- The CFTC issued an order to penalize bZeroX, LLC citing the illegal offering of leveraged and margined commodity transactions for $250,000.

- The regulatory body charged the successor of bZeroX, LLC, operating by the name of Ooki DAO as well for violating the Bank Secrecy Act.

- CFTC filing against a DAO, being a first of its kind, opens up the entire DAO market to potential harmful impact.

The Commodity Futures Trading Commission (CFTC) made headlines on September 22 for taking action against bZeroX, LLC and its founders. The event also marked the first-ever instance of the CFTC filing a lawsuit against a decentralized autonomous organization (DAO).

CFTC acts against OokiDAO

The Commission issued an order on September 22 for filing as well as settling the charges against bZeroX, LLC and its founders Tom Bean and Kyle Kristner. CFTC noted that the respondents were

- Illegally offering leveraged and margined retail commodity transactions in digital assets

- Engaging in activities only registered futures commission merchants (FCM) can perform

- Failing to adopt a customer identification program as part of a Bank Secrecy Act compliance program, as required of FCMs.

The charges also followed a $250,000 civil penalty, in addition to cease and desist. But CFTC did not pull the brakes here and even filed a federal civil enforcement action against OokiDAO. This DAO was noted to be a successor to bZeroX.

The legal action against DAO, the first of its kind, leaves any and every other similar autonomous organization vulnerable. The statement issued by the CFTC read,

“Margined, leveraged, or financed digital asset trading offered to retail U.S. customers must occur on properly registered and regulated exchanges in accordance with all applicable laws and regulations. These requirements apply equally to entities with more traditional business structures as well as to DAOs.”

DAO market reacts as expected

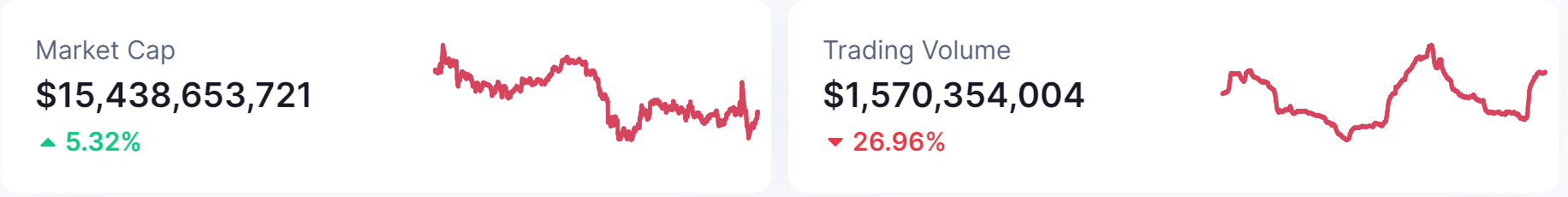

Since OokiDAO was not as big a name in the DAO space, its filing did not have a serious impact on the market. DAOs and their tokens currently have a combined market cap of $15.4 billion, led by the likes of Uniswap, AAVE and MakerDAO.

On the investment front, as it is, the bearish market has resulted in the 24-hour trading volume falling by 26.96%. Without recovery, this figure could keep rising, affecting a major cohort of the crypto market.

DAO tokens Market cap and trading volume

DAO tokens Market cap and trading volume