- Axie Infinity price nearing a gap fill within the Ichimoku Kinko Hyo system.

- Deeper retracement beyond near-term support is likely.

- Axie Infinity is expected to continue its outperformance of the broader market.

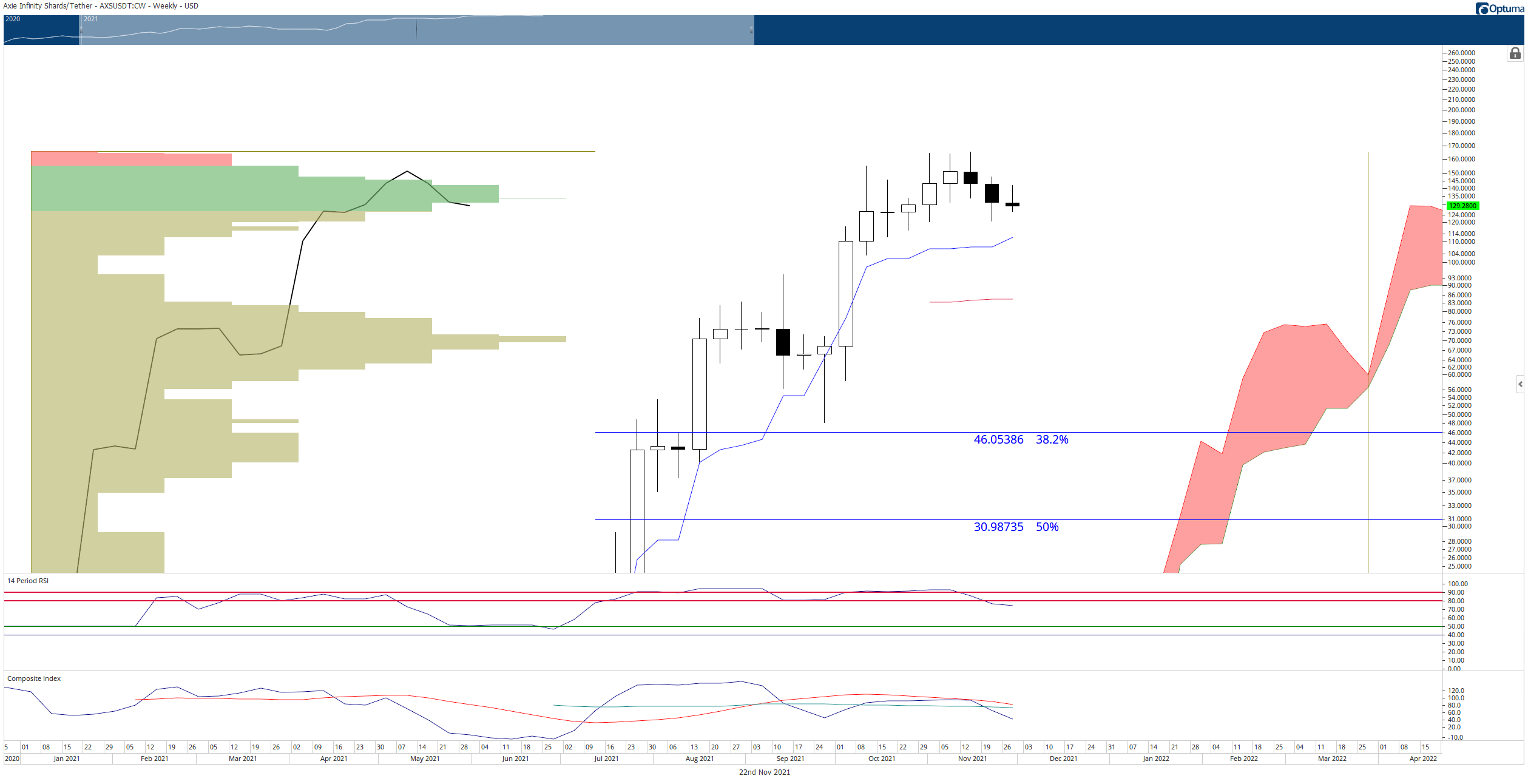

Axie Infinity price continues to outperform the broader cryptocurrency market but has spent the past couple of weeks filling a gap between the bodies of the weekly candlesticks and the Tenkan-Sen. As a result, AXS would need to fall a further 15% from the current weekly candlestick open to return to the weekly Tenkan-Sen.

Axie Infinity price could fall as much as 35% before resuming its uptrend

Axie Infinity price has a very high probability of moving beyond the projected 15% drop to the weekly Tenkan-Sen ($112) near term. The volume profile has a precipitous drop between $114 and $70. Consequently, the weekly Kijun-Sen is at $80 and shares the same high volume node near $70.

The likelihood of a fall to the $70 -$80 increases with the current status of the Relative Strength Index. The Relative Strength Index is was trading between the two overbought levels in a bull market, 80 and 90, for the past 20-weeks. The current weekly candlestick is the first 20 weeks to spend any considerable time below the 80 mark. This is a warning that any retracement could be strong and sustained.

AXS/USDT Weekly Ichimoku Chart

However, bears shouldn’t be overconfident nor expect a deep sell-off. Axie Infinity price has respected the Tenkan-Sen as its primary support level since the beginning of July. Additionally, sentiment, fundamentals, and forward guidance continue to support higher valuations for Axie Infinity price. If AXS does dip lower to the Tenkan-Sen at $112 and finds support, then Axie Infinity could be poised for another move to all-time highs. This time, targeting the $200 value area.