- EUR/USD bulls in control and target a deeper retracement of the bearish daily impulse.

- Eurozone data and fuller markets could be the catalyst to get it moving on Tuesday.

At the time of writing, EUR/USD is trading at 1.1860 within a US dollar subdued environment in Tokyo.

Forex price action is centred elsewhere within the commodity-FX space pertaining to central bank expectations:

RECOMMENDED

- Breaking: NZD/USD jumps over 40 pips on RBNZ rate hike expectations

Meanwhile, markets were fairly stable during the US Independence Day holiday.

The US dollar was mixed and net little changed against most of the G10 as bulls await the next potential leg to the upside from daily support:

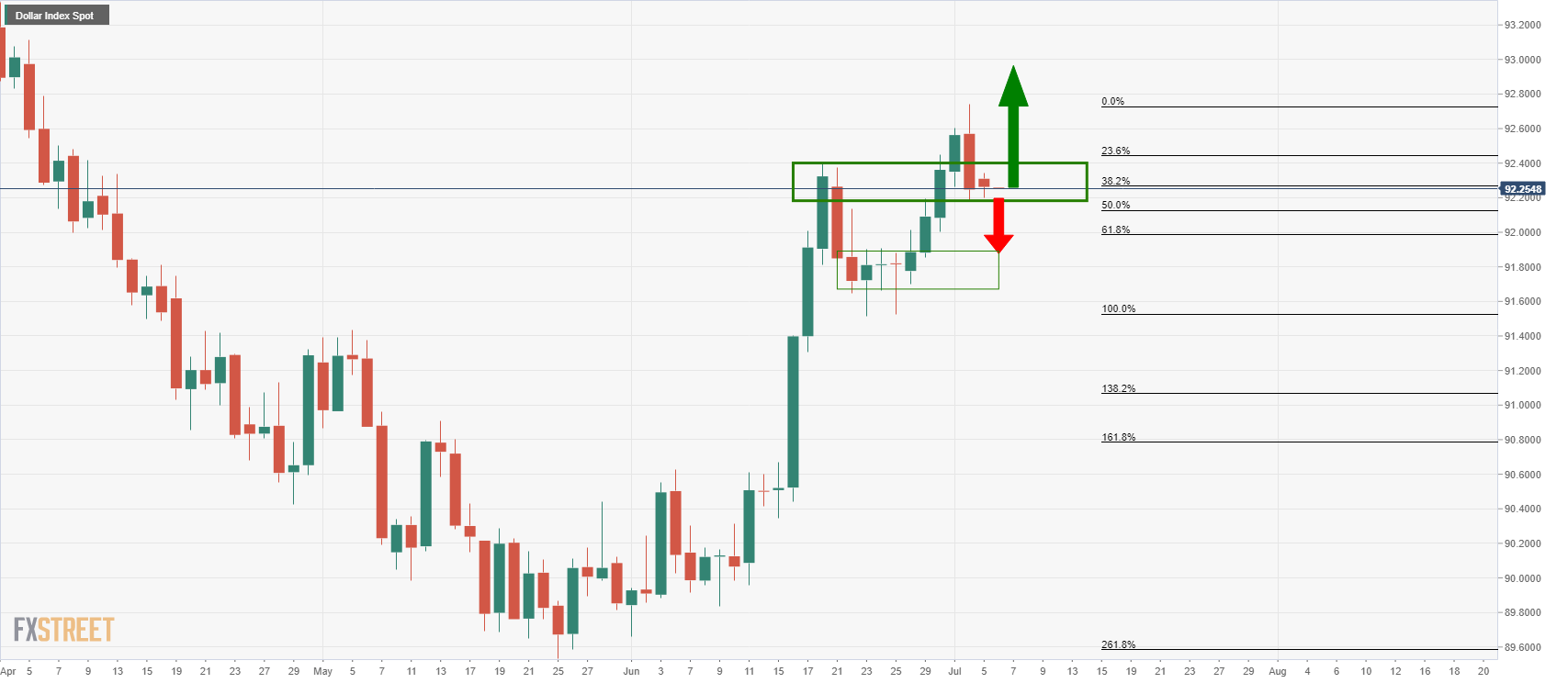

DXY daily chart

Meanwhile, EUR/USD ranged between 1.1851 and 1.1881 overnight as markets focussed on euro area data.

The final euro area services PMI for June rose unexpectedly to 58.3 (expected: 58, prior: 58) which has helped to keep the euro perky within the correction of the daily bearish impulse, as illustrated below.

Moreover, the improvement in the service sector was widespread, with France, Spain and Italy seeing improvements relative to the flash readings.

Looking ahead for the day, the Germany June ZEW investor survey and US June services ISM will be the key economic data related to the pair.

If the June ZEW survey of expectations remains upbeat, then this could add fuel to the current correction of the daily bearish impulse with the economic recovery beginning to materialise.

The reopening and robust consumer spending should drive another strong print in the June ISM services index (market f/c: 63.5), but this is nothing new and is expected.

This could give rise to a bias to the euro bulls for the near term.

EUR/USD technical analysis

As per the prior analysis, EUR/USD Price Analysis: Bulls target a 61.8% Fibo confluence, the bulls are correcting the bearish impulse from a projected daily support area near 1.1820:

From an hourly perspective, there is a fair bit of work to do from the bulls that still need to test the bear's commitments at resistance near 1.1880: