- GBP/USD remains on the back foot, recently sidelined around yearly low.

- Bearish impulse fades but bulls have limited upside room.

- September’s low challenges immediate recovery moves, further downside to aim for early November 2020 tops.

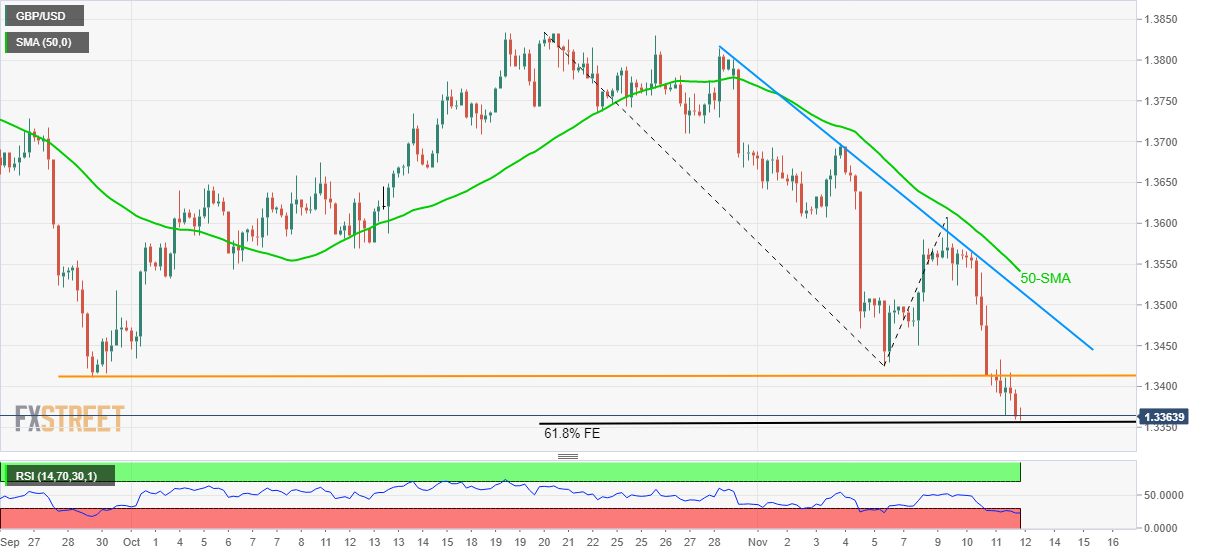

GBP/USD bears seem tiring around the lowest level since December 2020 as the cable pair seesaws near 1.3360-65 amid Friday’s Asian session, after refreshing the multi-day bottom the previous day.

The latest pause in the south-run could be linked to the oversold RSI conditions and the quote’s failures to break the 61.8% Fibonacci Expansion (FE) level of the quote’s moves between late October and November 09.

However, September’s low around 1.3410 stays ready to challenge the anticipated corrective pullback. Also acting as an upside barrier is the early month bottom close to 1.3425.

In a case where the GBP/USD prices remain firmer past 1.3425, a descending resistance line from October 28 and 50-SMA, respectively near 1.3520 and 1.3540, will be in focus.

Alternatively, further weakness needs to provide a decisive closing below 1.3350 immediate FE support ahead of visiting the early November 2020 peak near 1.3310.

Following that, the 100% FE level around the 1.3200 threshold will lure the GBP/USD bears.

GBP/USD: Four-hour chart

Trend: Corrective pullback expected