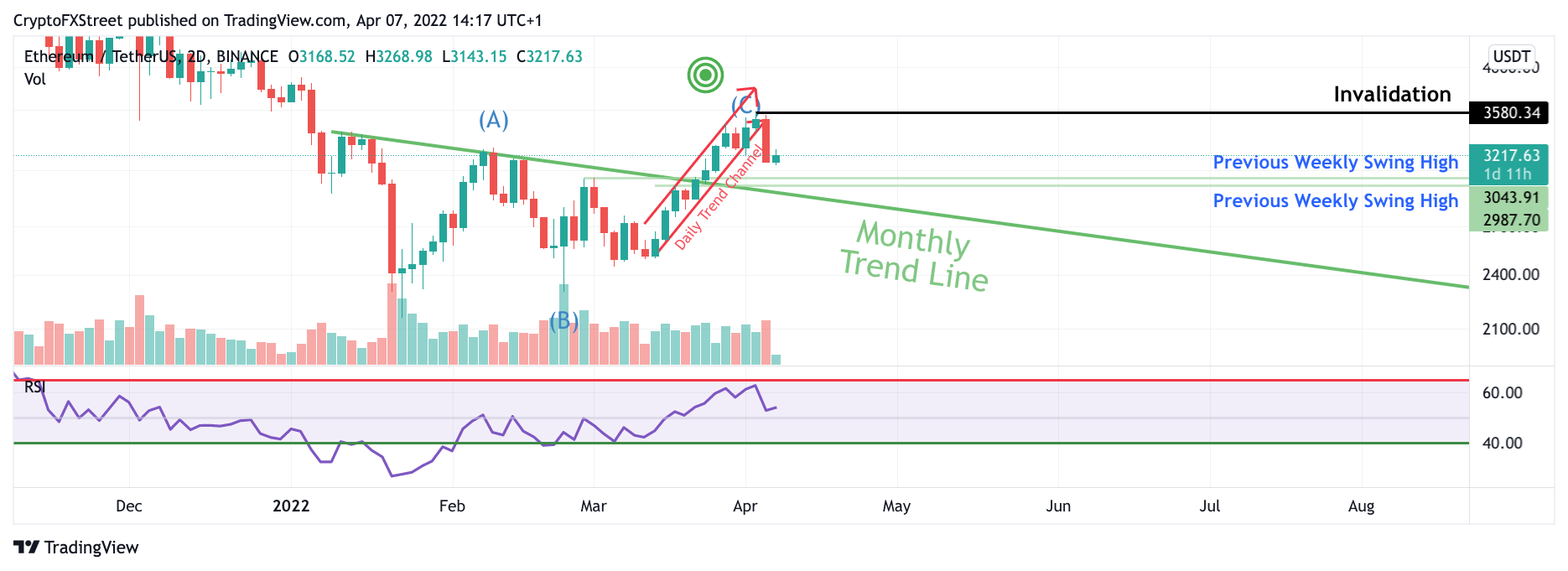

- Ethereum price has printed a large bearish engulfing candle on the two-day chart.

- ETH price volume has increased in the bears' favor.

- Invalidation for the bearish thesis is a touch of $3580.

Ethereum price will probably fall an additional 10% to test previous weekly swing highs and a breached monthly trend line.

Ethereum price has more downside potential

Ethereum price has experienced a 10% sell-off this week. It was mentioned in last week's bearish thesis that a sell-off at $3300 would occur. The sellers have halfway validated the thesis, signaling their control of the trend with yesterday's bearish engulfing candle. The bearish candle is the largest printed within the rally, which should concern investors.

Ethereum price currently trades at $3170 and will likely consolidate in a narrow range before price drops into last week's $3000 target. ETH price has more bearish confluence shown on the volume indicator as the bears have ramped up the selling pressure. ETH enthusiasts should be warned not to try any countertrend trades at the current time as there will likely be better opportunities in the crypto market.

ETH/USDT 2-Day Chart

The safer move will be to wait for a retest of weekly key levels below at $3043 and $2987. The breached monthly trend line at $2930 is also a zone that should be primed with liquidity following last month's successful trade setups that led to a 20% bull run.

An invalidation for the Ethereum price downtrend will be above $3580. If $3580 is to get breached, analysts will consider a possible expanding flat or 5th wave rally which could take the Ethereum price to $3700 and $3850, resulting in up to a 20% increase from the current ETH price.