- Cable is on the defence as covid headlines swirl at the start of the week.

- Bears eye the daily support structure for a deeper test of the recent daily lows.

GBP/USD has started out the week on the back foot as the price drops near to 0.5%.

Cable has fallen from a high of 1.3862 and met a low of 1.3755 in Tokyo.

The bears are in charge as investors fret over the rise of the delta variant in the UK and overseas, and GBP was poised for a weekly loss of 0.8%, its worst since mid-June.

In recent months, a variant of SARS-CoV-2, the virus that causes COVID-19, has been making headlines as it has spread across the world.

The Covid delta variant has exploded in the UK and there are questions as to whether the lifting of lockdown rules in England from Monday is a good idea.

"COVID cases are surging and the impact on the economy could prove more considerable than expected," MUFG analysts wrote in a note. "The job furlough scheme unwinds could therefore be more disruptive than expected."

Nevertheless, it is going ahead, even as the UK reported 54,674 new coronavirus cases on Saturday, the biggest one-day increase since January, and 41 new deaths.

The current wave of coronavirus infections could see up to 200,000 new cases a day, Imperial College London epidemiologist Neil Ferguson has warned.

Prof Ferguson told BBC1’s Andrew Marr Show that it was “almost inevitable” that daily infection rates would hit a record 100,000 within a week, and that cases could spike at more than double that figure.

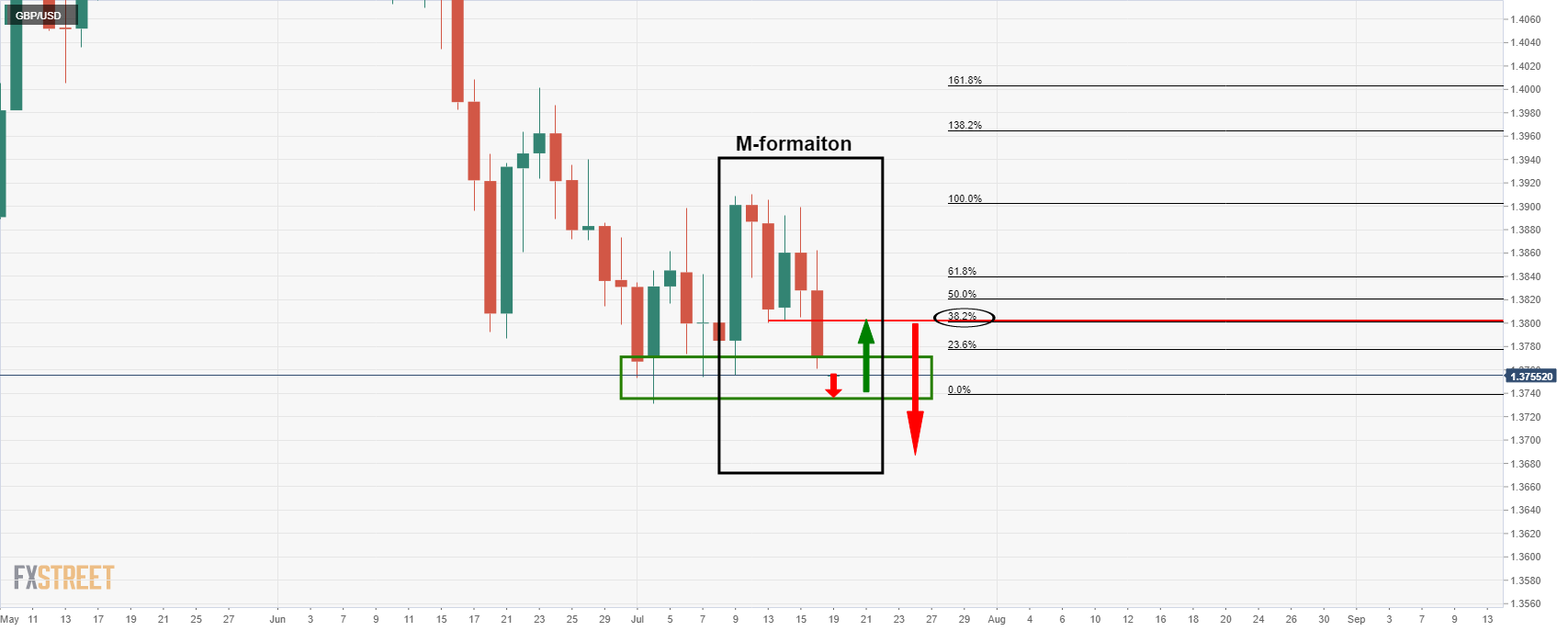

GBP/USD technical analysis

The M-formation is compelling as the price runs into support.

On a test of a lower low, there could be a surge back to the upside to test the prior daily lows and influence of the 38.2% Fibonacci retracement level.