By Dmitriy Gurkovskiy, Chief Analyst at RoboForex

After some confident growth last Friday, the major currency pair is looking quite stable early in the final week of summer. EUR/USD is mostly trading at 1.1800.

The US Fed Chairman Jerome Powell said on Friday that the regulator might as well consider a possibility of an earlier reduction of its QE program before the end of the year without any particular dates. He also believes that the inflation boost was temporary. In his opinion, it wouldn’t be right to tighten the monetary policy right now.

As a result, the “greenback” got a clear signal: yes, the Fed agrees that the QE program volume should be slowly reduced but the regulator is not going to do anything about it right now.

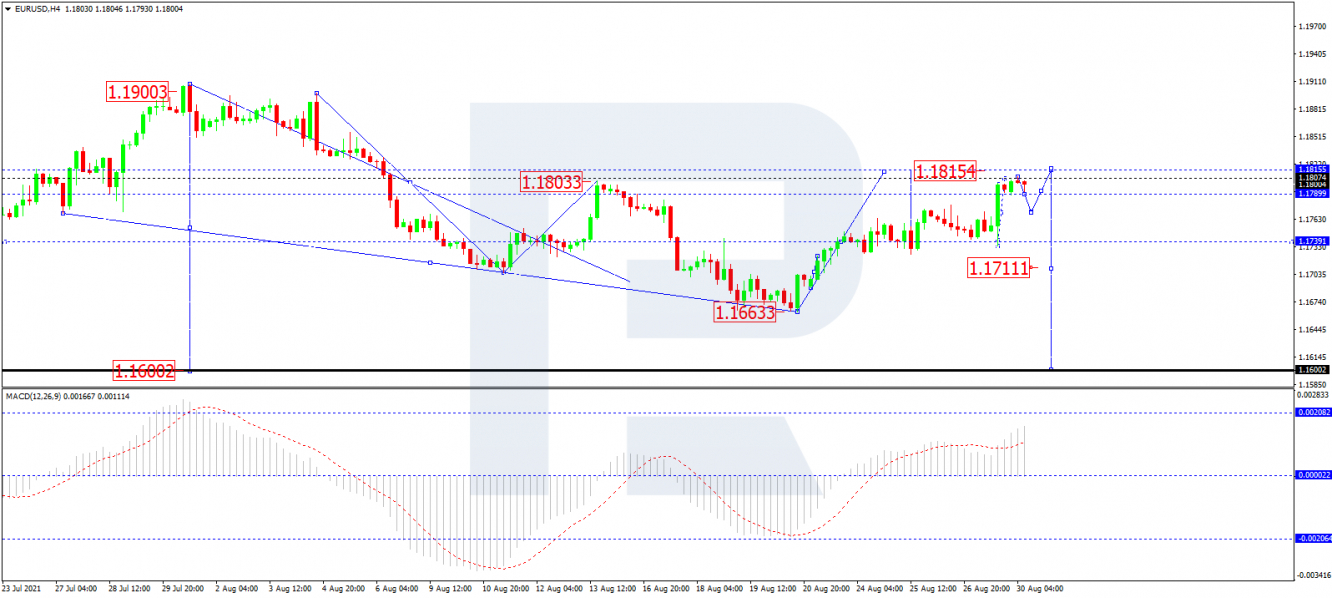

In the H4 chart, after rebounding from 1.1738, finishing the ascending wave at 1.1770, and then breaking the latter level to the upside, EUR/USD is expected to extend the correction; it has already reached the short-term upside target at 1.1808 and right now is correcting downwards. Possibly, the pair may fall to return to 1.1770 and then start another growth towards 1.1815. Later, the market may resume trading downwards with the target at 1.1711. From the technical point of view, this scenario is confirmed by MACD Oscillator: after re-entering the histogram area, its signal line is moving to the upside.

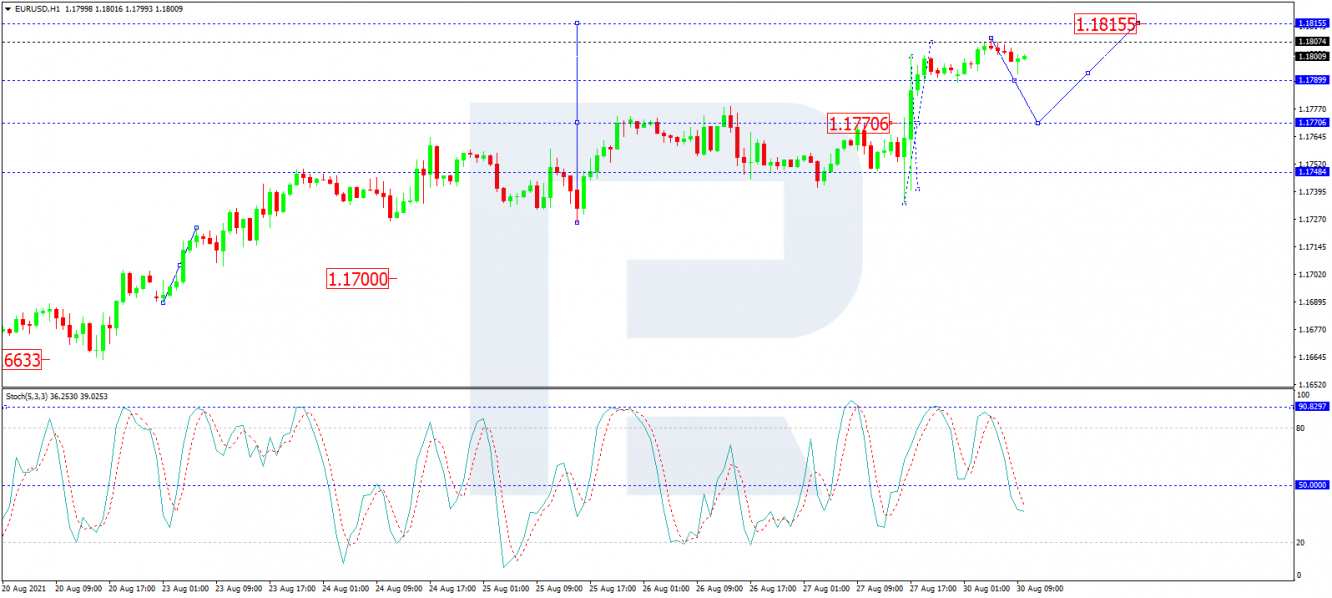

As we can see in the H1 chart, after breaking 1.1777 and finishing the ascending impulse with the short-term target at 1.1808, EUR/USD is correcting towards 1.1770. Later, the market may start another growth to break 1.1800 and then continue growing with the target at 1.1815. From the technical point of view, this scenario is confirmed by the Stochastic Oscillator: after breaking 50 to the downside, its signal line is steadily moving towards 20.

Disclaimer

Any forecasts contained herein are based on the author’s particular opinion. This analysis may not be treated as trading advice. RoboForex bears no responsibility for trading results based on trading recommendations and reviews contained herein.

RoboForex Ltd Review

Monday, 30 Aug, 2021 / 12:45