- EUR/USD moves to fresh tops above 1.1800 on Monday.

- German flash CPI next of note in the docket.

- Pending Home Sales, Dallas Fed index due later in the NA session.

The European currency looks to extend the recent bullish move, although EUR/USD appears to have met quite a moderate hurdle just above 1.1800 the figure.

EUR/USD now looks to data

EUR/USD adds to Friday’s moderate gains, although a convincing advance further north of the 1.1800 barrier appears to lack sufficient traction for the time being.

Spot and the rest of the risk-associated peers gathered further traction following the dovish tone of Powell’s speech at the Jackson Hole event on Friday, managing to flirt with levels just beyond 1.18 the figure for the first time since early August.

In addition, the pair charted a bullish “outside day” at the end of last week, allowing for the continuation of the rebound from 2021 lows near 1.1660 recorded on August 20.

In the domestic docket, the focus of attention will be on the release of German flash inflation figures for the current month. Earlier in the session, Business Confidence in Spain deflated to 0.1 in August, Retail Sales expanded 0.1% MoM in the same period and the CPI is seen rising 0.4% MoM and 3.3% from a year earlier.

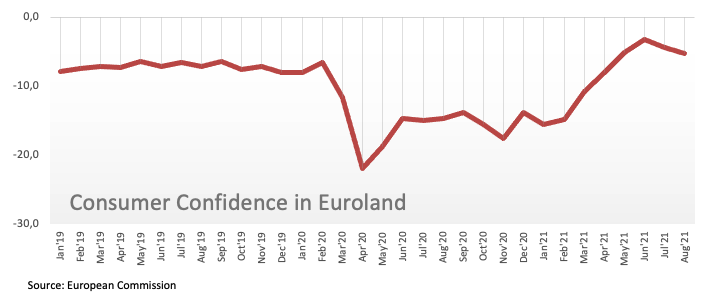

In the broader Euroland, the final Consumer Confidence tracked by the European Commission (EC) came in at -5.3 and the Economic Sentiment eased to 117.5. in Germany, preliminary CPI will take centre stage later.

Across the pond, Pending Home Sales and the Dallas Fed Index will kickstart the US weekly calendar.

What to look for around EUR

EUR/USD managed to regain the 1.1800 area in the wake of the speech by Chief Powell at the Jackson Hole event at the end of last week. The cautious note from Powell sparked a moderate selling pressure in the dollar, which eventually underpinned the recovery in the pair. Looking at the broader picture, the ongoing recovery in the pair from YTD lows (August 20) tracks the improvement in the risk complex as well as the corrective downside in the buck. However, the re-affirmed dovish stance from the ECB (as per its latest meeting) is expected to keep spot under pressure despite the healthy economic recovery in the region, which in turn stays propped up by the high morale among market participants.

Key events in the euro area this week: Final EMU Consumer Confidence, German flash CPI (Monday) – German labour market report, EMU flash CPI (Tuesday) – German Retail Sales, final Manufacturing PMIs (Wednesday) – final Services PMIs (Friday).

Eminent issues on the back boiler: Asymmetric economic recovery in the region. Sustainability of the pick-up in inflation figures. Progress of the Delta variant of the coronavirus and pace of the vaccination campaign. Probable political effervescence around the EU Recovery Fund. German elections in September could bring some political effervescence to the scenario. Investors’ shift to European equities in the wake of the pandemic could lend extra oxygen to the single currency.

EUR/USD levels to watch

So far, spot is gaining 0.03% at 1.1799 and faces the next up barrier at 1.1809 (weekly high Aug.30) followed by 1.1824 (55-day SMA) and finally 1.1908 (monthly high Jul.30). On the downside, a break below 1.1663 (2021 low Aug.20) would target 1.1612 (monthly low Oct.20 2020) en route to 1.1602 (monthly low Nov.4 2020).