Review Kowela

https://kowela.com/ Headquarters in St. Vincent & the Grenadines BEGIN item ContentsPros and ConsRegulationAccount TypesTrading PlatformsAssetsEducationCustomer ServiceConclusion

https://kowela.com/ Headquarters in St. Vincent & the Grenadines BEGIN item ContentsPros and ConsRegulationAccount TypesTrading PlatformsAssetsEducationCustomer ServiceConclusion

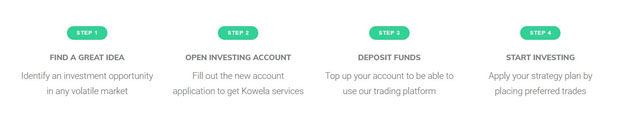

Kowela is a new forex and CFD broker that launched in 2021 and is based in the Caribbean nation of St Vincent and the Grenadines. As a new broker it is increasingly drawing the attention of traders who are eager to find a solid broker with which to trade. The following review is meant to assist traders in making the decision of whether or not they should give this up-and-coming broker a try.

One positive is that the broker is run by investors, who have a better understanding of what broker clients require. That allows Kowela to focus on the features that traders need, rather than simply adding more useless features that no one needs or uses. You will see specifically how that is helping clients in the account features section of this review.

In the following review we will dig deeper into the account types, platform, fees and other features of Kowela. For the most current information regarding the broker, we do recommend you visit their website.

Kowela Pros and Cons

Pros

Over 1,500 individual assetsStrong proprietary trading platformHigh 1:400 leverage available

Cons

No regulationSpreads are higher than average$2,500 minimum deposit

Broker Regulation

There is no regulating body in St Vincent and the Grenadines, and as a new broker Kowela has not been able to get a license from any of the top tier regulators yet either. However, the business is monitored by the St Vincent and Grenadines Financial Service Authority, and it is required to follow all the standard KYC and AML policies. This allows Kowela to retain a sense of trust and security. Adding to that is the very transparent operations of the broker.

In addition, there have been no negative reports regarding the broker’s conduct towards its clients.

And while some traders worry about offshore brokers, they do provide some benefits, such as the ability to access leverage that goes up to 1:400. The broker is also able to offer deposit and trading bonuses.

Account types

Kowela follows the tiered approach to its accounts, and there are seven different account tiers available. Each has a higher minimum deposit required, but each higher tier comes with additional benefits and features. This type of structure allows the broker to reward their most loyal and active traders, while still being fair to the smaller traders.

Below are the various account tiers and the additional features traders can expect as they climb through these tiers:

Junior

Minimum deposit $2,500Multiple markets: Indices, EnergiesIn-depth investing tools for daily tradingAccess to weekly signalsCompetitive market pricingMultiple execution orders24/5 multi-language support

Advanced

Minimum deposit $10,000Advanced markets: Stocks, EnergiesFundamental trading materialsAccess to multi-asset tradingLow market pricing

Investor

Minimum deposit $50,000Advanced markets: Stocks, CurrenciesDaily technical and main materialsSignals with comprehensive analysisComplex charting and indicatorsMultiple execution orders

Trader

Minimum deposit $100,000Customized trading portfolioAdvanced global market instrumentsDaily technical and primary materialsLive signals with analysis

Trader Pro

Minimum deposit $250,000Islamic AccountsThousands of market productsDaily technical and main trading materialsLow and allotted market pricing

VIP

Minimum deposit $1,000,000Customized investing materialsAll-inclusive daily trading toolsDaily comprehensive analysisSophisticated investment resourcesAdvanced execution orders

VIP PRO

Minimum deposit $10,000,000Invitations to market eventsPersonalized market offersCustomized investing materialsSophisticated investment resourcesAdvanced execution orders

Trading Platforms

Kowela differs from many of the existing brokers because it has taken the time, effort, and expense to create its own proprietary trading platform. Rather than simply offering the ubiquitous MetaTrader 4 or MetaTrader 5, Kowela has decided to create a platform that is best suited to the modern trader. With that in mind the platform they have created comes with 38 different built-in indicators, three chart types, 37 graphical objects, and the ability to trade right from the charts.

The trading platform is hidden behind the account login. That means there is no way to see the platform without creating an account. Also, there is no demo account available, so it is impossible to test the platform before depositing.

Available Assets

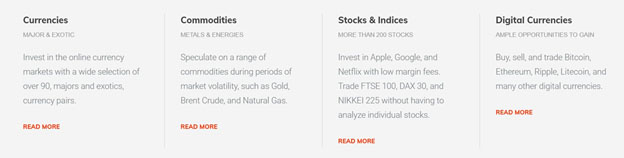

We have already mentioned that Kowela offers over 1,500 different individual assets, which gives traders the ability to trade in any type of market conditions. Plus, it allows for broad diversification, since there are six different asset classes available as you can see:

CurrenciesCommoditiesEnergiesStocksIndicesDigital Currencies

CurrenciesCommoditiesEnergiesStocksIndicesDigital Currencies

Education and Research

Education and research are two of the cornerstones of improved trading, and Kowela understands that since the company was created by investors. Kowela offers a large amount of education and research, including daily and weekly signals, technical and fundamental educational materials, and comprehensive daily market analysis. They do not offer these research tools and educational materials to just anyone. The research and education only unlock as clients reach higher tiers in the account structure. So, for example, to gain access to the daily signals with analysis a trader needs to get to the Investor level account, which also requires a $50,000 minimum.

Customer Service

Customer service at Kowela is similar to what you will find at most brokers. It is available 24/5, and support team members can be contacted via email, telephone, and live chat. Support is also offered in several languages.

Phone: +1 800 861 5256

Email: customer.info@kowela.com

In Conclusion

Kowela may be a new broker, but they appear to be a solid choice for traders. That could be due to the strong focus of the broker creators, who are investors themselves and know what traders need to be successful. The broker has a huge number of available assets, and a modern, advanced proprietary trading platform. And for those who like leverage, the 1:400 leverage offered by Kowela will be a breath of fresh air when compared with European CFD brokers.

In conclusion, we are quite satisfied with what Kowela has to offer and consider it a great broker for a range of investors. As such, we would like to conclude our Kowela broker review with a definite recommendation.

END latest_news