- Ethereum price notices a decline in momentum as it pierces the $1,514 to $1,670 supply zone.

- The RSI spots a bearish divergence while the transaction data reveals upside is limited to around $1,984.

- Invalidation of the bearish outlook will occur if ETH flips the $2,000 psychological level into a support floor.

Ethereum price shows a clear sign of slowing down as it heads into a supply zone. Although there is a slow climb to the upside, the chances of a further continuation are very low.

Ethereum price reveals bears’ emergence

Ethereum price has inflated by 37% since January 1 and is currently inside the daily supply zone, extending from $1,514 to $1,670. Additionally, the recent attempt to overcome the said hurdle has resulted in a bearish divergence on a four-hour chart.

This technical formation happens when the underlying asset produces a set of higher highs while the Relative Strength Index (RSI) sets up lower highs. This non-conformity is termed as bearish divergence and often leads to a reversal of the bullish move.

In such a case, investors should look out for a retest of the $1,422 level. Beyond this barrier, Ethereum price could visit the $1,331 and $1,227 support floors.

ETH/USDT 4-hour chart

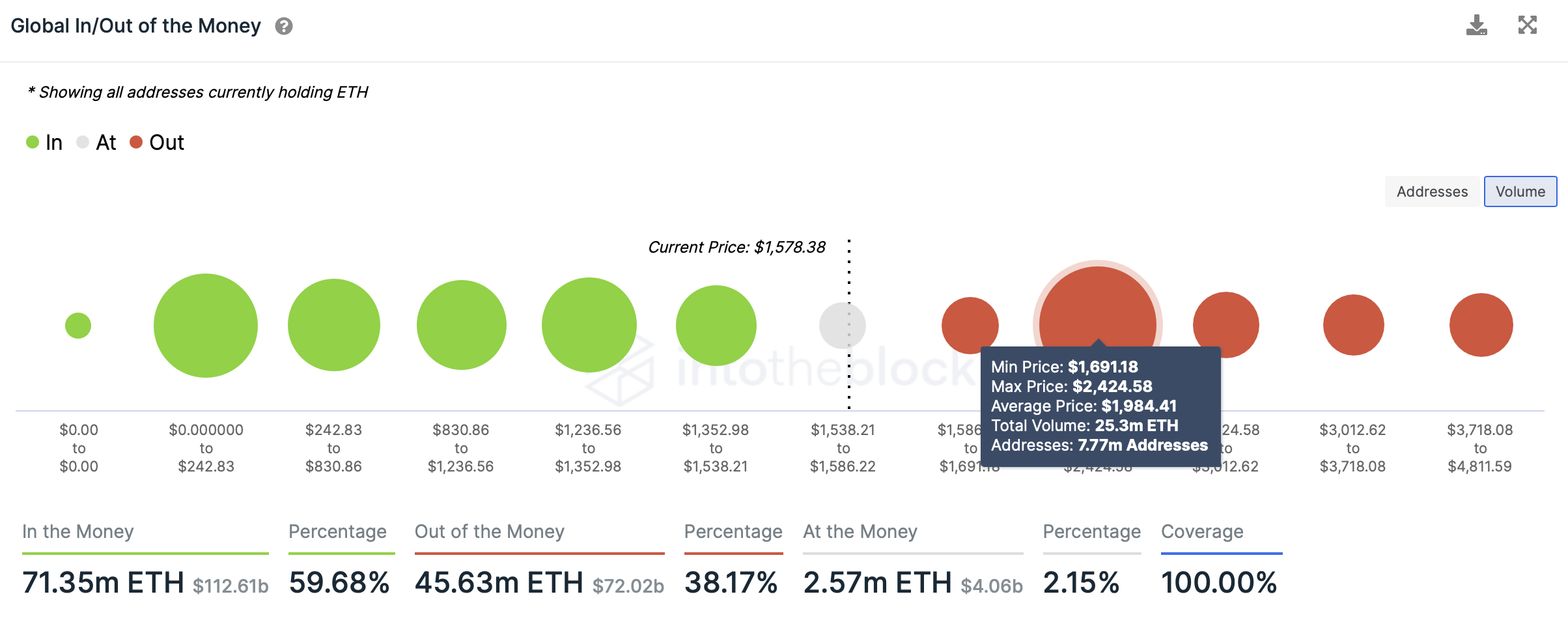

Further confirming the presence of massive hurdles ahead for the Ethereum price journey is IntoTheBlock’s Global In/Out of the Money (GIOM) model. This on-chain index shows that the upside for the smart contract is capped at $1,984, where roughly 7.7 million addresses purchased 25.3 million ETH.

Hence, even if Ethereum price manages to overcome the aforementioned supply zone, it will face a massive spike in selling pressure around $1,984, making it harder for bulls to continue.

ETH GIOM

On the other hand, if Ethereum price manages to overcome the selling pressure at $1,984 and flip the $2,000 psychological level into a support level, it will invalidate the bearish thesis. Additionally, this move would further signal the buyers to jump in, triggering a continuation of the uptrend.

In such a case, Ethereum price could collect the buy-stop liquidity resting above the equal highs at $2,013 formed in May and August 2022. A flip of this level will directly propel ETH to $2,333.