- Bitcoin price has rallied over 30% in three consecutive weeks for January.

- BTC has paired back a substantial part of the decline in the crypto winter of 2022.

- Bitcoin bulls in the trade enjoy the profits but have an issue cashing them in.

Bitcoin (BTC) price has advanced substantially in the first weeks of the year as global markets kept deaf, dumb and blind to the warnings of the central bankers that with the new year, all problems for 2023 will be suddenly erased. Inflation will remain a big topic for 2023, as central bankers might be right that inflation is nowhere near where it needs to be. Markets have been too eager to price in the current declines as being a straight line to the downside, meaning that markets would or want to quickly pop higher towards their all-time highs, which seeing the current situation, is not likely.

Bitcoin price set for cold fever as inflation is set to spike

Bitcoin price will see traders learning to deal with reality the hard way, While markets have been eager to price in an almost linear decline of inflation back to 2%, the reality could be not much further from the truth as it is now. Traders that are not paying attention to what is going on have missed that layoffs are picking up speed, and several car manufacturers are laying off and shutting down production lines for several new car models with technical furlough as another chip shortage is setting back deliveries by 3 to 6 months at least. This will ramp up the prices for second hand cars again and drive inflation back up.

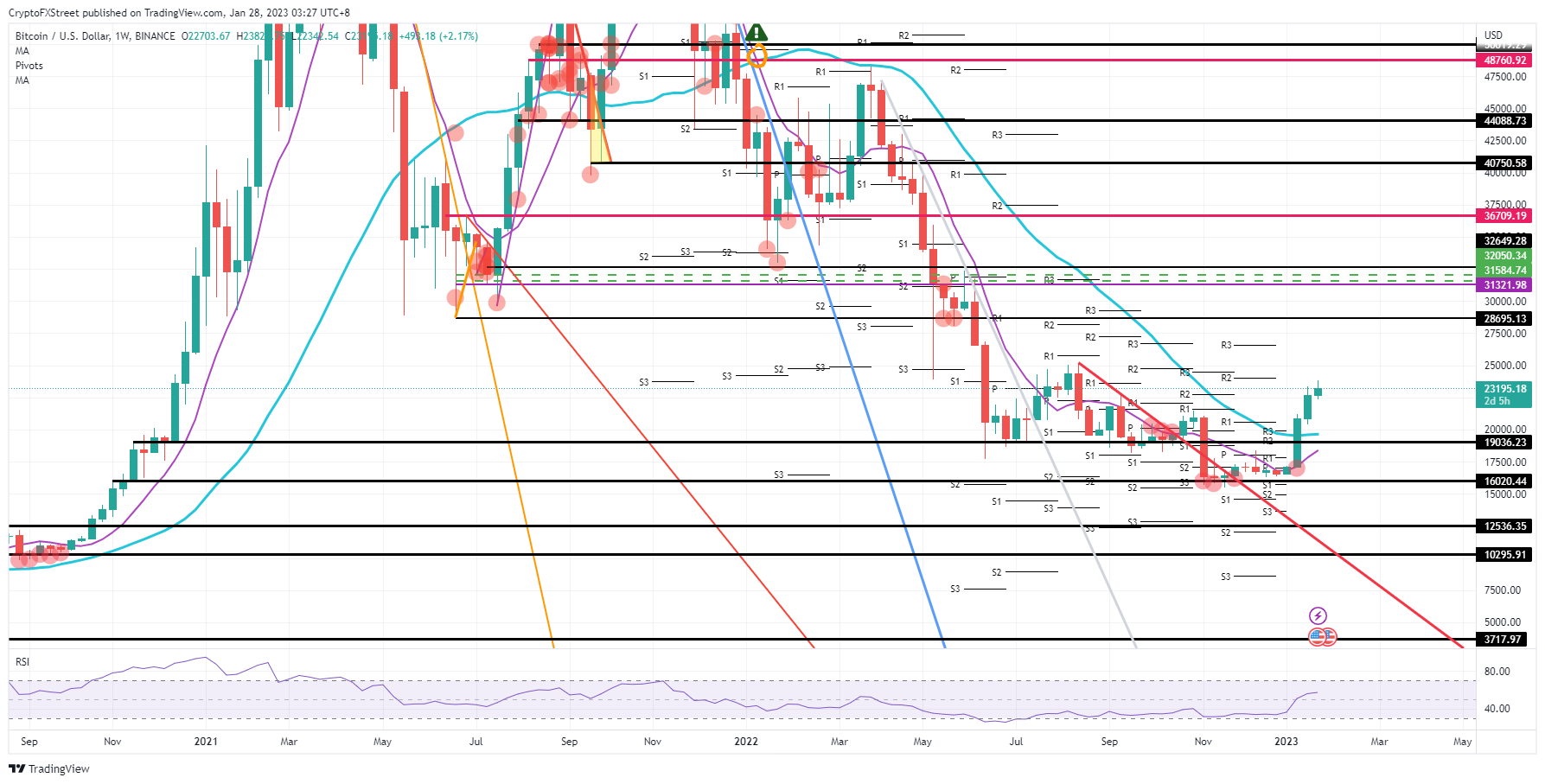

BTC will first receive a blow from the central banks set to make their appearance at the beginning of February, towards $20,000. Pressure will mount and could see Bitcoin price action decline towards $16,020 should Producer Price Indexes or inflation numbers climb instead of dropping further with a big rotation out of risk assets. Traders will quickly exit their long positions as the next profit level at $28,695 is too far off and unreachable under these conditions.

BTC/USD weekly chart

Chip shortage is, of course, just one segment of the economy, as several commodity prices are currently coming off their highs. The same goes for US rates and the US dollar, which has seen the whole segment price lower or weaker in the relevant asset. Should the Fed confirm next week that the market is right and rate cuts are set to kick in for 2023, expect a sigh of relief and a ‘steady as she goes’ rally with hesitant last-minute bulls to join the rally and push price action further up with BTC set to reach $28,695 in a matter of weeks, maximum two months.