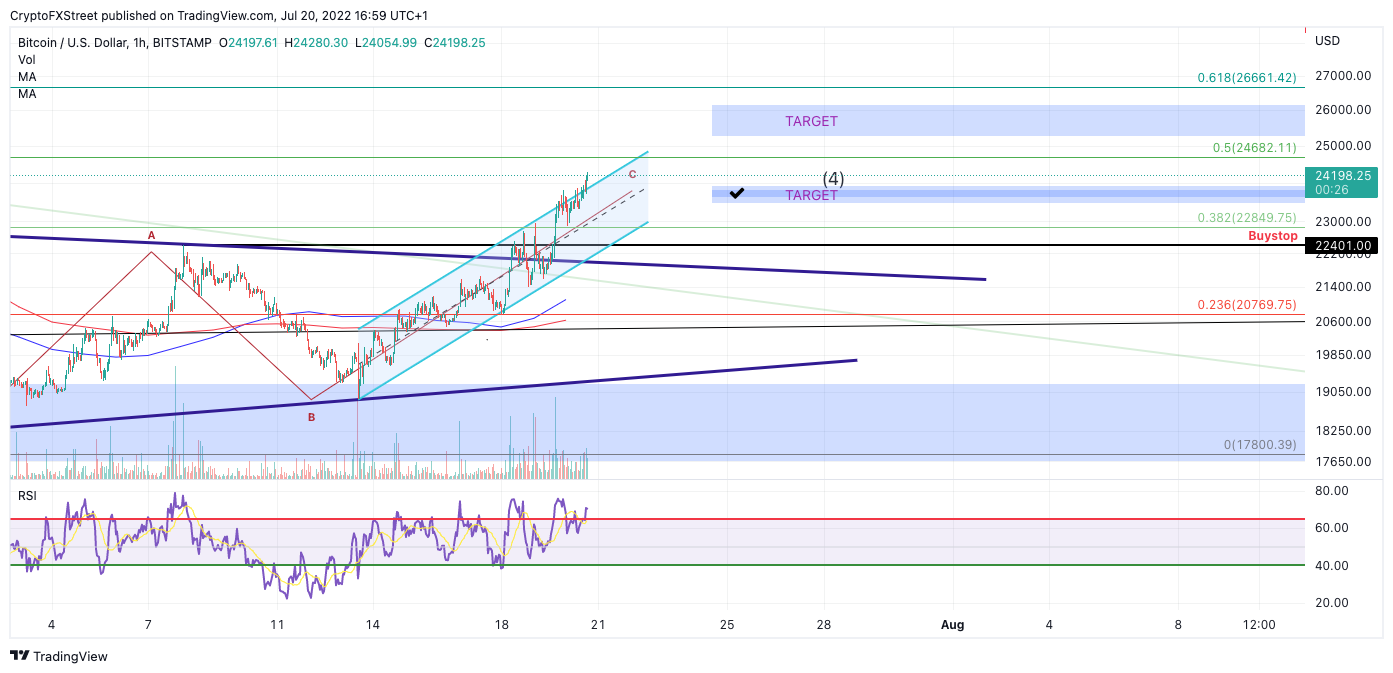

- Bitcoin price hits the first target mentioned in Monday’s bullish trade setup.

- BTC slope of incline continues to increase.

- Safety stops should not be moved into profit, but the risk can be reduced by 50% to $22,000. Invalidation of the uptrend can be $22,014.

Bitcoin price has more upside potential. Placing a bet against the uptrend is ill-advised until further evidence is displayed.

Bitcoin price moves to the beat of its own drum

Bitcoin price continues to rally as the slope of the uptrend is increasing. On July 20, 2022, Bitcoin price has succesfully validated the previous bullish trade setup. Although retail traders may still be in disbelief about the uptrend, the market is providing profitable opportunities for those willing to engage.

Bitcoin price currently trades at $23,751, just above July 17’s first target at $23,650. The Relative Strength Index is in no way, shape or form a justifiable sell. It is best to stay with the uptrend until clear evidence of a change in market structure is displayed. The next bullish targets are $24,685 and $26,000.

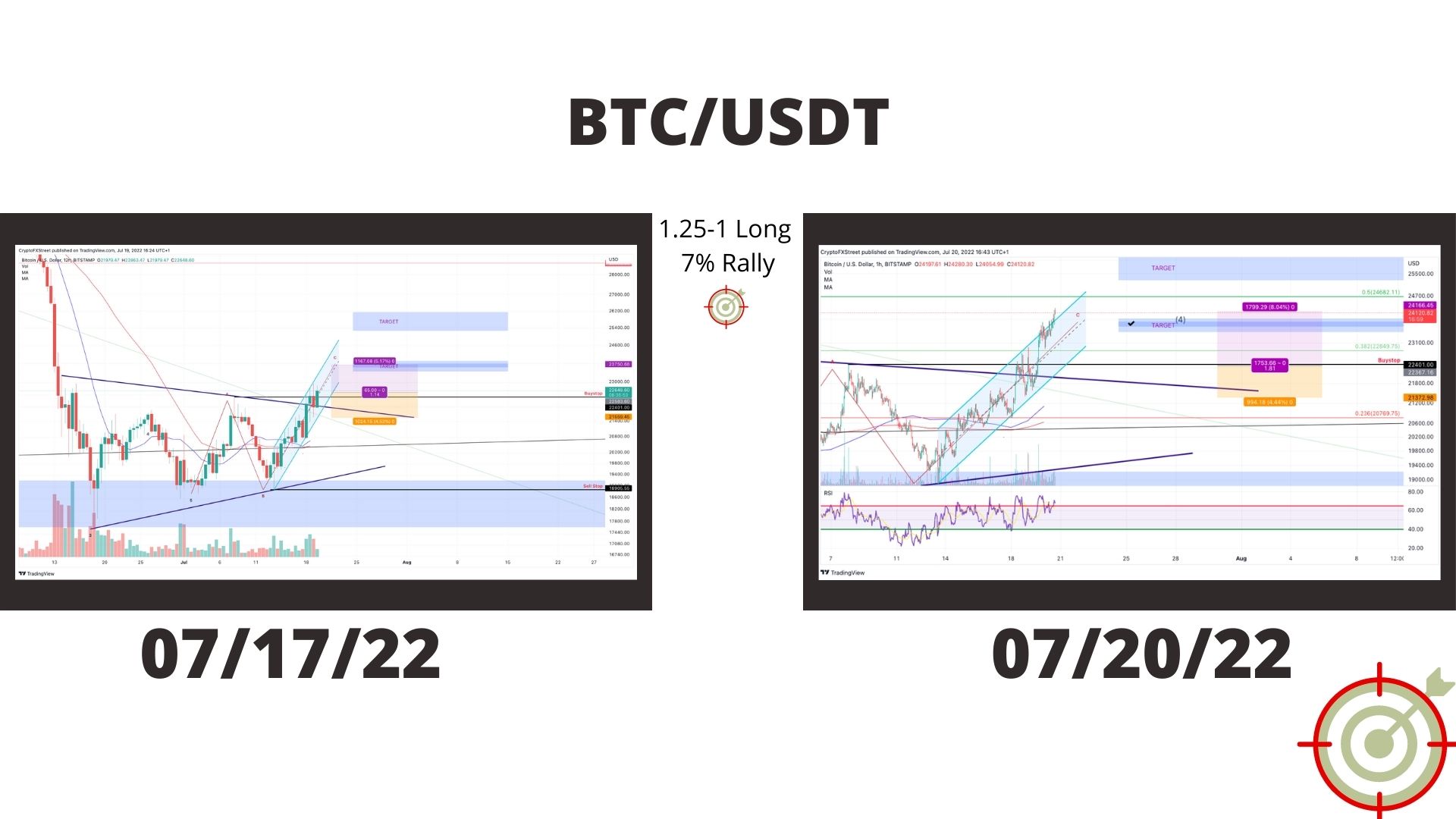

BTC/USDT 7/17-7/20 Forecast

Traders who partook in the uptrend setup can move their stop losses to breakeven for a risk-free trade, but doing so is ill-advised. Reducing the risk by half is a safer play based on the technicals. Thus, invalidation of the uptrend is now $22,000. If 22,00 were to get breached, the bears could re-route the peer-to-peer digital currency as low as $17,000, resulting in a 28% decline from the current Bitcoin price.

BTC/USDT 3-Hour Chart

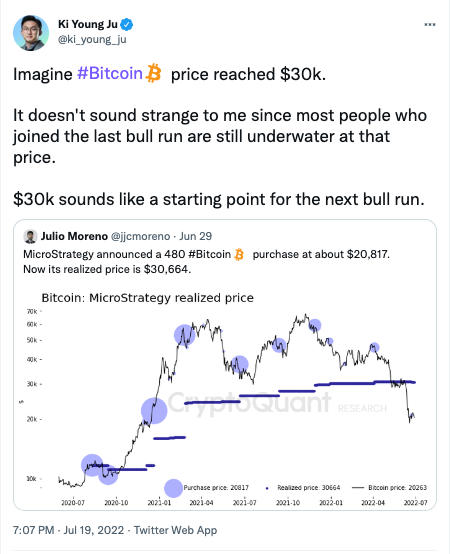

“Ki Young Ju, CEO of CryptoQuant, predicted that $30,000 will be the starting point of another bull run in Bitcoin” – FXStreet Team.

Original Tweet

In the following video, our analysts deep dive into the price action of Bitcoin, analyzing key levels in the market. -FXStreet Team