- Chainlink price finds a bottom as buyers step in to prevent further movement south.

- A Christmas rally is on the table for Chainlink as it eyes a 35% gain.

- Threats to the downside remain but are likely limited in scope.

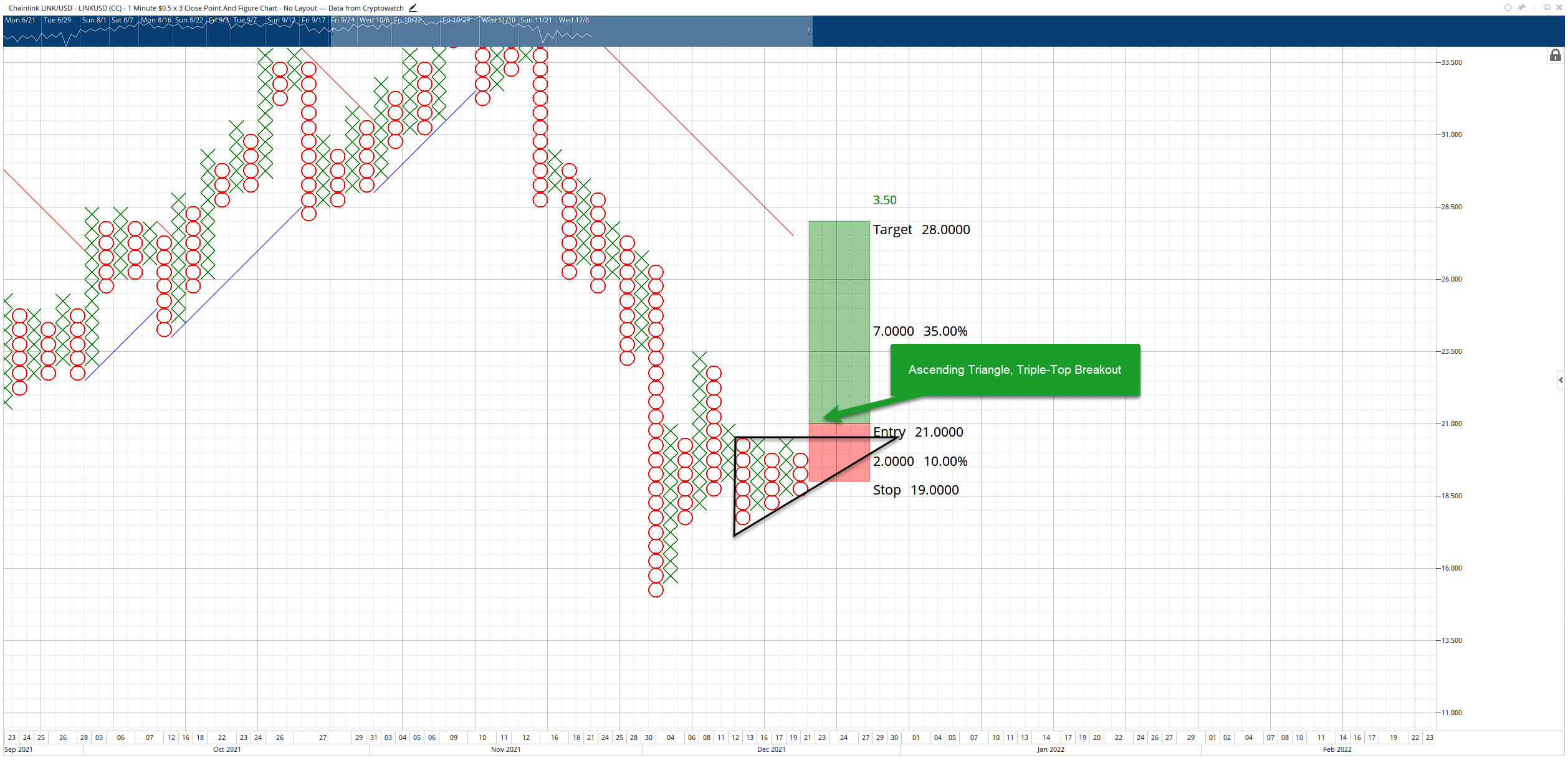

Chainlink price is developing an exceptionally bullish pattern on its $0.50/3-box reversal Point and Figure chart. As a result, reaching the entry level of this hypothetical trade setup could see a considerable spike towards the $28 value area.

Chainlink price ready to bounce and spike higher, short sellers likely trapped and feeling the pressure

Chainlink price has a series of ascending higher lows on its Point and Figure chart while also developing a triple-top. Additionally, an ascending triangle pattern has formed, giving a greater probability of a bullish breakout in the near future.

The hypothetical long trade is a buy stop order at $21, a stop loss at $19, and a profit target at $28. This trade setup represents a 3.5:1 reward for the risk. In addition, a trailing stop of two to three boxes would help protect any implied profits post entry.

The $28 target is likely too conservative, but it is based on the Vertical Profit Target Method in Point and Figure Analysis. Buyers may look at taking profit at $28 as it is just above the current bear market trend line. Hitting $28 would convert Chainlink price into a bull market, and the likely selling pressure would result in the first pullback – a good sign for a return to higher prices.

Chainlink $0.50/3-box Reversal Point and Figure Chart

The hypothetical long setup is invalidated if Chainlink price moves below the $14 value area. If that move were to occur, then Chainlink price would be under threat of a flash-crash towards the $9 range.