- XAU/USD has tumbled down as dollar demand triggers selling.

- The Confluence Detector is showing gold has critical support at $1,744.

- Gold Price Forecast: XAU/USD bears seize control as focus shifts to FOMC meeting

Fear has gripped markets – the Federal Reserve may still go ahead with tapering of its bond-buying scheme and China's Evergrande is in deep financial trouble, The second-largest real-estate firm in the second-largest economy seems to be on the brink of missing a debt payment or even bankruptcy.

In turn, stock markets are under pressure and the safe-haven dollar is in demand. Moreover, US returns on 10-year Treasuries are on the rise, making yieldless gold less attractive. How is the precious metal positioned?

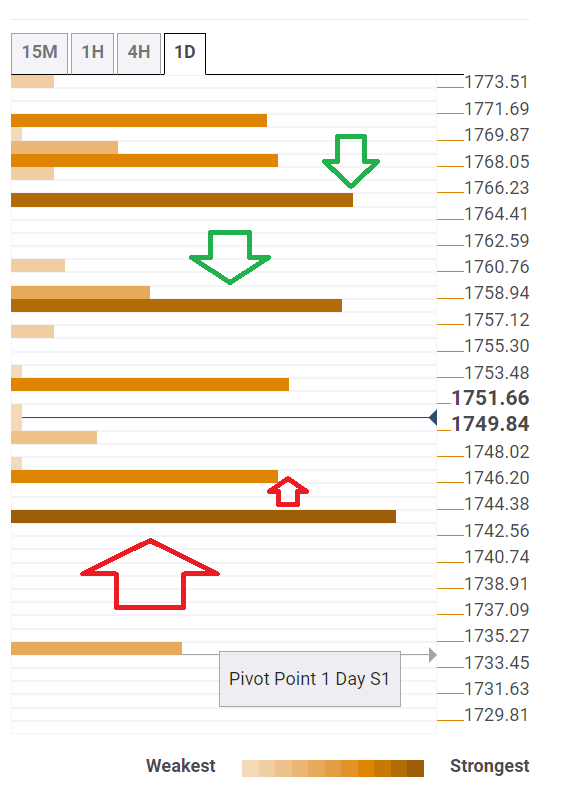

The Technical Confluences Detector is showing that XAU/USD has weak support at $1,746, which is the convergence of the Bollinger Band 4h-Lower and the previous day's low.

The critical line in the sand for the yellow metal is $1,743, which is where the all-important Fibonacci 38.2% one-month hits the price.

Looking up, two resistance lines are eyed. First, $1,758 is the confluence of the Fibonacci 23.6% one-day, the Simple Moving Average 100-15m and the BB 1h-Middle.

The second line is $1,765, which is the meeting point of the Fibonacci 38.2% one day and the BB 1h-Upper.

XAU/USD resistance and support levels

Confluence Detector

The Confluence Detector finds exciting opportunities using Technical Confluences. The TC is a tool to locate and point out those price levels where there is a congestion of indicators, moving averages, Fibonacci levels, Pivot Points, etc. Knowing where these congestion points are located is very useful for the trader, and can be used as a basis for different strategies.

Learn more about Technical Confluence