CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. Trade Responsibly: 71.58% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. This content is intended for information and educational purposes only and should not be considered investment advice or investment recommendation.

FxPro competes among the top MetaTrader brokers, featuring multiple account options and various execution methods. It provides its own proprietary FxPro Edge app – though it isn’t yet available for mobile – alongside access to the BnkPro app (which isn’t yet available in all regions).

FxPro’s primary drawback is its higher-than-average pricing, which just can’t compete with the lowest-cost forex brokers.

-

Minimum Deposit:

$100.00

Trust Score:

90

Tradeable Symbols (Total) :

2175

FxPro pros & cons

Pros

- Founded in 2006, FxPro is regulated in one tier-1 jurisdiction and two tier-2 jurisdictions, making it a safe (low-risk) broker for trading forex and CFDs.

- FxPro offers a variety of pricing options across its account types, including fixed and variable spreads.

- FxPro is best known for its MetaTrader and cTrader platform offerings, available for desktop, web, and mobile.

- FxPro provides fully-transparent execution methods that vary by account type – with less than 1% of client orders requoted in 2020.

Cons

- The pricing at FxPro isn’t quite competitive enough to challenge industry leaders such as IG and CMC Markets.

- FxPro’s proprietary platform, FxPro Edge, has established a good foundation for a new web-based platform, but still can’t compete with the best proprietary trading platforms (and is not yet available as a mobile app).

- FxPro offers fewer symbols for forex and CFD traders than the leading multi-asset brokers.

- The BnkPro app for banking and payments offers thousands of global stocks to trade, but is not yet fully rolled out in all regions, such as Europe and Asia.

Overall Summary

| Overall | |

| Trust Score | 90 |

| Offering of Investments | |

| Commissions & Fees | |

| Platforms & Tools | |

| Research | |

| Mobile Trading Apps | |

| Education |

Is FxPro safe?

help

90

Trust Score

FxPro is considered low-risk, with an overall Trust Score of 90 out of 99. FxPro is not publicly traded, does not operate a bank, and is authorised by one tier-1 regulator (high trust), two tier-2 regulators (average trust), and one tier-3 regulator (low trust). FxPro is authorised by the following tier-1 regulators: Financial Conduct Authority (FCA). Learn more about Trust Score.

Regulations Comparison

| Year Founded | 2006 |

| Publicly Traded (Listed) | No |

| Bank | No |

| Tier-1 Licenses | 1 |

| Tier-2 Licenses | 2 |

| Tier-3 Licenses | 1 |

| Trust Score | 90 |

Offering of investments

The range of symbols available at FxPro will largely depend on your chosen trading platform. For traders that choose to use MetaTrader’s suite of platforms, FxPro offers over 400 CFDs, including forex, shares, indices, metals, and cryptocurrencies, compared to roughly 100 for its cTrader offering. There are also thousands of shares available to trade in FxPro’s BnkPro app, though it isn’t yet fully available globally. The following table summarizes the different investment products available to FxPro clients.

Cryptocurrency: Cryptocurrency trading is available at FxPro through CFDs, but not available through trading the underlying asset (e.g. buying Bitcoin). Note: Crypto CFDs are not available to retail traders from any broker’s U.K. entity, nor to U.K. residents.

FxPro offering of investments:

| Forex Trading | Yes |

| CFD Trading | Yes |

| Tradeable Symbols (Total) | 2175 |

| Forex Pairs (Total) | 70 |

| US Stock Trading (Non CFD) | No |

| Int’l Stock Trading (Non CFD) | No |

| Social Trading / Copy-Trading | Yes |

| Cryptocurrency (Physical) | No |

| Cryptocurrency (CFD) | Yes |

| Crypto Disclaimer (UK) | Note: Crypto CFDs are not available to retail traders from any broker’s U.K. entity, nor to U.K. residents (except to Professional clients). |

Commissions and fees

FxPro’s pricing is higher than the industry average, putting it at a disadvantage compared to industry peers like Pepperstone or IC Markets, who both also offer the full MetaTrader and cTrader suites.

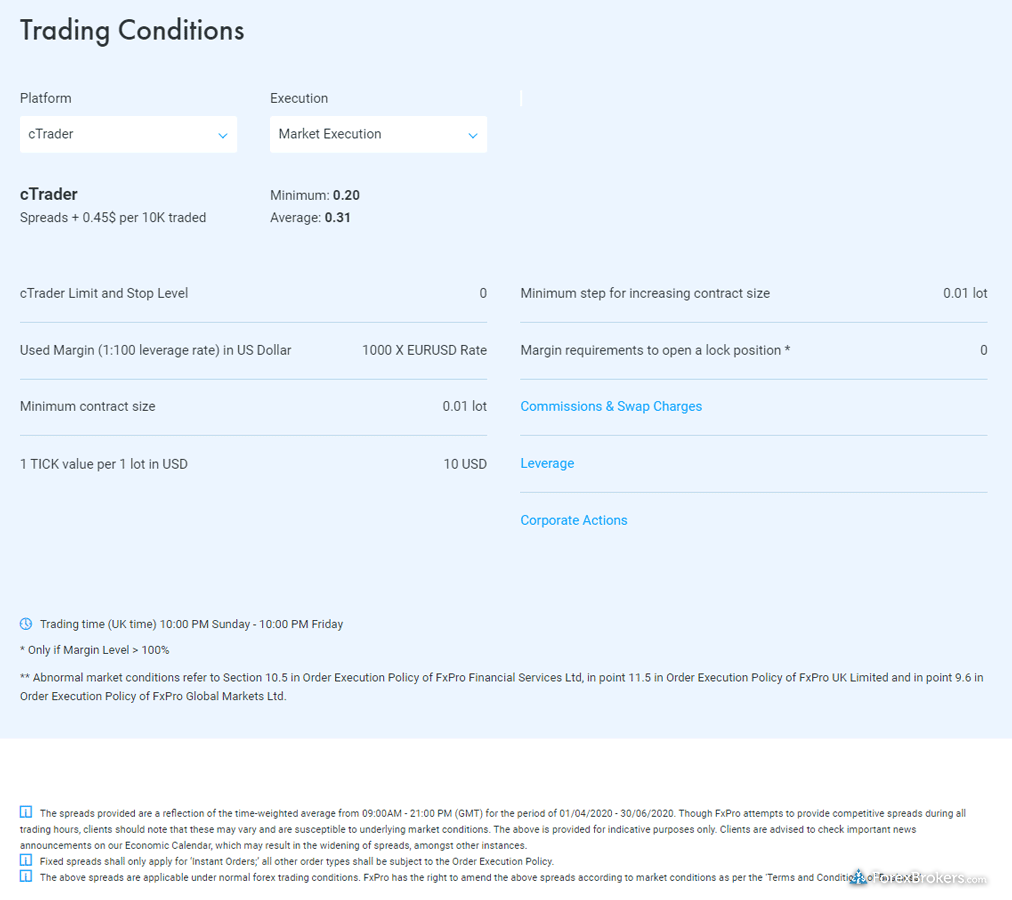

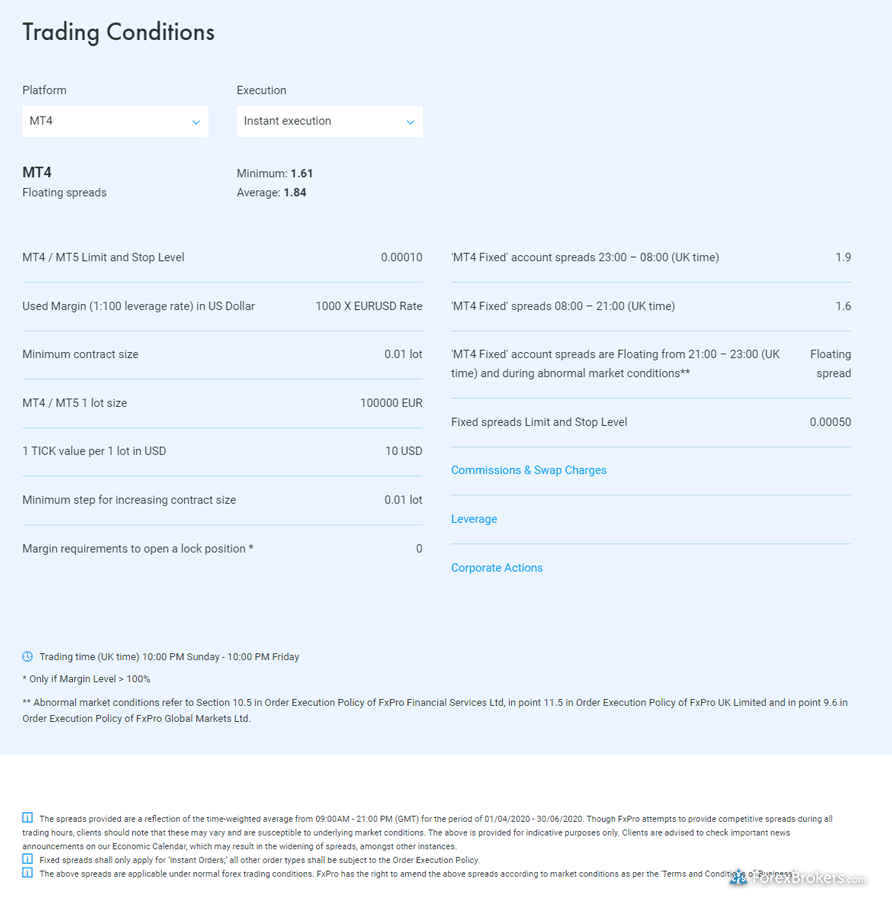

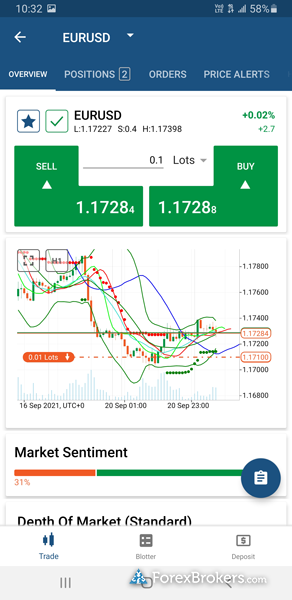

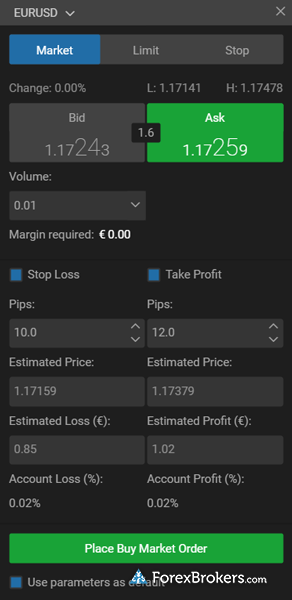

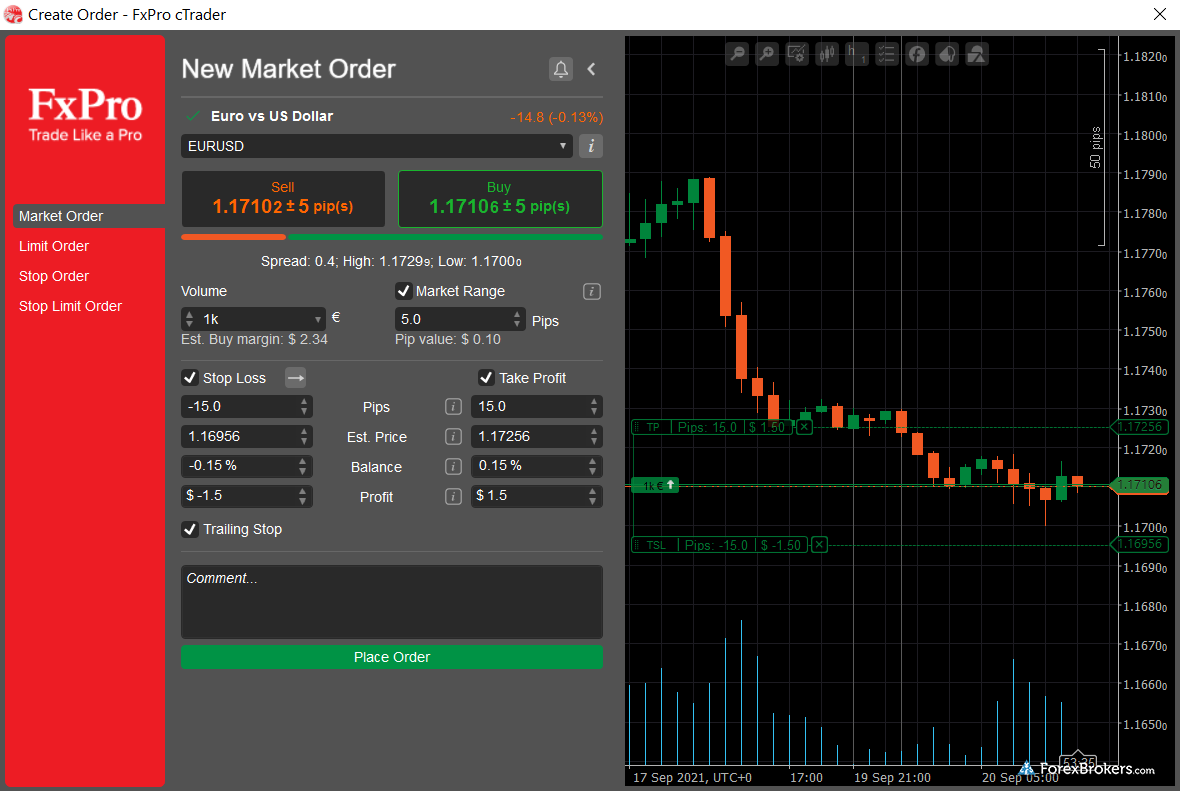

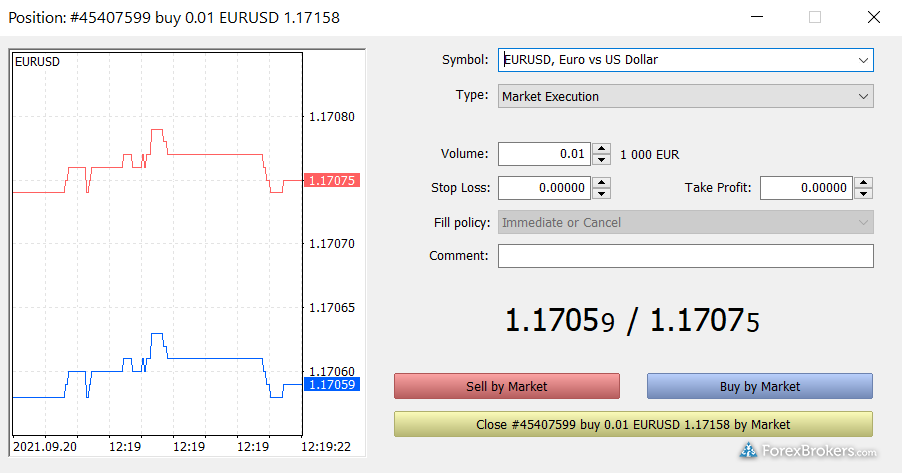

Execution method: On FxPro’s MT4 offering, traders can choose variable or fixed spreads. For the variable-spread pricing, there are two types of execution-based pricing: instant and market. Instant execution is subject to requotes but no slippage, while market execution has the potential for slippage – but without requotes.

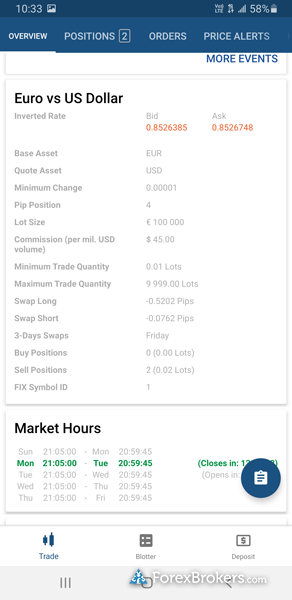

Commissions: FxPro’s most competitive spreads are available on its cTrader platform, which features commission-based pricing. FxPro’s effective spread for trading the EUR/USD pair on cTrader is roughly 1.27 pips. This figure takes into account FxPro’s average spread (from August 2020) of 0.37 pips, as well as a 0.9 pip commission-equivalent.

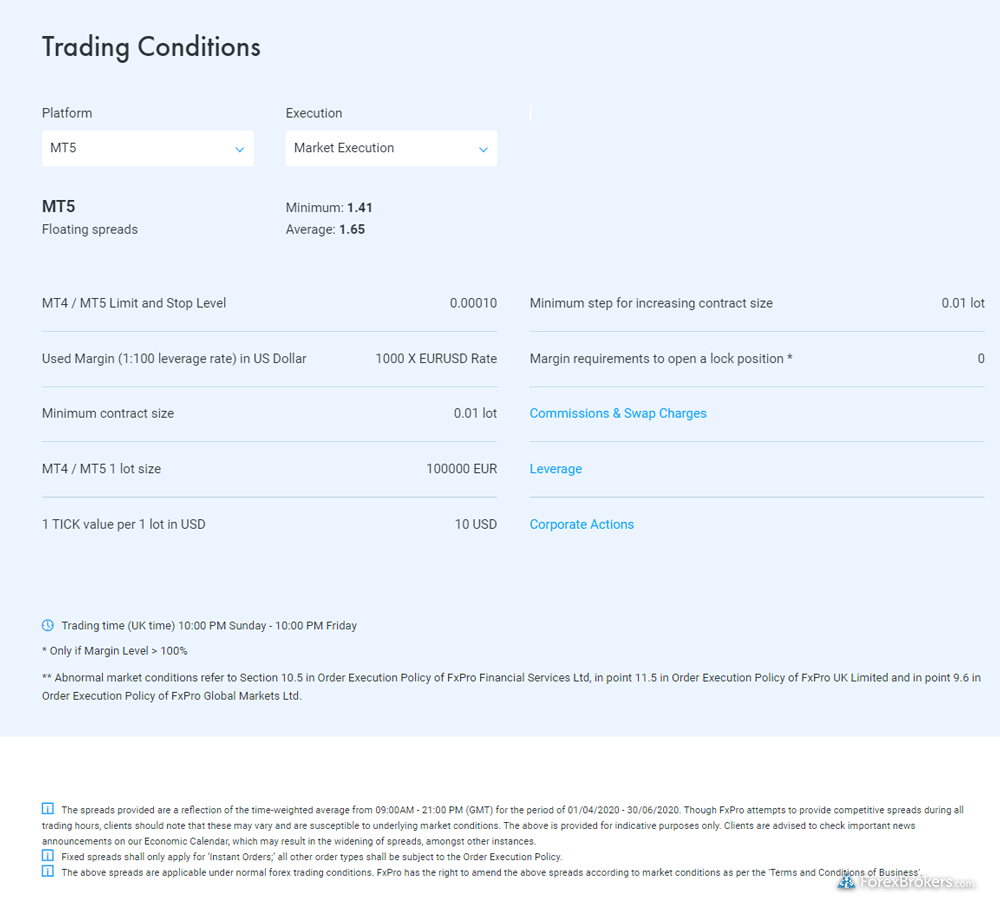

Spreads: FxPro’s floating-rate (variable spread) model is available on MT4 and MT5, featuring EUR/USD spreads of 1.58 for accounts on market execution (1.51 pips on MT5), and 1.71 for accounts with instant execution – as per FxPro’s data from August 2020.

Fixed pricing: On MT5, there is no fixed-spread offering, and only market execution is available.

Active traders: FxPro offers an Active Trader program as part of its VIP account offering, although its discounts are not as attractive as what’s available from competitors like FOREX.com, IG, and Saxo Bank.

Executing large orders: No question; FxPro’s best feature is its ability to execute large orders, placed with no minimum distance away from the current market price.

Gallery

FxPro pricing summary:

| Minimum Deposit | $100.00 |

| Average Spread EUR/USD – Standard | 1.51 (August 2020) |

| All-in Cost EUR/USD – Active | 1.27 (August 2020) |

| Active Trader or VIP Discounts | Yes |

| Execution: Agency Broker | Yes |

| Execution: Market Maker | Yes |

Mobile Trading Apps

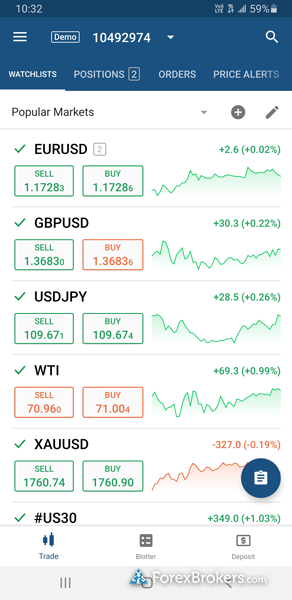

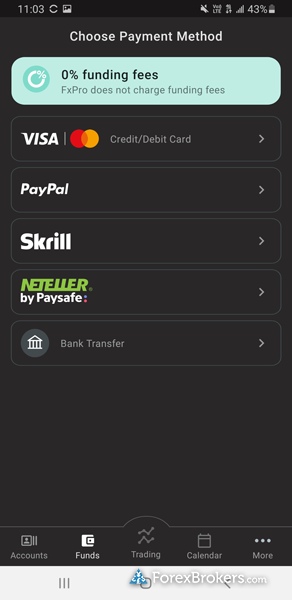

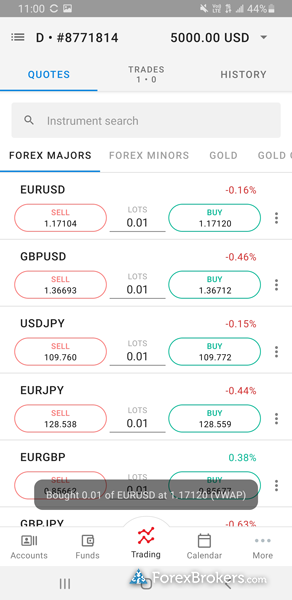

Apps overview: FxPro provides its own proprietary FxPro Edge app for trading, account management, and basic market news, as well as a third-party mobile lineup designed by the same providers that power its desktop and web-based platforms: MetaTrader (MetaQuotes) and cTrader (Spotware). FxPro also offers the BnkPro app for share trading, which will eventually include a Mastercard debit card and banking service – but the app has not been fully rolled out globally.

Ease of use: FxPro Direct is FxPro’s proprietary mobile app, which supports trading for users that have a CFD account, but is mainly optimized for account management. It features charts, but with no drawing tools and virtually no indicators (other than volume data). The FxPro Edge platform is only available for mobile as a browser-based experience – it can’t be installed as a standalone app. While FxPro Edge provided a smooth user experience, the option to download the platform for Android and iOS would be a welcome addition.

Gallery

Gallery

FxPro mobile trading:

| Android App | Yes |

| Apple iOS App | Yes |

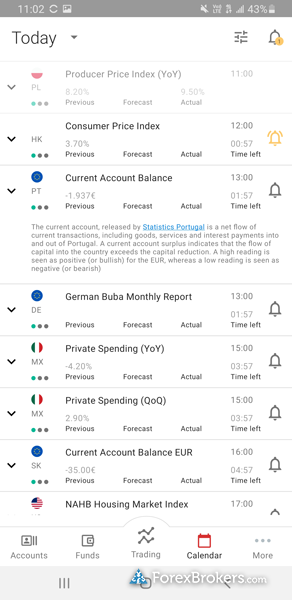

| Alerts – Basic Fields | Yes |

| Watch List | Yes |

| Watch List Syncing | Yes |

| Charting – Indicators / Studies | 30 |

| Charting – Draw Trendlines | Yes |

| Charting – Trendlines Moveable | Yes |

| Charting – Multiple Time Frames | Yes |

| Charting – Drawings Autosave | No |

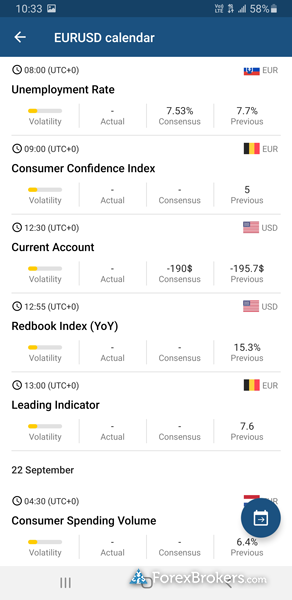

| Forex Calendar | Yes |

Other trading platforms

Due to the availability of MetaTrader, cTrader, and its own proprietary FxPro Edge web platform, traders at FxPro have a diverse selection of platform options that support a variety of trading styles. While FxPro Edge clearly trails platform leaders such as Saxo Bank, CMC Markets, and IG, it’s a good foundation for future improvements, and helps FxPro stand out from the crowded field of MetaTrader-only brokers.

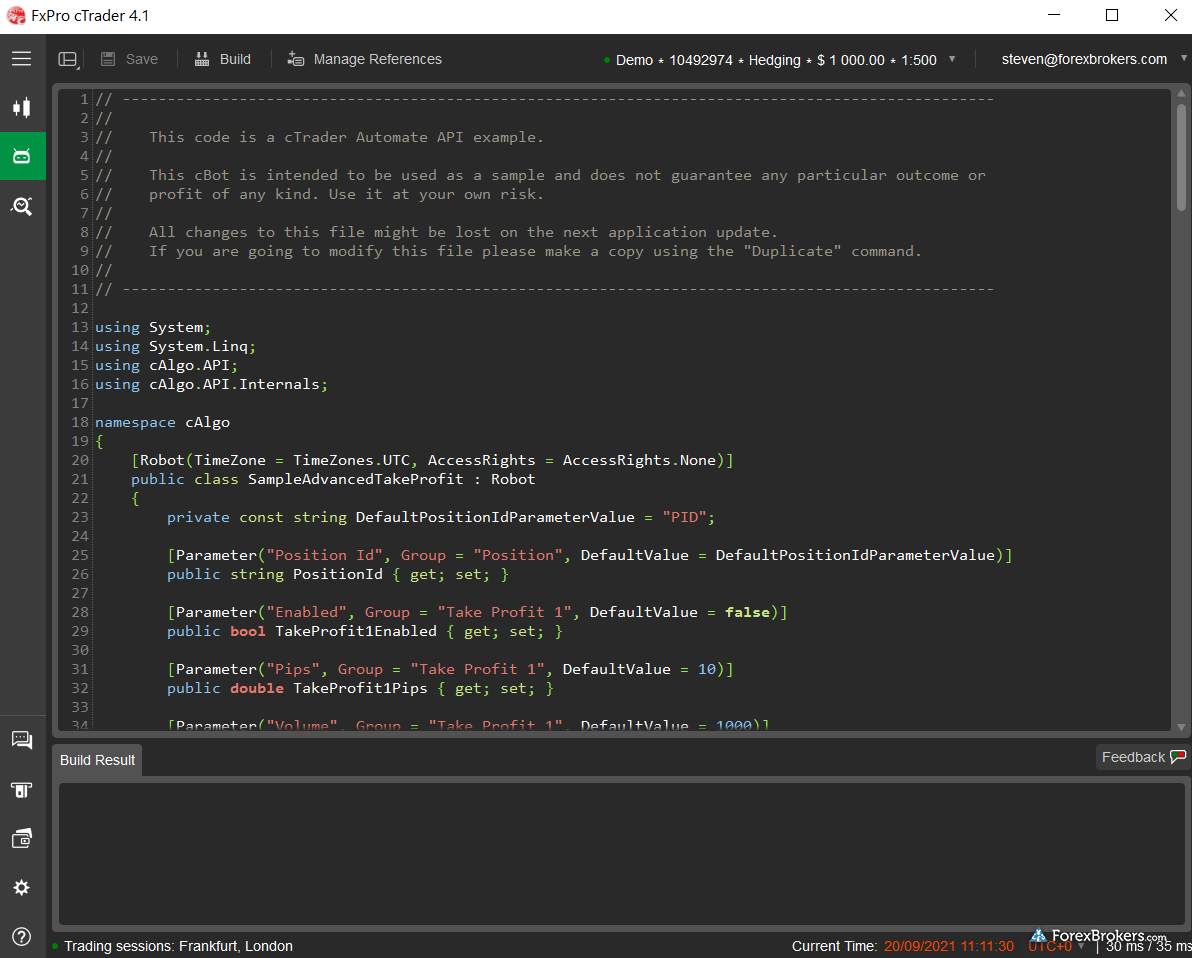

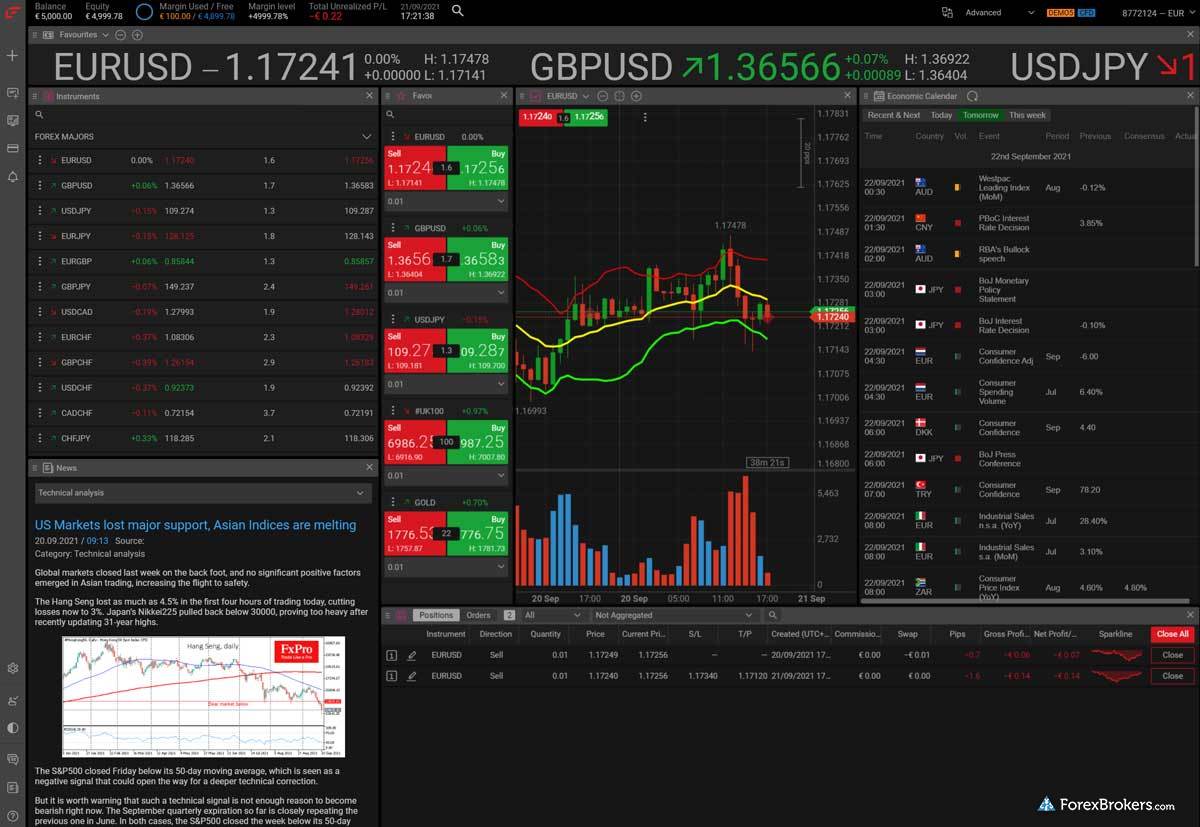

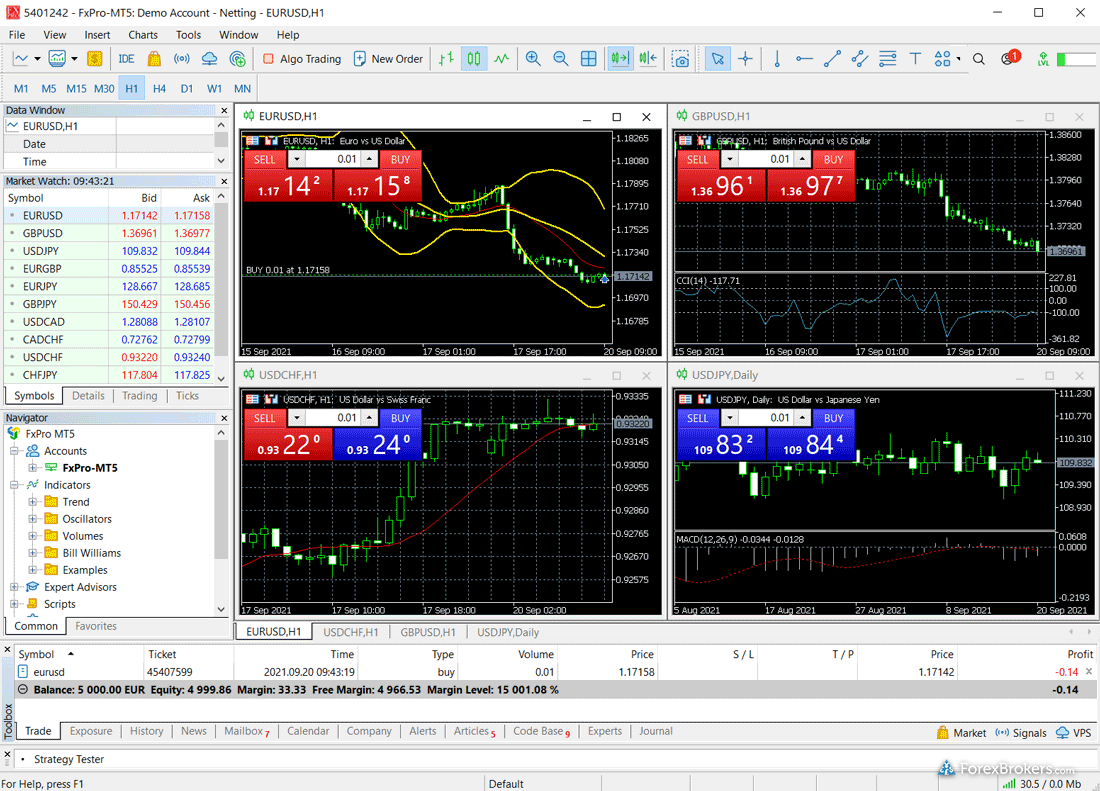

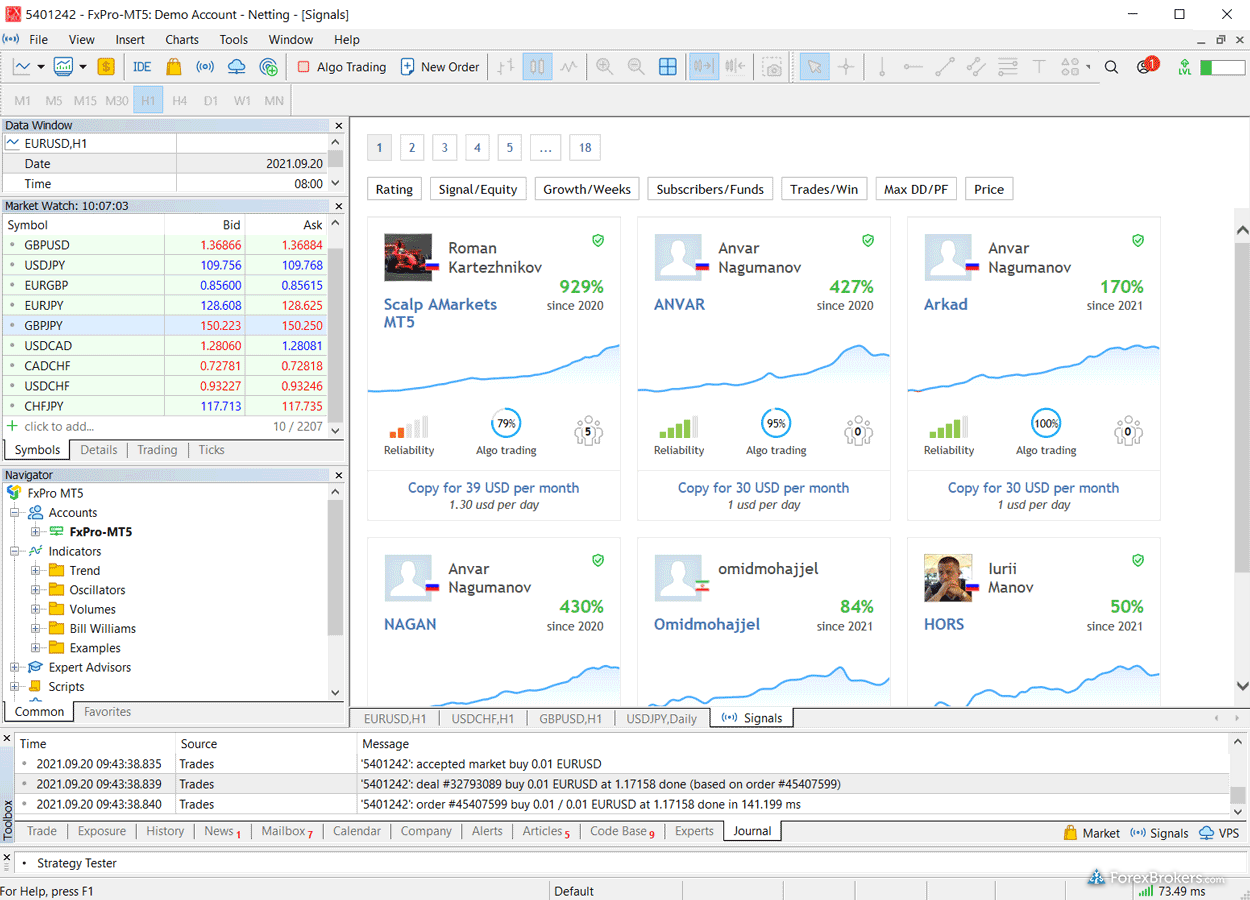

Platforms overview: FxPro offers three platforms in total: FxPro Edge, MetaTrader, and cTrader. FxPro Edge is FxPro’s in-house web-based platform, which features robust charts and a responsive design. The full MetaTrader suite (MT4 and MT5) is also available for web and desktop, along with the FxPro cTrader platform and the cAlgo desktop app for algorithmic trading.

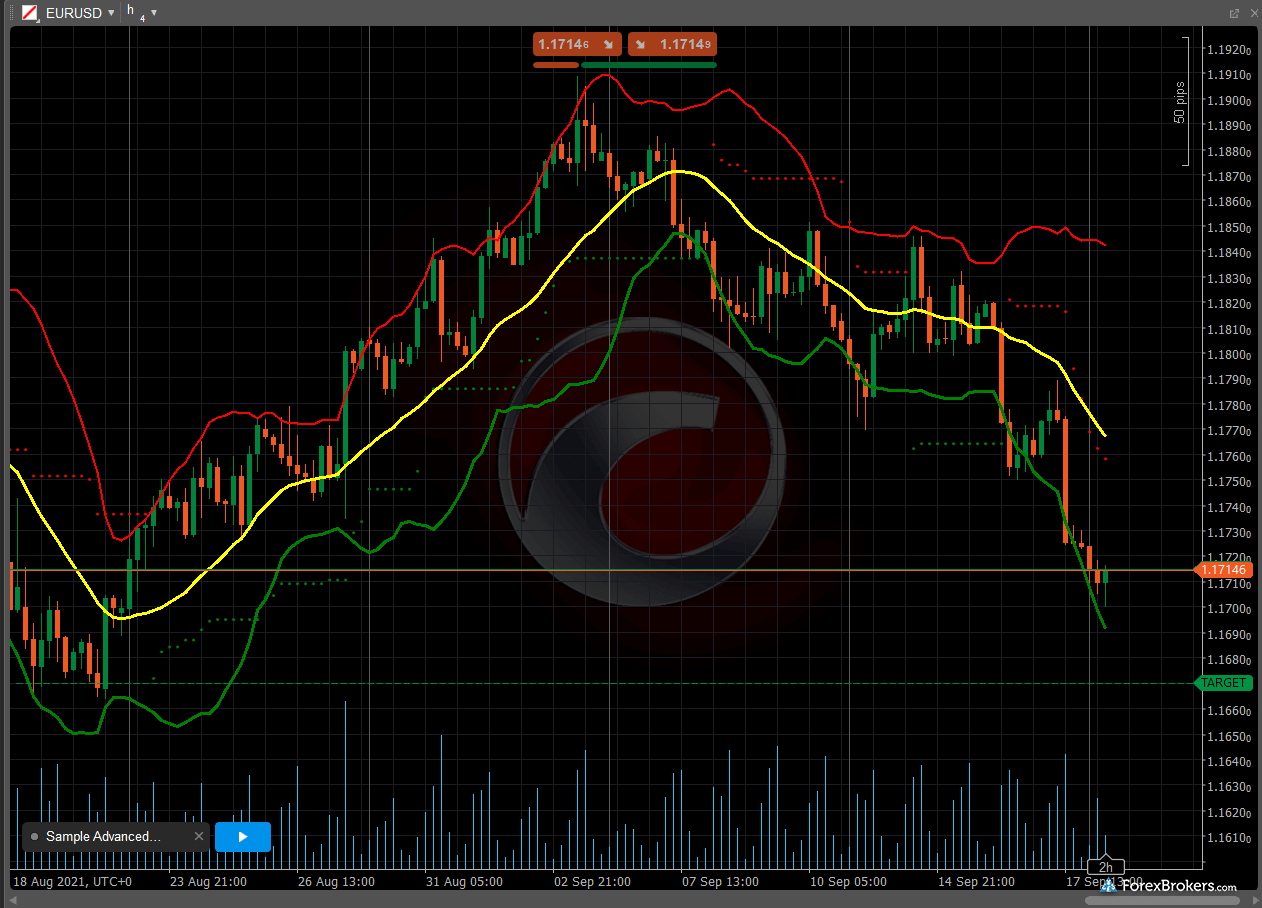

Charting: The FxPro Edge platform features smooth charting, with 53 indicators and several selectable chart types. For comparison, cTrader has 73 indicators and dozens of drawing tools, and boasts a sleeker charting experience than you’ll find with MetaTrader.

Trading tools: Signals from Trading Central are available as a plugin for MetaTrader. Besides the cTrader and MetaTrader platform suites, the FxPro Edge platform comes with a few default layouts, as well as drag-and-drop modules and widgets. Overall, FxPro has a good range of tools and third-party solutions across its available platforms, yet still has room to improve to match category leaders.

Gallery

FxPro trading platform:

| Virtual Trading (Demo) | Yes |

| Proprietary Platform | Yes |

| Desktop Platform (Windows) | Yes |

| Web Platform | Yes |

| Social Trading / Copy-Trading | Yes |

| MetaTrader 4 (MT4) | Yes |

| MetaTrader 5 (MT5) | Yes |

| cTrader | Yes |

| DupliTrade | No |

| ZuluTrade | No |

| Charting – Indicators / Studies (Total) | 51 |

| Charting – Drawing Tools (Total) | 31 |

| Charting – Trade From Chart | Yes |

| Watchlists – Total Fields | 7 |

| Order Type – Market | Yes |

Market Research

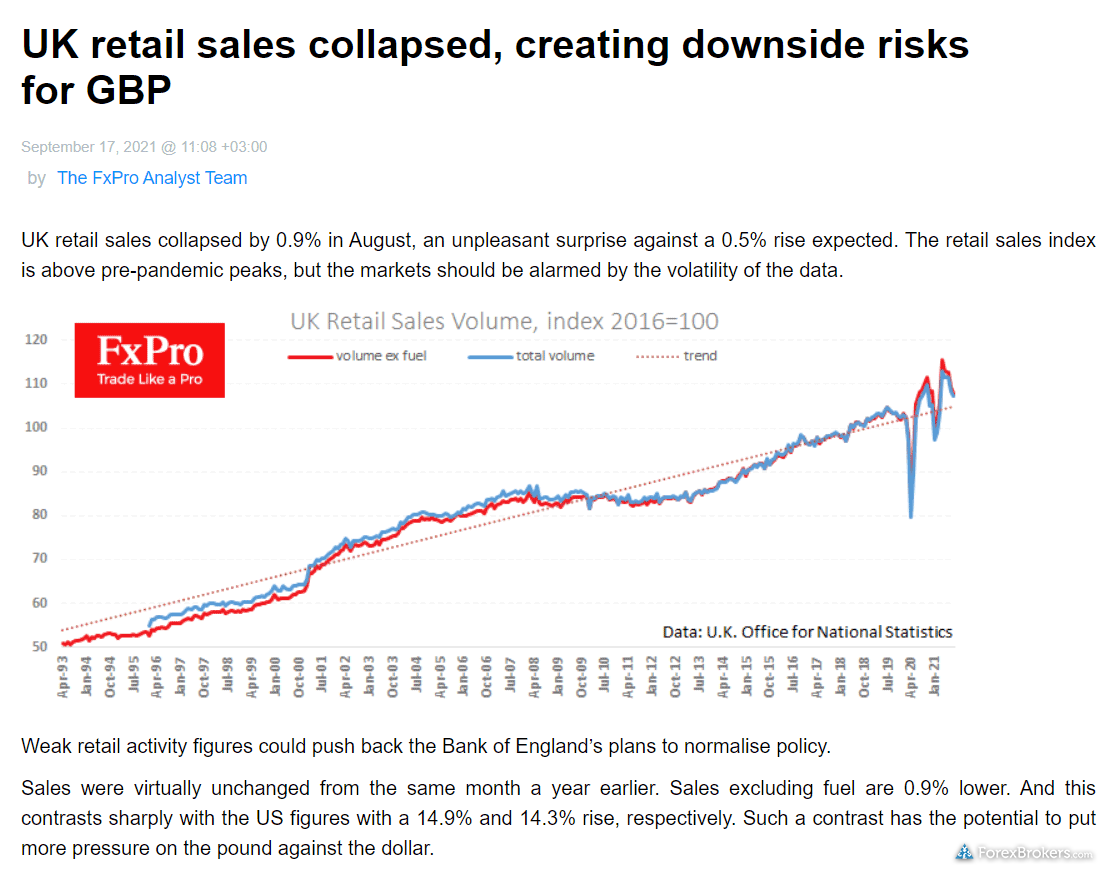

FxPro provides daily market updates and analysis on its blog, along with content from third-party providers. FxPro’s in-house staff has produced good-quality articles, but FxPro’s YouTube channel mostly features webinars, platform tutorials, and promotional videos (the exception being FxPro’s Russian YouTube channel, which does produce daily videos). For comparison, XM Group and Tickmill produce numerous daily research videos.

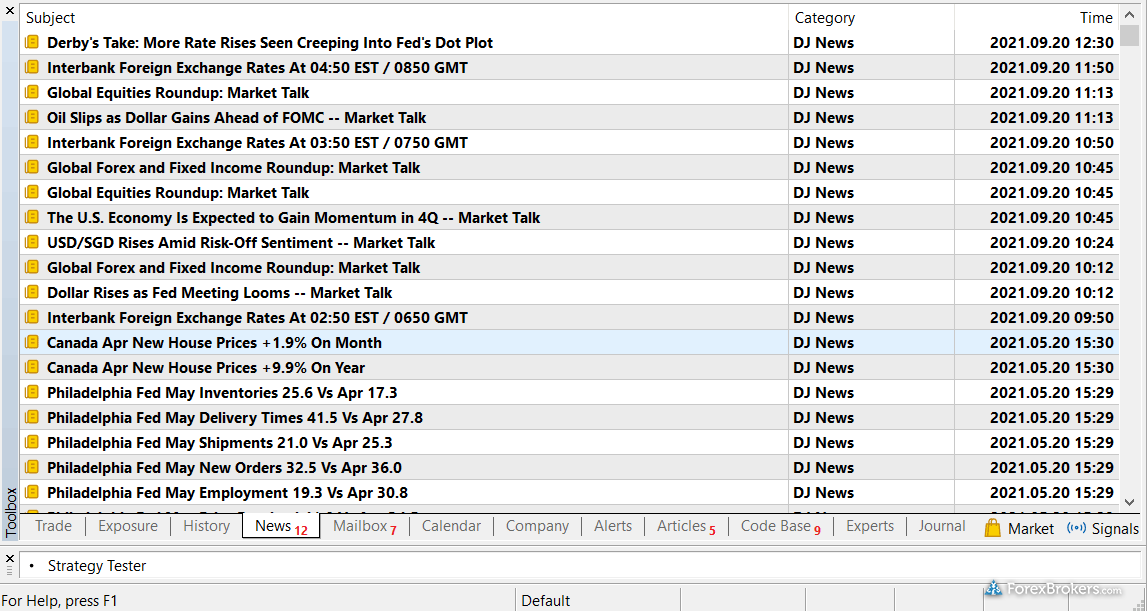

Research overview: FxPro’s dedicated blog offers multiple daily articles, including its Market Overview, Technical Analysis, and Crypto Review series. These articles provide a well-organized daily outlook, and are available within the FxPro Edge platform. Headlines from Dow Jones International (DJI) stream in FxPro’s MetaTrader platform offering – but not in FxPro Edge.

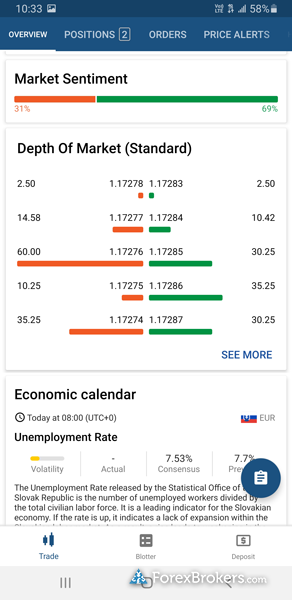

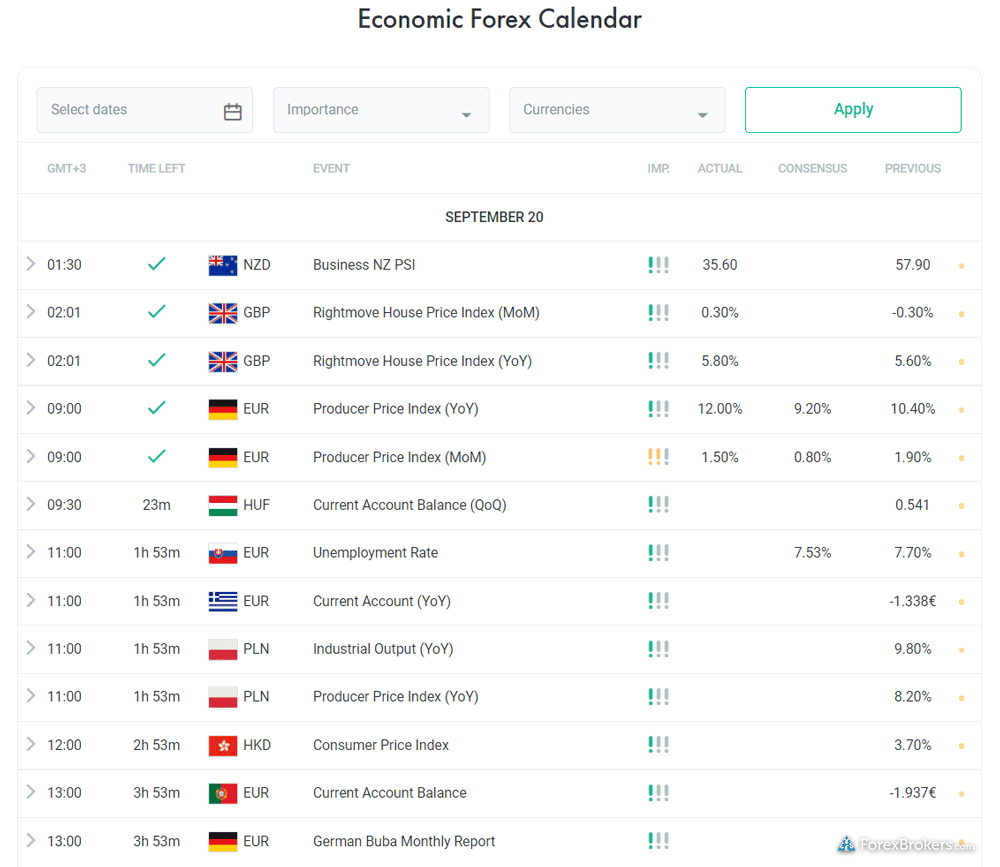

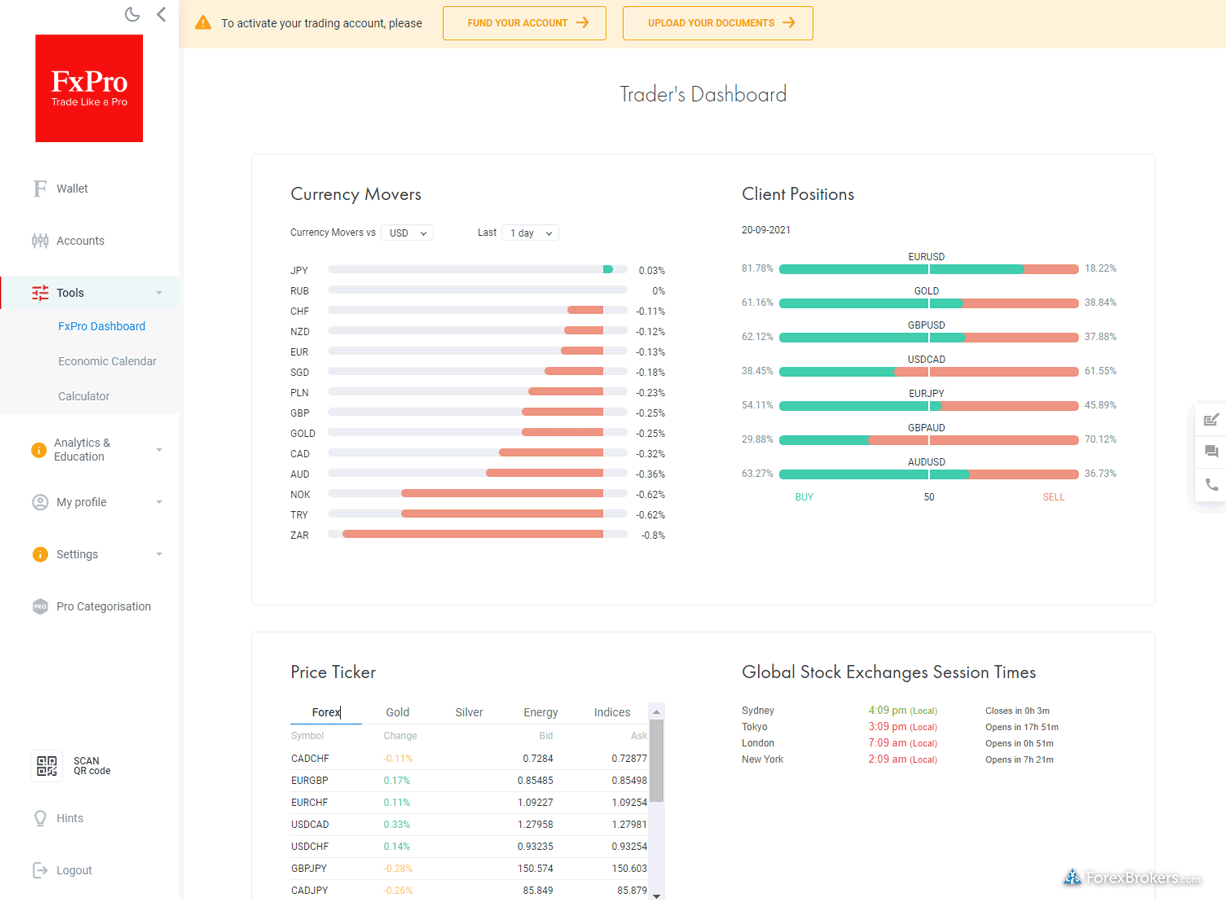

Market news and analysis: FxPro’s client portal provides access to sentiment data for various symbols and forex pairs, along with trading session times and a summary of gainers and losers. There is also an integrated economic calendar. Centralizing these resources into one portal by either adding trading capabilities to the client portal, or merging these features with the Edge platform would make FxPro’s platform easier to use.

Gallery

FxPro research:

| Daily Market Commentary | Yes |

| Forex News (Top-Tier Sources) | Yes |

| Autochartist | No |

| Trading Central (Recognia) | Yes |

| Delkos Research | No |

| Social Sentiment – Currency Pairs | Yes |

| Economic Calendar | Yes |

Education

FxPro’s education section provides written materials along with a handful of educational videos. FxPro has built a good foundation of educational content, yet the quantity and scope of available materials falls behind what is offered by education leaders such as IG, Saxo Bank, and FXCM.

Learning center: FxPro’s educational section has a useful mini card feature, with snippets of information that briefly explain concepts like “What is a stop out?” There are 36 cards in the Psychology section, and each of its four other learning areas contain a collection of mini cards. FxPro has added a nice touch to this section by including a progress tracking feature, allowing traders to keep track of which modules or chapters they’ve finished.

Room for improvement: Expanding its coverage, adding more videos, and including interactive quizzes would balance out the FxPro educational offering.

Gallery

![]()

FxPro education:

| Has Education – Forex or CFDs | Yes |

| Client Webinars | No |

| Client Webinars (Archived) | Yes |

| Videos – Beginner Trading Videos | Yes |

| Videos – Advanced Trading Videos | No |

| Investor Dictionary (Glossary) | Yes |

Final thoughts

FxPro is a well-capitalized, trustworthy broker that offers multiple platform options, multiple trade execution methods, and can cleanly execute large orders for professional traders.

However, pricing is higher than the industry average at FxPro, and its proprietary FxPro Edge app is a limited platform option that isn’t currently available for mobile.

About FxPro

Founded in 2006, FxPro has executed more than 455 million orders since its inception and has serviced 1.8 million clients in over 173 countries. As of 2021, FxPro lists over $100 million in Tier 1 capital and has more than 200 employees across its four offices. The FxPro brand holds regulatory licenses in the United Kingdom under FxPro UK Limited, Cyprus under FxPro Financial Services Limited, South Africa, and the Bahamas.

2022 Review Methodology

For our 2022 Forex Broker Review we assessed, rated, and ranked 39 international forex brokers over a three-month time period resulting in over 50,000 words of published research.

Each broker was graded on 113 different variables, including our proprietary Trust Score algorithm. This innovative scoring system ranks the level of trustworthiness for each broker based on factors such as licenses, regulation and corporate structure. Read about Trust Score here.

As part of our annual review process, all brokers had the opportunity to provide updates and key milestones and complete an in-depth data profile, which we hand-checked for accuracy.

Ultimately, our rigorous data validation process yields an error rate of less than .1% each year, providing site visitors with quality data they can trust. Learn more about how we test.