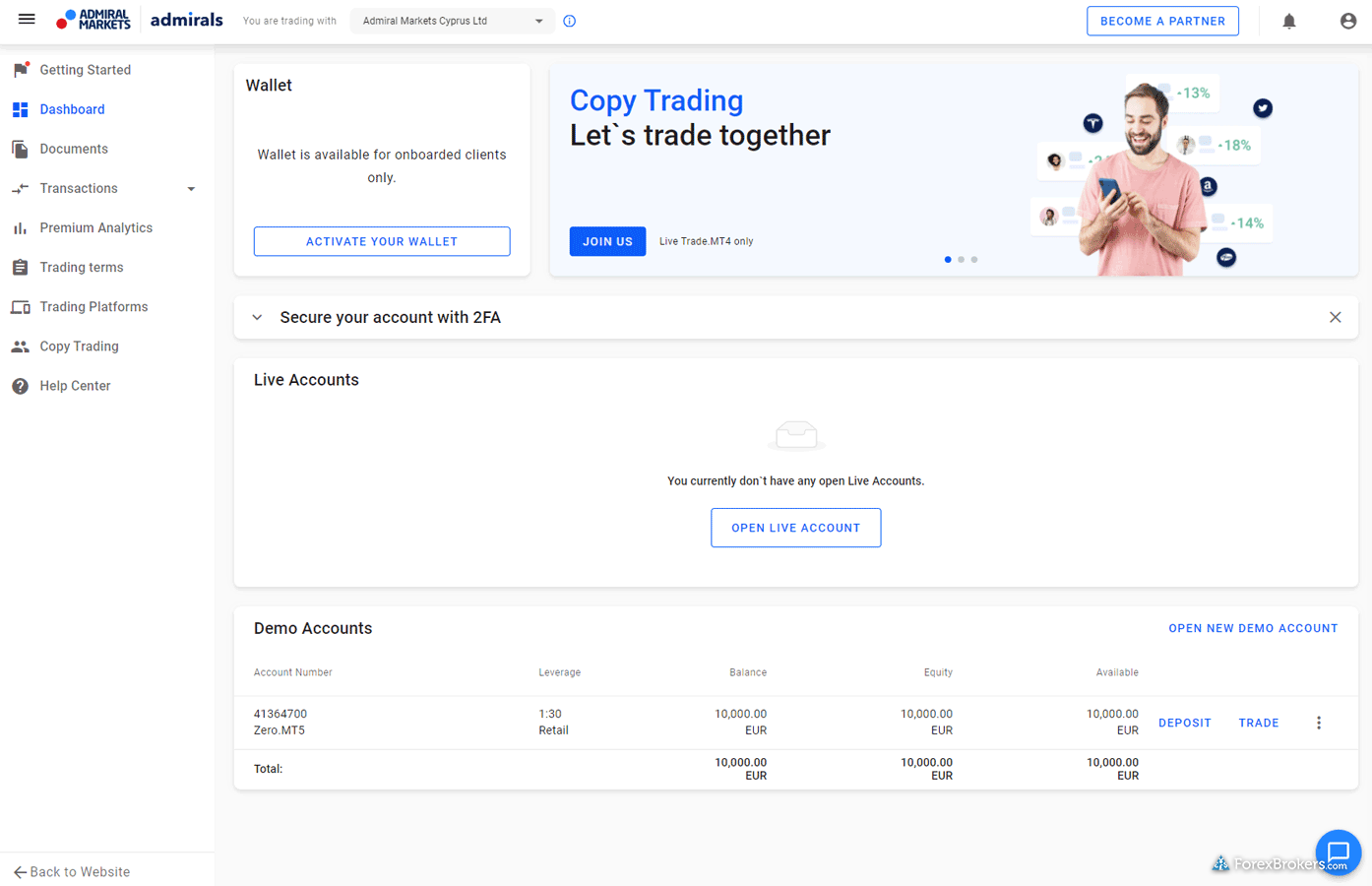

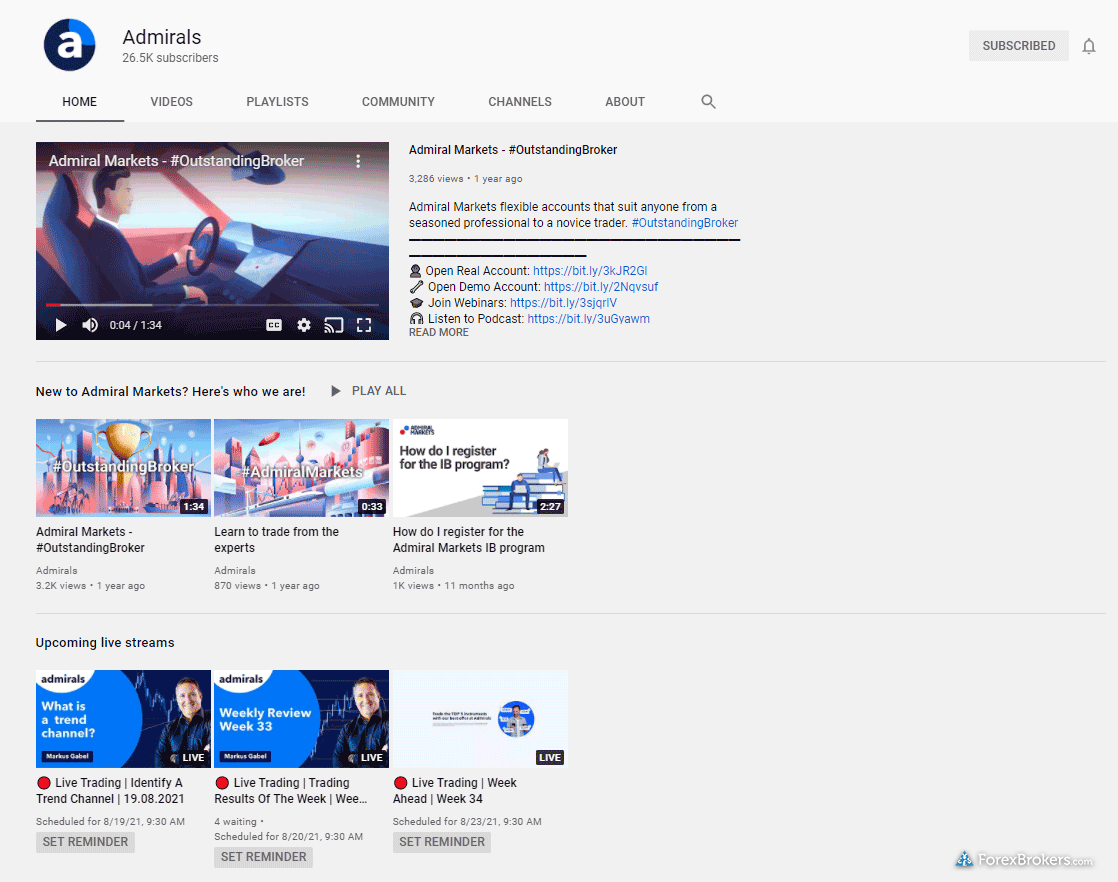

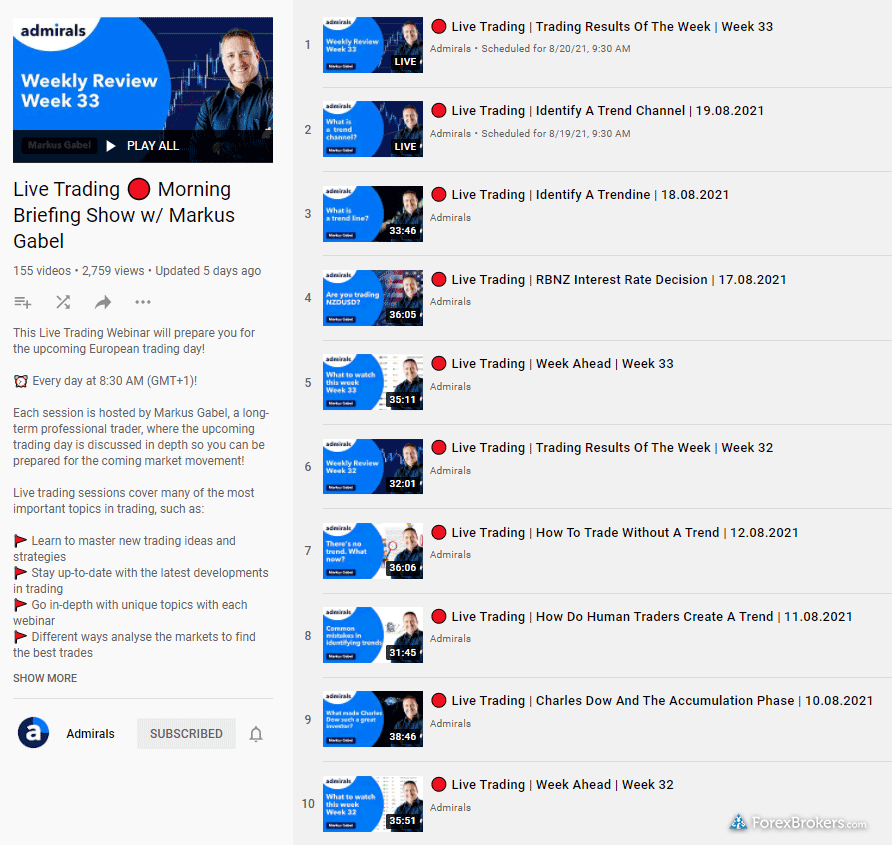

Gallery: Admiral Markets app and platforms

Gallery: Admiral Markets tools and resources

2022 Review Methodology

For our 2022 Forex Broker Review we assessed, rated, and ranked 39 international forex brokers over a three-month time period resulting in over 50,000 words of published research.

Each broker was graded on 113 different variables, including our proprietary Trust Score algorithm. This innovative scoring system ranks the level of trustworthiness for each broker based on factors such as licenses, regulation and corporate structure. Read about Trust Score here.

As part of our annual review process, all brokers had the opportunity to provide updates and key milestones and complete an in-depth data profile, which we hand-checked for accuracy.

Ultimately, our rigorous data validation process yields an error rate of less than .1% each year, providing site visitors with quality data they can trust. Learn more about how we test.