- EUR/USD rebounds to 3-day and advances above the parity level.

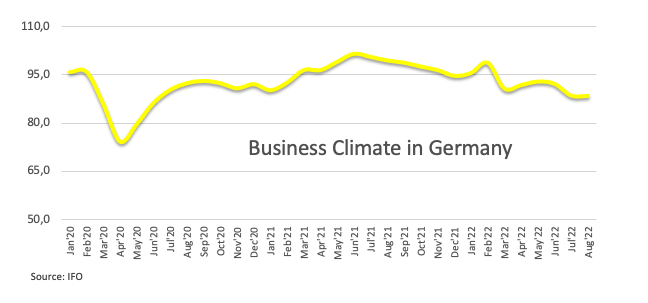

- Germany Business Climate came almost unchanged in August,

- The Jackson Hole Symposium will take centre stage in the next days.

The generalized better tone in the risk complex lifts EUR/USD back above the parity level, although the bull run has so far stalled around 1.0030 on Thursday.

EUR/USD now looks to USD and Jackson Hole

EUR/USD extends further the rebound from cycle lows in the 0.9900 neighbourhood recorded earlier in the week on the back of the renewed offered stance in the greenback.

Indeed, the US Dollar Index (DXY) retreats from the area of recent peaks north of 109.00 the figure, as investors appear to have priced in a 75 bps rate hike in September as well as a hawkish speech from Chief Powell on Friday.

In the domestic calendar, Germany’s Business Climate tracked by the IFO Institute receded marginally in August to 88.5 (from 88.6), while Business Confidence in France eased to 104 for the same month (from 106) and final figures saw the GDP Growth Rate in Germany expand 1.7% YoY and 0.1% inter-quarter in Q2. Later in the session, the ECB will publish its Accounts of the latest meeting.

Across the Atlantic, another revision of the US GDP Growth Rate is due along with weekly Initial Claims.

What to look for around EUR

EUR/USD reclaims part of the ground lost in recent sessions and regains the parity zone and beyond against the backdrop of the loss of upside traction in the buck.

Price action around the European currency, in the meantime, is expected to closely follow dollar dynamics, geopolitical concerns, fragmentation worries and the Fed-ECB divergence.

On the negatives for the single currency emerge the so far increasing speculation of a potential recession in the region, which looks propped up by dwindling sentiment gauges and the incipient slowdown in some fundamentals.

Key events in the euro area this week: Germany Final Q2 GDP Growth Rate, Germany IFO Business Climate, ECB Accounts (Thursday) – Germany GfK Consumer Confidence.

Eminent issues on the back boiler: Continuation of the ECB hiking cycle. Italian elections in late September. Fragmentation risks amidst the ECB’s normalization of its monetary conditions. Impact of the war in Ukraine on the region’s growth prospects and inflation.

EUR/USD levels to watch

So far, spot is up 0.44% at 1.0006 and faces the next resistance at 1.0202 (high August 17) followed by 1.0256 (55-day SMA) and finally 1.0368 (monthly high August 10). On the other hand, a break below 0.9899 (2022 low August 23) would target 0.9859 (December 2002 low) en route to 0.9685 (October 2022 low).