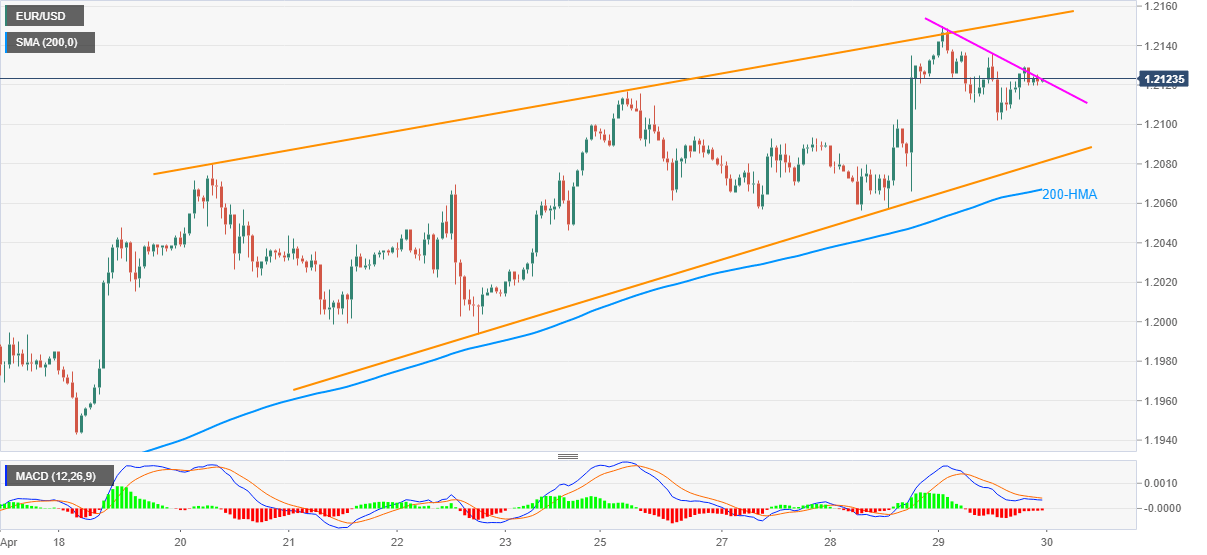

- EUR/USD keeps pullback from two-month high inside a bearish chart pattern.

- Downbeat MACD keeps sellers hopeful but 200-HMA tests the bear’s entry.

EUR/USD struggles for clear direction while taking rounds to 1.2120-25 during Friday’s Asian session. The currency major pair rallied to the highest since late February the previous day before closing the daily books with a loss.

Not only the failures to refresh the multi-day top but bearish MACD and rising wedge chart formation on the hourly play also back the EUR/USD seller’s entry.

It should, however, be noted that the 1.2090 and the 200-HMA level of 1.2067 offer extra barriers, in addition to the rising wedge’s support near 1.2080, for the EUR/USD bears’ welcome.

On the contrary, 1.2125 and the stated pattern’s upper line close to 1.2155 guards the pair’s short-term upside ahead of the late January’s top near 1.2190.

In a case where the EUR/USD bulls keep reins past-1.2190, the 1.2200 round figure and February’s high of 1.2243 will be in the spotlight.

EUR/USD hourly chart

Trend: Pullback expected