A squeeze on bearish altcoin traders has brought fresh energy into crypto markets, absent for months as the FTX exchange imploded in scandal. PLUS: Alex Thorn talks on crypto VC in 2023.

Good morning. Here’s what’s happening:

Prices: Solana's SOL and altcoins including Serum's SRM are benefiting from the year's first mini-rally in altcoins. A short squeeze added fuel.

Insights: Alex Thorn, head of research at crypto investment firm Galaxy Digital, tells CoinDesk that Web3 blockchain startups and trading-based services could continue to lead venture-capital deals and funding in 2023.

Prices

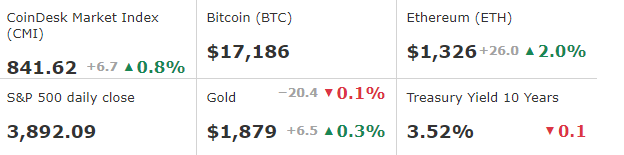

BTC/ETH prices per CoinDesk Indices; gold is COMEX spot price. Prices as of about 4 p.m. ET

Mini altcoin rally generates enthusiasm for first time in months

By Sam Reynolds

Everyone gets a second chance in crypto.

Weeks ago, Solana was on its deathbed. As 2022 came to a close, the Ethereum competitor — which was at the center of the Sam Bankman-Fried universe of tokens — had lost more than 90% of its value. Its loudest cheerleaders, like Sino Global Capital, may have gotten stuck as big holders.

But now Solana's native SOL tokens are getting a fast price pump as crypto markets attempt a recovery after months in the doldrums, according to CoinDesk data. The protocol’s token is up 11% in the last 24 hours and 46% in the last two weeks. As CoinDesk reported earlier, there’s strong transactional activity on the network, with daily active users increasing by 40% during the last two weeks. Silly meme coins like the Shiba Inu-themed BONK token, which is paying out 2021 "DeFi Summer"-like 1,000% yield for liquidity providers, has a lot to do with it.

Aside from Solana’s comeback story, the other crypto majors are also doing well. Bitcoin (BTC) is slowly creeping its way back to $20,000, having recently breached the $17,000 mark, and ether (ETH) is up 3% in the last 24 hours, coming in at $1,326. Altcoins got a boost from a short squeeze. The CoinDesk Market Index (CMI) is up 1.2% over the past 24 hours.

All this is pushing up crypto-related mining stocks too. Granted, many are down 80% on-year for 2022, but recoveries begin with green shoots.

Insights

Galaxy Digital's Head of Research Sees More Venture Funding for Web3 Firms This Year

By Fran Velasquez

Web3 blockchain startups and trading-based services led venture-capital deals and funding in 2022, and the trend could continue this year, according to Alex Thorn, head of research at crypto investment firm Galaxy Digital.

Thorn told CoinDesk TV’s “First Mover” on Monday that the Web 3 sector, which is made up of non-fungible tokens (NFTs), decentralized autonomous organizations, the metaverse and online gaming, were 31% of deals in 2022, while 13% were made up of trading platforms.

VCs invested more than $30 billion into crypto and blockchain startups in 2022, according to Galaxy's “Crypto VC Year End” report.

Thorn noted, however, that the number of deals and amount of money invested steadily declined every quarter during 2022, pointing out that macroeconomic factors coupled with the fall of significant crypto companies may have played a role in the decrease.

Important events

9:10 a.m. HKT/SGT(1:10 UTC) Bank of Japan's Governor Kuroda Speech

11:30 p.m. HKT/SGT(15:30 UTC) Australia Monthly Consumer Price Index (YoY/Nov)

12:30 a.m. HKT/SGT(16:30 UTC) China Consumer Price Index (YoY/Dec)