- Bitcoin price has printed a local top signal prior to its 6% downswing from the August 14 high.

- Although BTC is consolidating, institutional interest has accelerated, according to Fidelity.

- Bitcoin price may be trapped in a sideways range in the near term, but Fidelity’s plan for new infrastructure for the asset class may incentivize the bulls.

Bitcoin price is witnessing a pullback after gaining over 63% since the July 20 low. Institutional interest in the leading cryptocurrency’s investment products has likely fallen due to the seasonal effects. However, BTC may see hope as a major financial institution revealed its biggest clients are increasingly interested in accessing the new asset class.

Bitcoin price retraces, but institutional interest accelerates

Bitcoin price is experiencing a minor sell-off, following its local high recorded on August 14 at $48,251. Institutional cryptocurrency investments have seen another week of consecutive outflows with a total of $22 million.

According to a report from CoinShares, the low investor participation could be due to the seasonal effects witnessed in other asset classes as well.

Investment giant Fidelity, on the other hand, stated that 90% of its biggest clients are interested in accessing the bellwether cryptocurrency and other digital assets. The asset manager will provide more institutional pathways to the new asset class.

The head of sales and marketing for Fidelity Digital Assets explained that institutional interest in Bitcoin has been accelerating. Tom Jessop, the head of the crypto arm of the firm, added that governments around the world printing money due to the COVID-19 pandemic was one of the largest motivators for investors to get into cryptocurrency.

Fidelity is aiming to build the long-term financial infrastructure necessary for investors to access the digital asset market directly.

On the daily chart, the Momentum Reversal Indicator (MRI) has presented a top signal on August 13, a clear indication of a potential pullback. Now, Bitcoin price has continued to retrace as BTC has had four consecutive days of lower closes.

As a result, Bitcoin price lost the 200-day Simple Moving Average (SMA) as support, which opens up the possibility of further losses.

The first line of defense for BTC is at the 20-day SMA, coinciding with the 23.6% Fibonacci retracement level at $43,673.

BTC/USDT daily chart

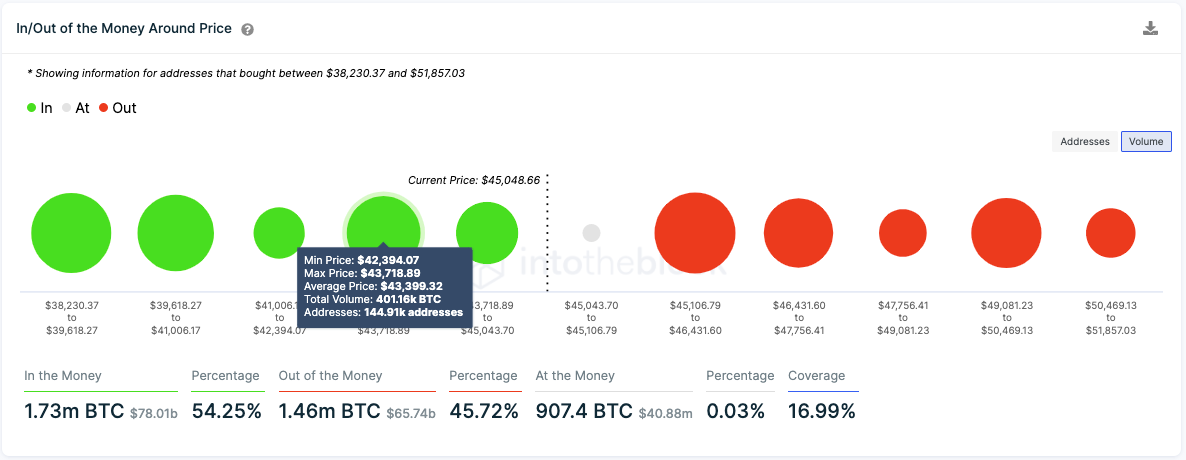

It appears that the largest cluster of support under the current price, according to IntoTheBlock’s In/Out of the Money Around Price (IOMAP) data, is at an average price of $43,399, where 144,910 addresses purchased 401,160 BTC.

An increase in selling pressure may push Bitcoin price lower toward the 38.2% Fibonacci retracement level at $40,920.

The IOMAP data suggests that the following largest cluster of support may materialize at a similar level, where 484,000 addresses bought 442,530 BTC at an average price of $40,088.

BTC IOMAP

For the bulls to reverse the period of underperformance, Bitcoin price will need to break above the 200-day SMA at $45,570 for any chance of continuing its rally. The IOMAP metric also indicates that this level could act as stiff resistance for the bellwether cryptocurrency, as a large cluster of 864,540 addresses that purchased 519,770 BTC at an average price of $45,895 are currently out of the money.

A break above this level could mean that Bitcoin price could target higher levels following its consolidation, as institutional interest accelerates. The next aim for the bulls would be at the local top at $48,251 – then at $49,810, the May 16 high.