CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 76% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. This content is intended for information and educational purposes only and should not be considered investment advice or investment recommendation.

Darwinex provides forex traders with a unique social copy trading community that enables investors to buy and sell trader-developed strategies. Copy trading aside, while Darwinex also offers the full MetaTrader suite, the offering is just average.

-

Minimum Deposit:

$500

Trust Score:

83

Tradeable Symbols (Total) :

265

Top Takeaways

Here are our top findings on Darwinex:

Overall Summary

Please Note: Darwinex was not included in our last annual review. As a result, this broker’s ratings may be outdated. Read our best forex brokers guide for a breakdown of the top rated forex and CFDs brokers.

| Overall | |

| Trust Score | 83 |

| Offering of Investments | |

| Commissions & Fees | |

| Platforms & Tools | |

| Research | |

| Mobile Trading Apps | |

| Education |

Is Darwinex Safe?

help

83

Trust Score

Darwinex is considered average-risk, with an overall Trust Score of 83 out of 99. Darwinex is not publicly traded and does not operate a bank. Darwinex is authorised by one tier-1 regulator (high trust), zero tier-2 regulators (average trust), and zero tier-3 regulators (low trust). Darwinex is authorised by the following tier-1 regulator: Financial Conduct Authority (FCA). Learn more about Trust Score.

Regulations Comparison

| Year Founded | 2012 |

| Publicly Traded (Listed) | No |

| Bank | No |

| Tier-1 Licenses | 1 |

| Tier-2 Licenses | 0 |

| Tier-3 Licenses | 0 |

| Trust Score | 83 |

Offering of Investments

Darwinex provides traders access to a total of 306 instruments consisting of CFDs on ten indices, six metals, 244 US shares, five cryptocurrencies, and 41 forex pairs. The following table summarizes the different investment products available to Darwinex clients.

Cryptocurrency: Cryptocurrency trading is available through CFDs, but not available through trading the underlying asset (e.g. buying Bitcoin). Note: Crypto CFDs are not available to retail traders from any broker’s UK entity, nor to UK residents.

Offering Comparison

| Forex Trading | Yes |

| CFD Trading | Yes |

| Tradeable Symbols (Total) | 265 |

| Forex Pairs (Total) | 41 |

| US Stock Trading (Non CFD) | No |

| Int’l Stock Trading (Non CFD) | No |

| Social Trading / Copy-Trading | Yes |

| Cryptocurrency (Physical) | No |

| Cryptocurrency (CFD) | Yes |

| Crypto Disclaimer (UK) | Note: Crypto CFDs are not available to retail traders from any broker’s U.K. entity, nor to U.K. residents (except to Professional clients). |

Commissions and Fees

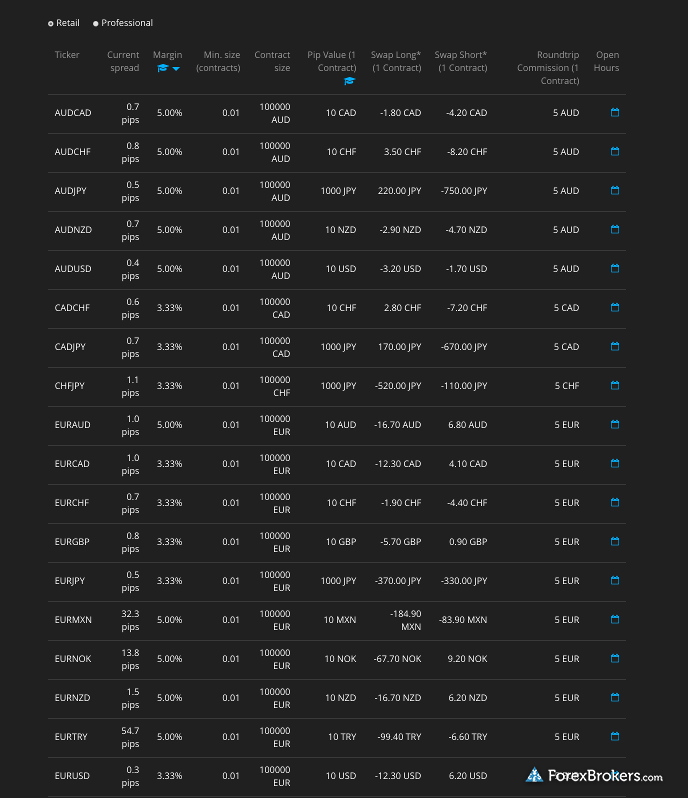

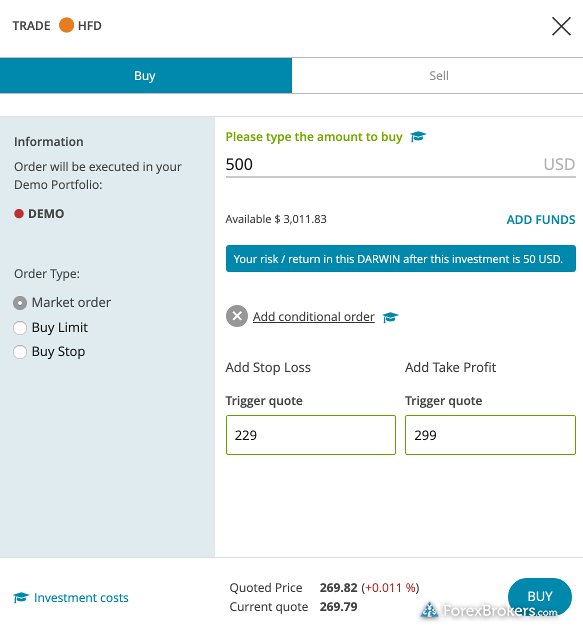

When it comes to commissions and fees at Darwinex, trading costs vary depending on whether users are investing via the Darwinex platform or carrying out self-directed trading on MT4 and MT5. Using live spread data from the broker’s website, which is not meant to be indicative of average spreads, the EUR/USD was generally 0.2 to 0.3 pips.

Base fees: All users, including investors and self-directed traders, incur the spreads on each trade – plus commission, as Darwinex is an agency-broker (non-dealing desk). Spreads are variable, and the round-turn commission is equal to 5 units of the base currency you trade. For example, on the EUR/USD pair, the commission is denominated in euro, as that is the base currency. Therefore, a euro base pair will incur €2.5 charged per side for every 100,000 units traded (one standard lot), which equates to €5 per standard lot round turn (RT). Using the USD/JPY as an example, the RT commission is $5 per standard lot.

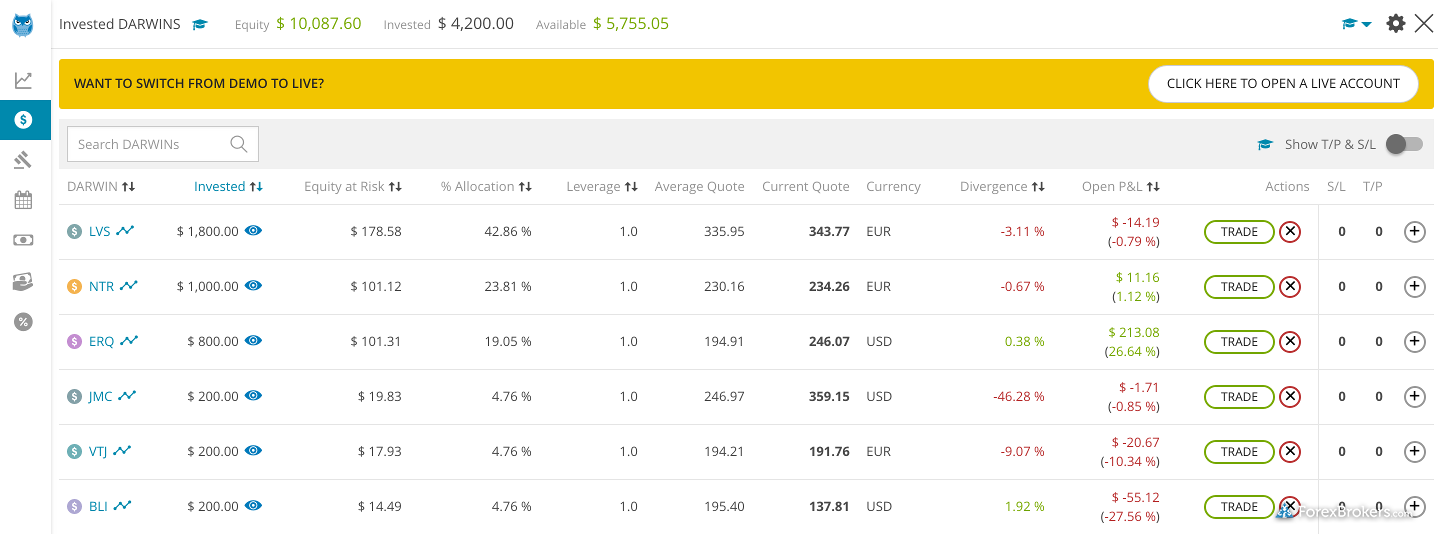

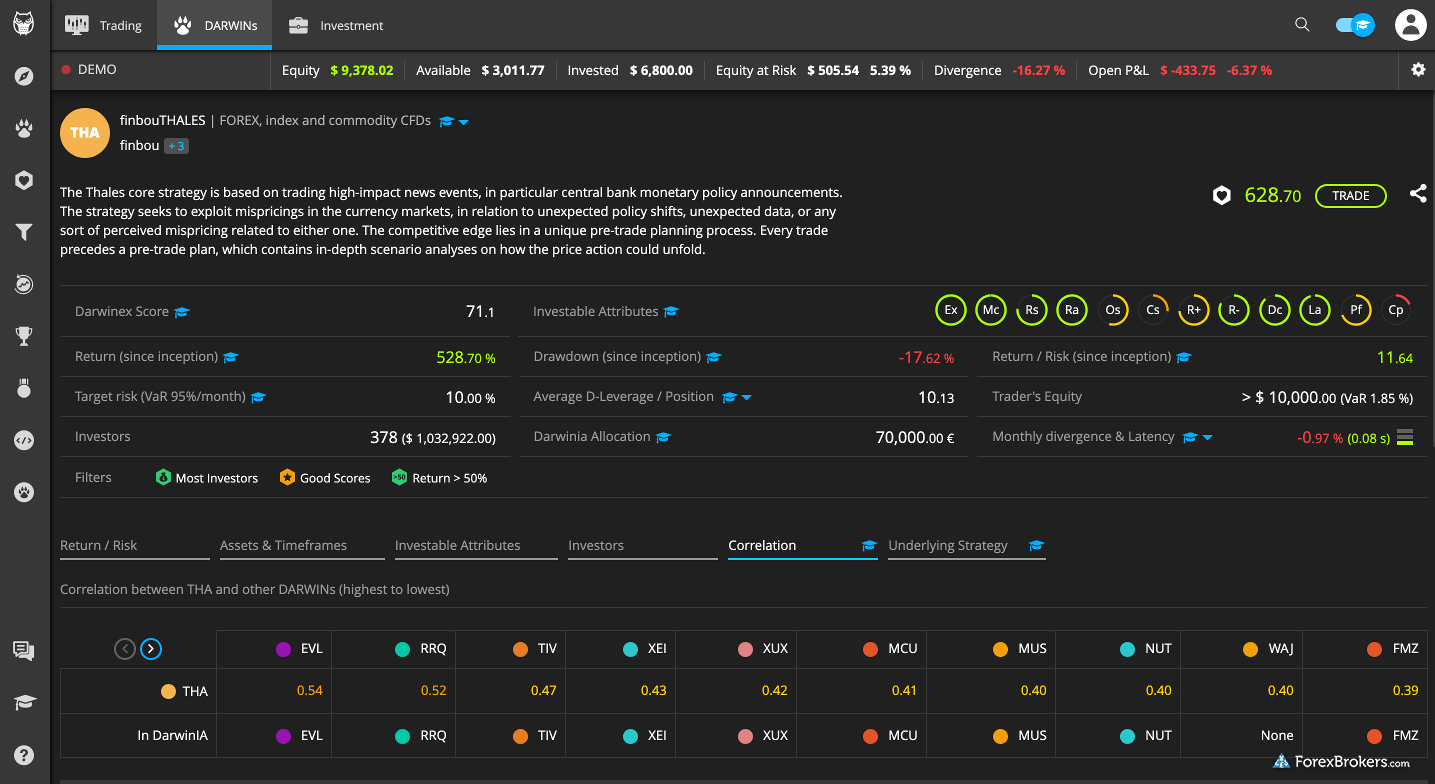

Slippage and execution: While slippage can occur and the resulting performance can vary between an investor’s account and the underlying strategy, Darwinex lists this tracking error as a divergence value within the platform. Such metrics help make the research and investing process transparent at Darwinex. Darwinex also publishes its execution statistics to provide greater transparency to its users.

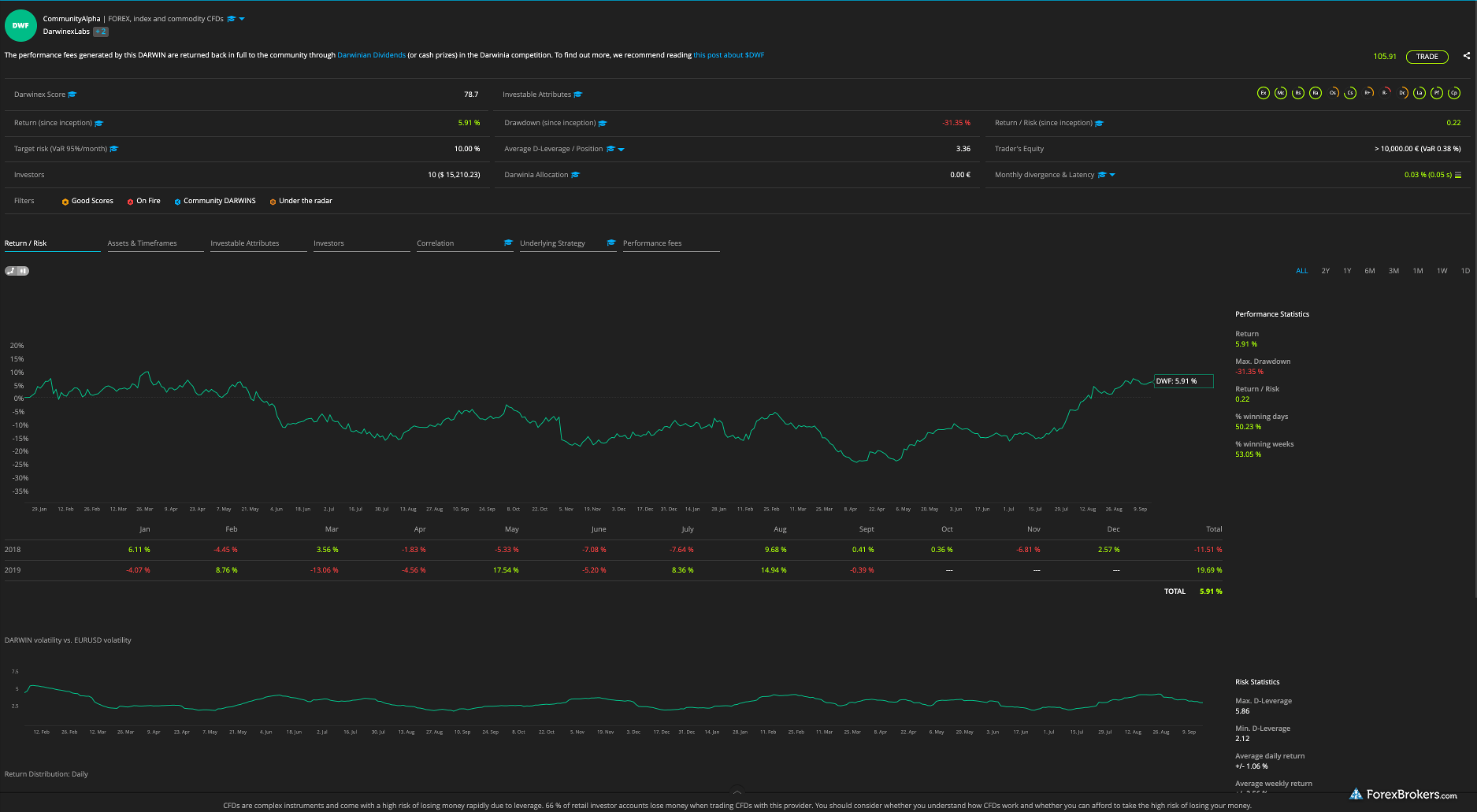

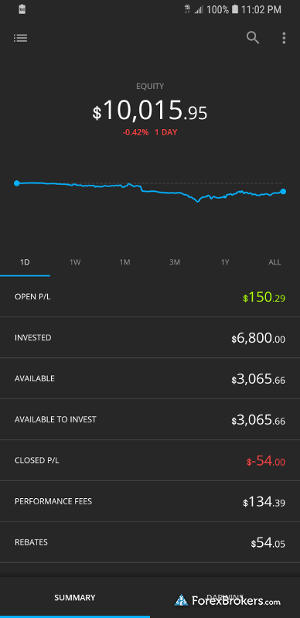

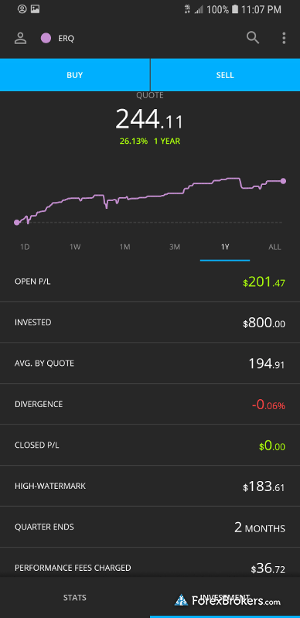

Darwin performance fee: For every subscribed strategy (Darwin), investors on Darwinex only pay a 20% quarterly performance fee if the performance of their subscribed strategy achieves a new high watermark. This fee, calculated by comparing any net new profits above a prior high, is comparable to the incentive fee structure of a hedge fund.

Performance discounts: Darwinex also offers talent-linked pricing, which is comparable to an active trader offering. With talent-linked pricing, trading costs drop when the performance realized by users surpass certain thresholds reflected in a higher D-Score ranking by Darwinex.

Gallery

Fees Comparison

| Minimum Deposit | $500 |

| Average Spread EUR/USD – Standard | N/A |

| All-in Cost EUR/USD – Active | N/A |

| Active Trader or VIP Discounts | Yes |

| Execution: Agency Broker | Yes |

| Execution: Market Maker | No |

Platforms and Tools

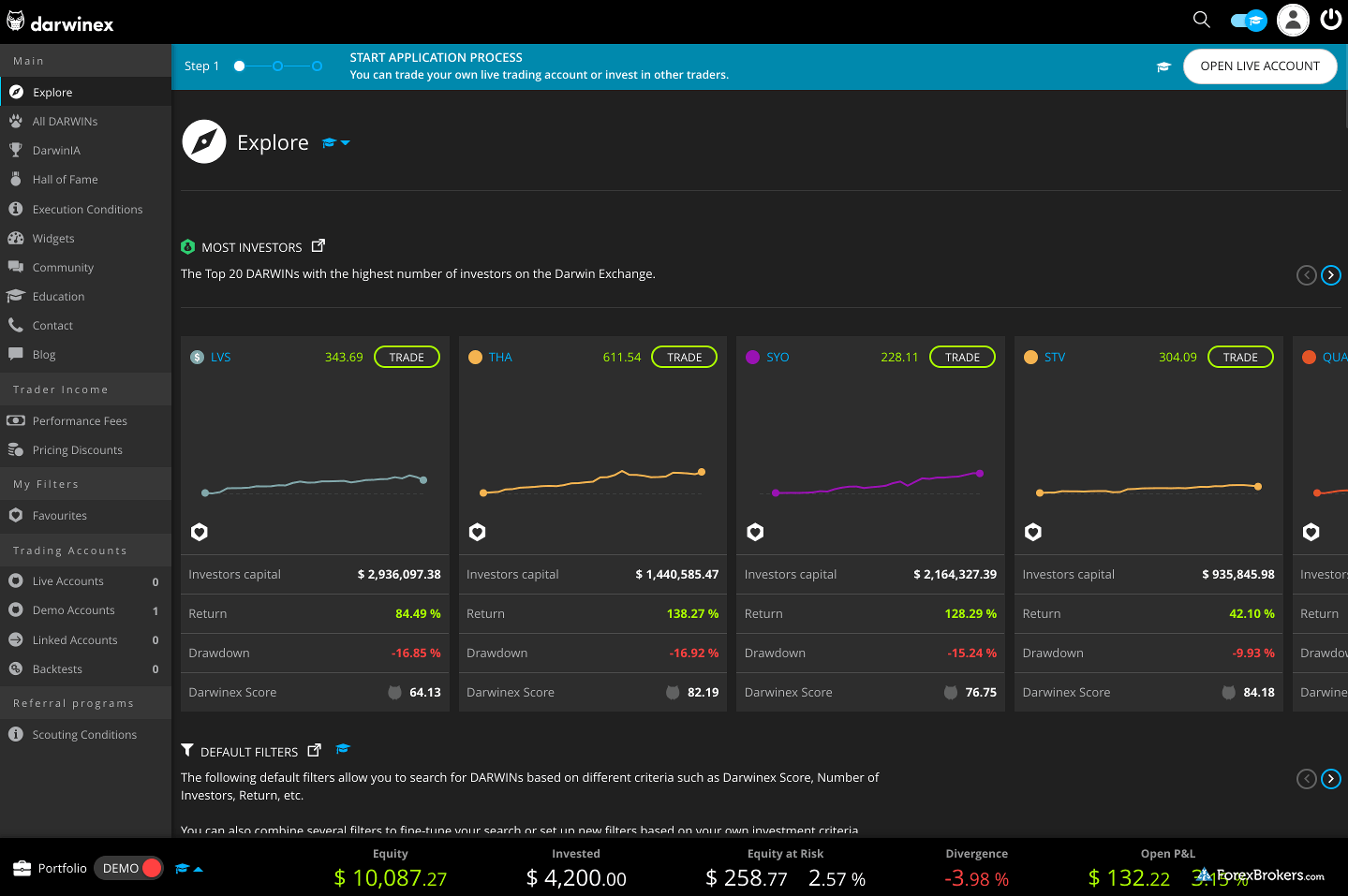

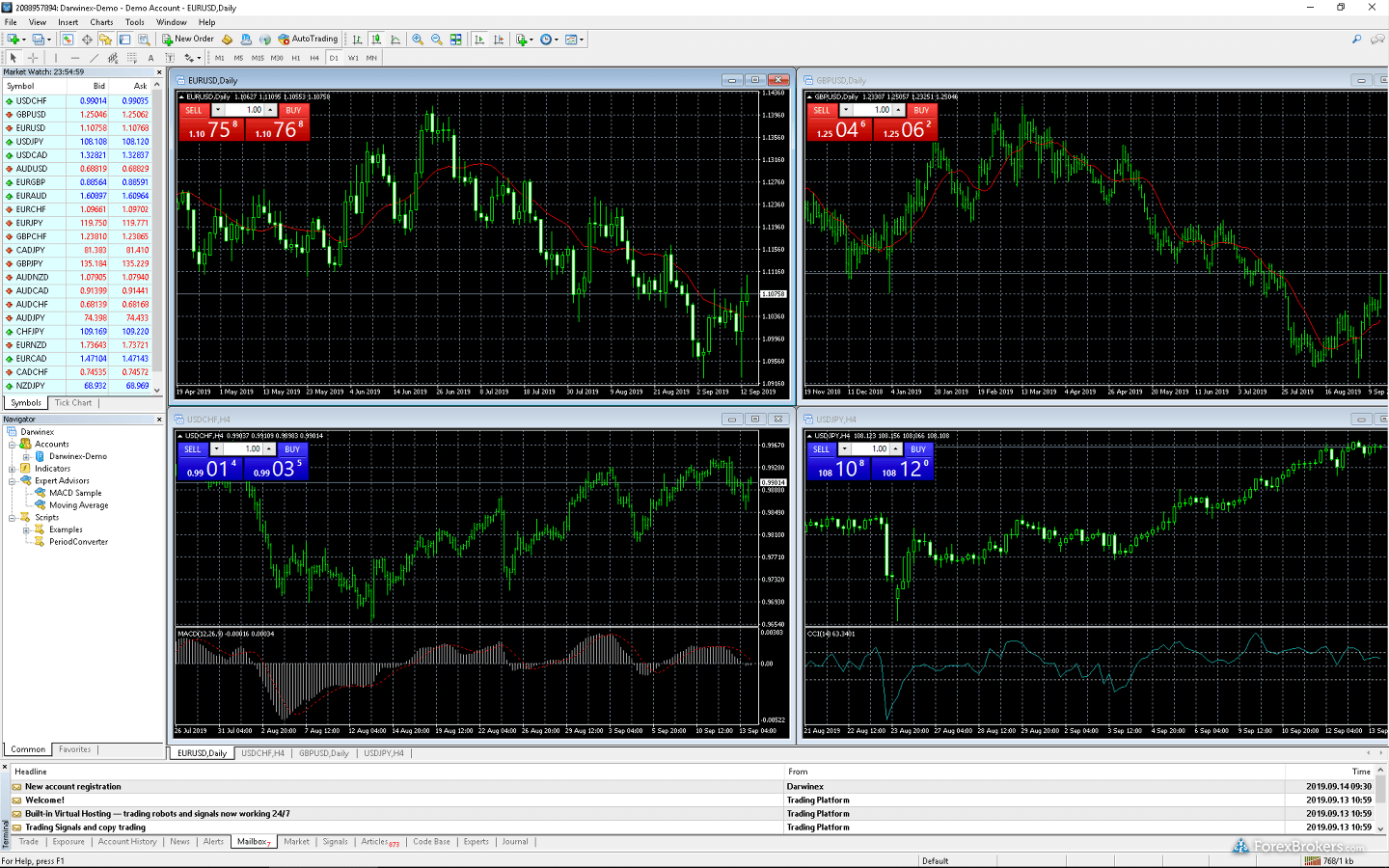

Darwinex offers its proprietary software built solely for copy trading on the Darwin Exchange, alongside the popular MetaTrader 4 (MT4) and MetaTrader 5 (MT5) platforms for traditional self-directed forex and CFDs trading. This is a key difference from copy trading leader eToro, which caters to both investors and self-directed traders on one single platform.

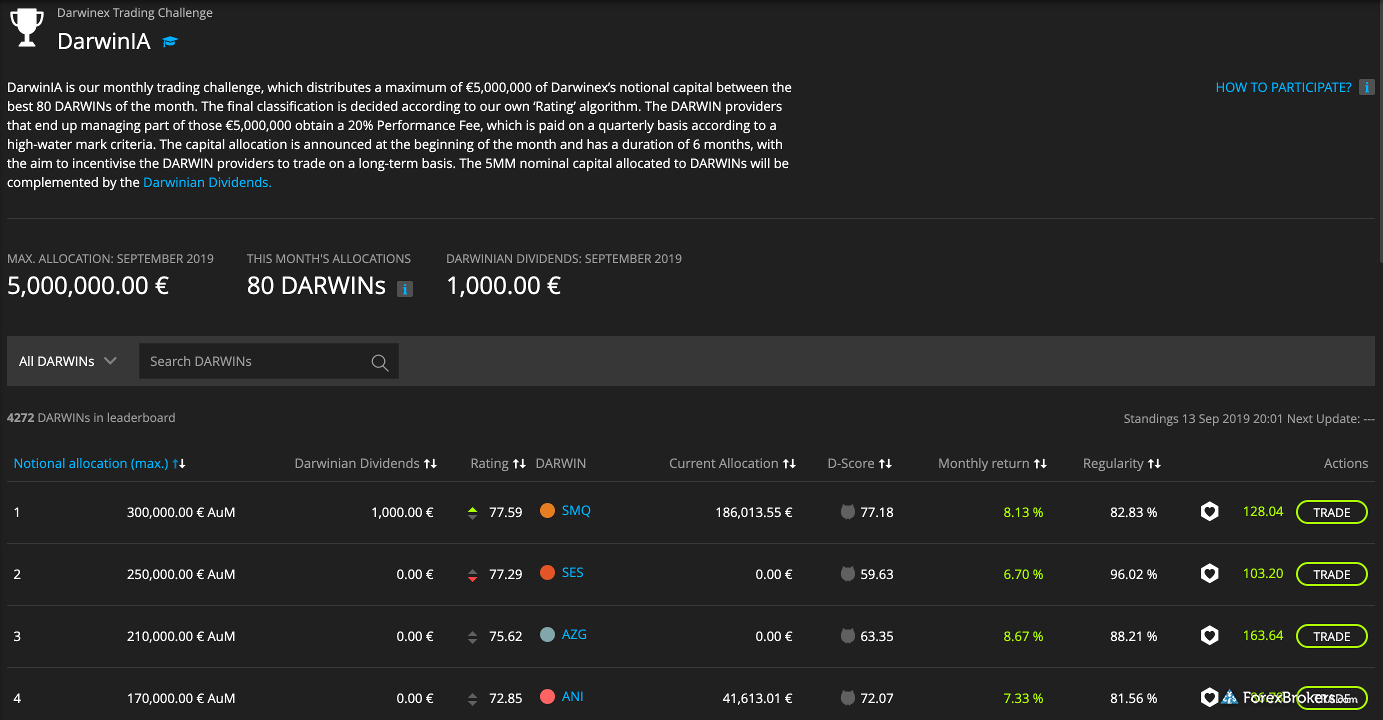

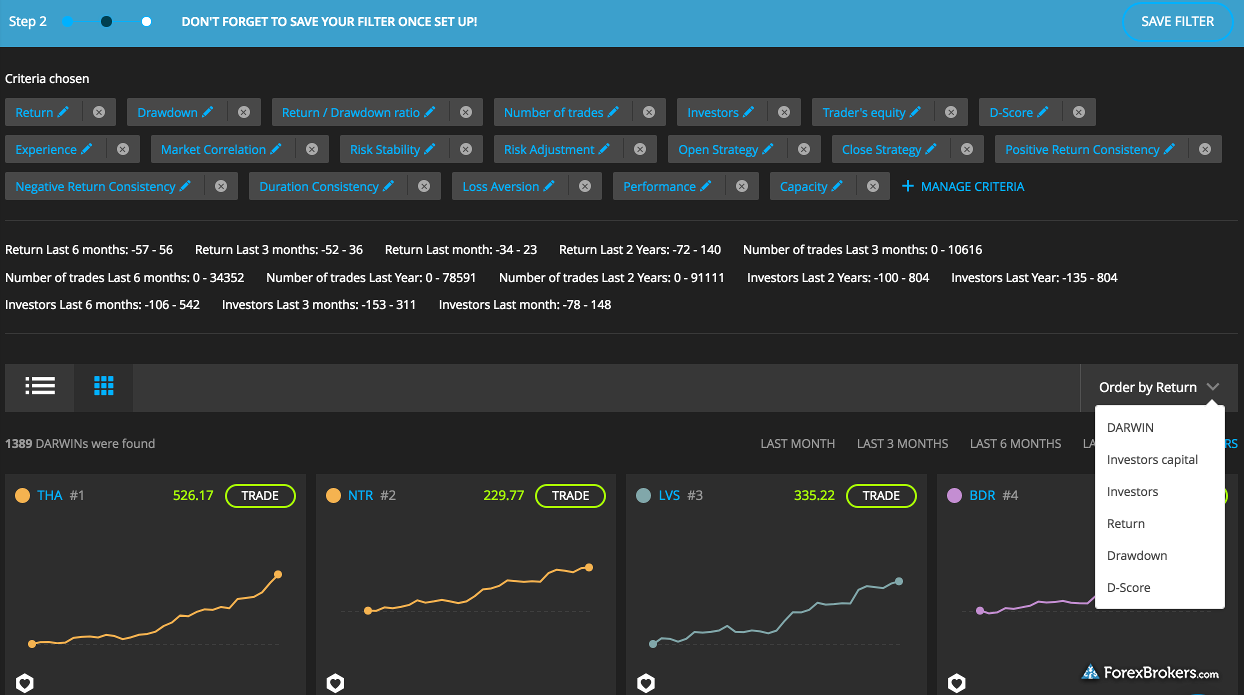

Darwins: When a trader creates a trading strategy – known as a Darwin – within the Darwinex community, investors can buy and sell these strategies by selecting the respective Darwin symbol. Each month, 80 of the top-performing Darwins are eligible to receive allocations from a pool of five million of the firm’s capital.

Darwin Portfolios: Investors can also build portfolios consisting of Darwin strategies (there are more than 4,000) created by a trading system developer. Strategy creators share their strategies in the Darwin community via the available MetaTrader platforms, which connect to Darwinex.

€5 million pool: The top 80 trading system developers with the most consistent results become eligible for allocations from a pool of €5 million in notional funding each month from Darwinex. The distributions received by the 80 recipients remain invested in their respective strategies for six months. This funding structure acts as a further incentive for users to create successful Darwins and help them earn performance fees in return for positive results. Darwinex maintains a maximum of €30 million invested in Darwins that qualify to receive allocations.

Calculating maximum risk: Darwinex uses a Value-at-Risk (VaR) approach to calculate the maximum risk investors are willing to take. This math formula remains in the background as a guide when investors customize their investment preferences in their portfolios. A threshold percentage value is chosen (based on the client’s balance), and this takes into consideration the historical volatility of each strategy in the overall portfolio.

MetaTrader: The full MetaTrader suite is also available for use by self-directed traders at Darwinex to access CFDs on 41 forex pairs, 244 single-stocks, ten indices, and six metals contracts and five cryptocurrencies. In 2020, Darwinex finished Best in Class among brokers offering MetaTrader.

Gallery

Research

Aside from excellent copy trading research tools and occasional articles and news on the company’s blog, Darwinex does not provide traditional forex research for self-directed trading.

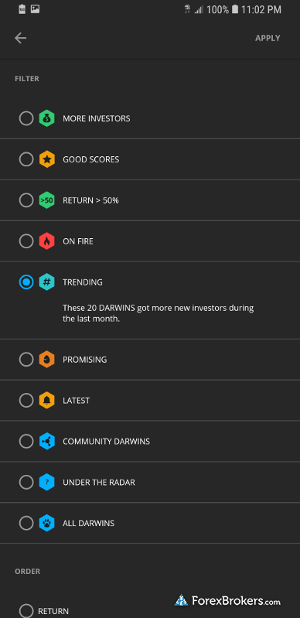

Copy-trading research: One of the key research tools the broker provides is the Darwinex platform itself. Traders get access to a broad range of configurable parameters for sorting through over 2000 Darwin strategies (including closed Darwins) and can research performance rankings using predefined and custom filters, such as overall return. The Darwinex score, for example, uses the firm’s proprietary ranking to gauge a strategy’s global potential – where the higher the score is, the better.

Gallery

Mobile Trading

Darwinex offers its own proprietary Darwinex mobile app for investors, as well as MetaTrader4 (MT4).

Pros: The Darwinex mobile app has a modern look and feels and includes many of the crucial features of the web version. For example, the Darwinex mobile app provides users the ability to explore Darwin strategies and view a summary of open Darwin positions. You can also see historical performance data and rankings, including chart visuals for each strategy.

Cons: Darwinex mobile offers no ability functionality for traditional self-directing trading. For now, MT4 and MT5 remain the only option for those wanting to trade from the list of forex pairs and CFDs available at Darwinex.

Gallery

Customer Service

To score Customer Service, ForexBrokers.com partnered with customer experience research group Customerwise to conduct phone tests from locations throughout the UK. For our 2020 Review, 330 customer service tests were conducted over six weeks.

Results

-

Average Connection Time:

<1 minute - Average Net Promoter Score: 5.8 / 10

- Average Professionalism Score: 5.6 / 10

- Overall Score: 6.36 / 10

-

Ranking: 18

th (22 brokers)

Final Thoughts

Thanks to its competitive pricing and execution offered through the firm’s FCA-regulated entity, along with £500,000 in supplemental insurance (beyond the £85,000 in coverage from the FCSC in the UK) Darwinex is a viable option for investors and experienced traders to invest in or commercialize forex strategies.

About Darwinex

Founded in 2012, Darwinex is regulated via its UK entity Tradeslide Trading Tech Limited, and passported throughout 31 EU-member states under MiFID regulation. Through its Darwin Exchange, Darwinex provides a unique approach to social copy trading. Darwinex users can trade strategies as financial assets based on their net asset value (NAV) indexed to 100. As a hybrid broker and asset manager, Darwinex currently manages nearly 36 million in assets. Read more on Wikipedia about Darwinex.

Darwinex Trading Features

| Virtual Trading (Demo) | Yes |

| Proprietary Platform | Yes |

| Desktop Platform (Windows) | Yes |

| Web Platform | Yes |

| Social Trading / Copy-Trading | Yes |

| MetaTrader 4 (MT4) | Yes |

| MetaTrader 5 (MT5) | Yes |

| cTrader | No |

| DupliTrade | No |

| ZuluTrade | No |

| Charting – Indicators / Studies (Total) | 51 |

| Charting – Drawing Tools (Total) | 31 |

| Charting – Trade From Chart | Yes |

| Watchlists – Total Fields | 7 |

| Order Type – Market | Yes |

Darwinex Research Features

| Daily Market Commentary | No |

| Forex News (Top-Tier Sources) | No |

| Autochartist | No |

| Trading Central (Recognia) | No |

| Delkos Research | No |

| Social Sentiment – Currency Pairs | No |

| Economic Calendar | Yes |

Darwinex Mobile App Features

| Android App | Yes |

| Apple iOS App | Yes |

| Alerts – Basic Fields | Yes |

| Watch List | Yes |

| Watch List Syncing | No |

| Charting – Indicators / Studies | 30 |

| Charting – Draw Trendlines | Yes |

| Charting – Trendlines Moveable | No |

| Charting – Multiple Time Frames | Yes |

| Charting – Drawings Autosave | No |

| Forex Calendar | No |