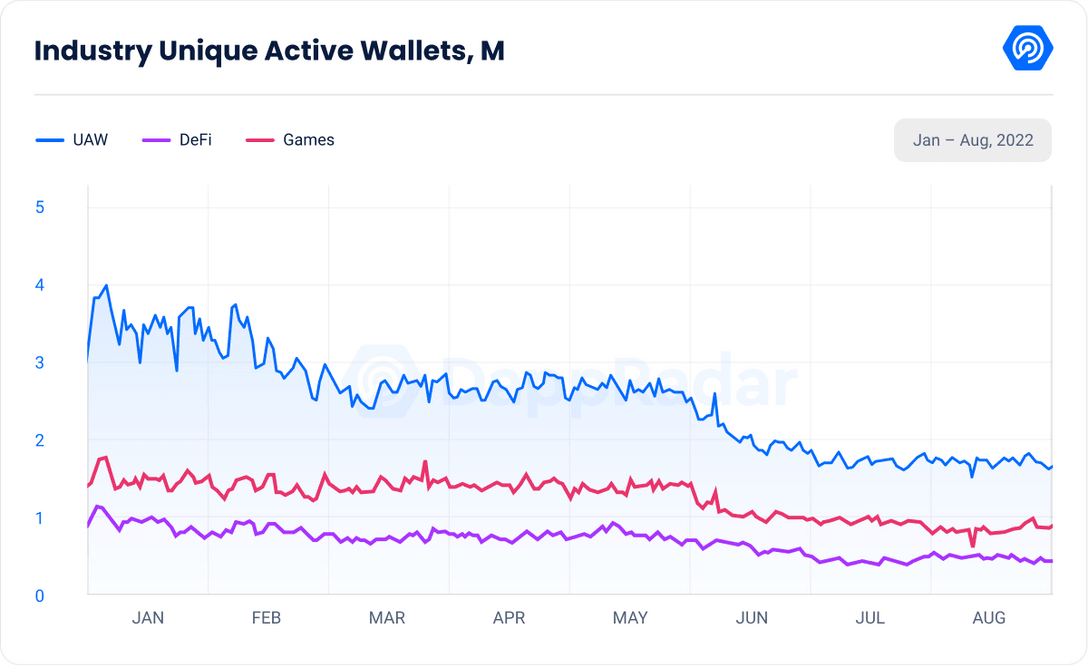

- DappRadar’s DeFi report for August highlighted the presence of just 1.67 million unique active wallets.

- The month of August also noted multiple exploits and hacks, which resulted in the loss of more than $211 million.

- Following the Merge, DeFi activity is expected to ramp up on Ethereum, and the same is expected out of Cardano’s Vasil hard fork.

Ethereum made Decentralized Finance (DeFi) available to the crypto space when it introduced smart contracts, and the industry since then continued to flourish at a rapid rate. However, the bear markets of January and May 2022 took a severe toll on this growth, and the DeFi market has still not completely recovered from it.

August was an equally good and bad month for Decentralized Finance

According to DappRadar’s industry report for the month of August, the current daily Unique Active Wallets (UAW) is at its lowest ever recorded figure since the beginning of this year. The drop to 1.67 million UAW marks a 3.52% decrease from July and an overall 14.73% decline from August 2021.

Active wallets throughout the market

However, FLOW emerged to be one of the better-performing DeFi chains, registering a daily average UAW increase of 577% from the previous month. This rise can primarily be attributed to the support of Flow-based NFTs on Instagram.

But along with the good came the bad, and that too in the form of exploits and attacks. This month, multiple such incidents took place, including the Solana wallet attack and the Acala & Nomad exploits. The latter occurrence was singlehandedly responsible for a majority of the $211 million losses experienced by the DeFi market.

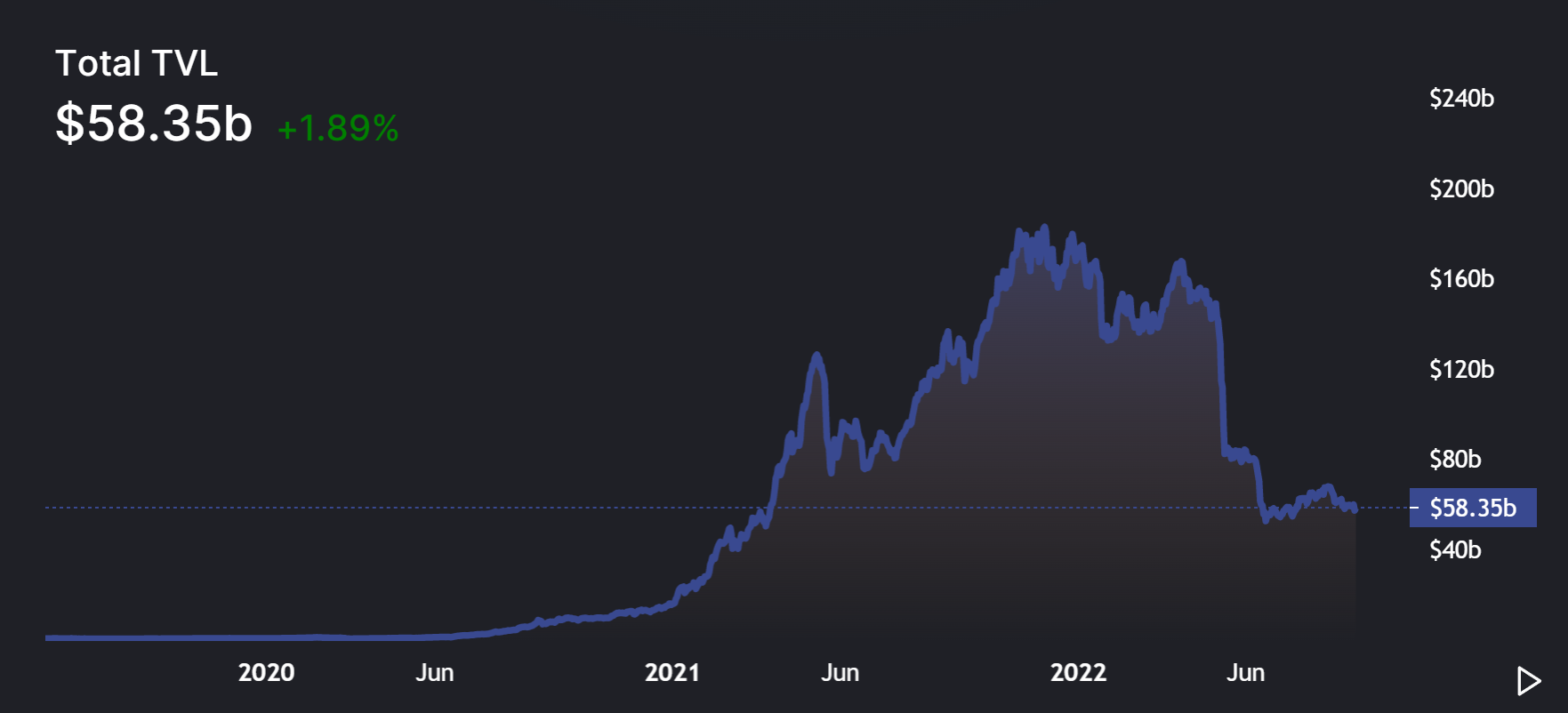

While not an exploit, DappRadar highlighted that the sanctions on Tornado Cash also impacted the total value locked (TVL) onto dApps. Falling by 10.47% month-over-month, about $8.7 billion was lost just due to the sanctions.

The total DeFi TVL currently stands at just $58.35 billion

The total DeFi TVL currently stands at just $58.35 billion

However, the DeFi space is expected to be revamped by the end of this month.

Ethereum and Cardano are bringing gifts for the DeFi market.

While Ethereum is the biggest DeFi chain in the world, Cardano, since its inception, has always been touted as the future of crypto with next-gen DeFi applications. This is yet to be seen, but the arrival of the Vasil hard fork is expected to bring new life into Cardano’s decentralized finance capabilities.

A week before that happens, Ethereum will also go through the Merge, shifting the blockchain from Proof of Work to Proof of Stake, eventually making the chain far more efficient and scalable for DeFi operations.