- Gold offered for the first time in July, reverses from three-week top.

- Covid woes, indecision over central bank measures weigh on risk appetite.

- ECB special meeting, US Jobless Claims will be the key.

Souring risk appetite weighs on the gold (XAU/USD) prices amid early Thursday. That said, the yellow metal registers a 0.18% intraday loss of around $1,800, down for the first time since June 29.

The coronavirus (COVID-19) woes recently spread out of the Asia-Pacific region after the UK reported the highest daily covid infections since late January and the US witnessed a fresh variant, Epsilon, in California that resists vaccine. Elsewhere, South Korea reported all-time high cases and Tokyo also up for extending the virus-led emergencies to late August. Furthermore, Australia’s Health Expert Catherine Bennett, per ABC News, says many more Australians need to be vaccinated before states and territories can even consider doing away with lockdowns to control outbreaks.

Amid these plays, World Health Organization (WHO) official Mike Ryan warned, per The Guardian, of ‘epidemiological stupidity’ of early Covid reopening.

Elsewhere, the latest FOMC minutes marked upside risk to inflation while also rejecting immense pressure to act immediately. Following the minutes, Atlanta Federal Reserve President Raphael Bostic said, per Reuters, “A new rise in coronavirus infections driven by the more virulent Delta variant could cause consumers to "pull back" and slow the US recovery.”

It’s worth noting that geopolitical tension in the Middle East and Sino-American tussles also heavy the market’s mood.

That said, S&P 500 Futures drop 0.14% intraday while the US 10-year Treasury yields remain on the back foot around 1.31%, the lowest level since late February, by the press time.

Looking forward, weekly US Jobless Claims may entertain gold traders but major attention will be given to the European Central Bank’s (ECB) Special Meeting as policymakers jostle over inflation target. Above all, risk catalysts are crucial to watch for near-term direction.

Technical analysis

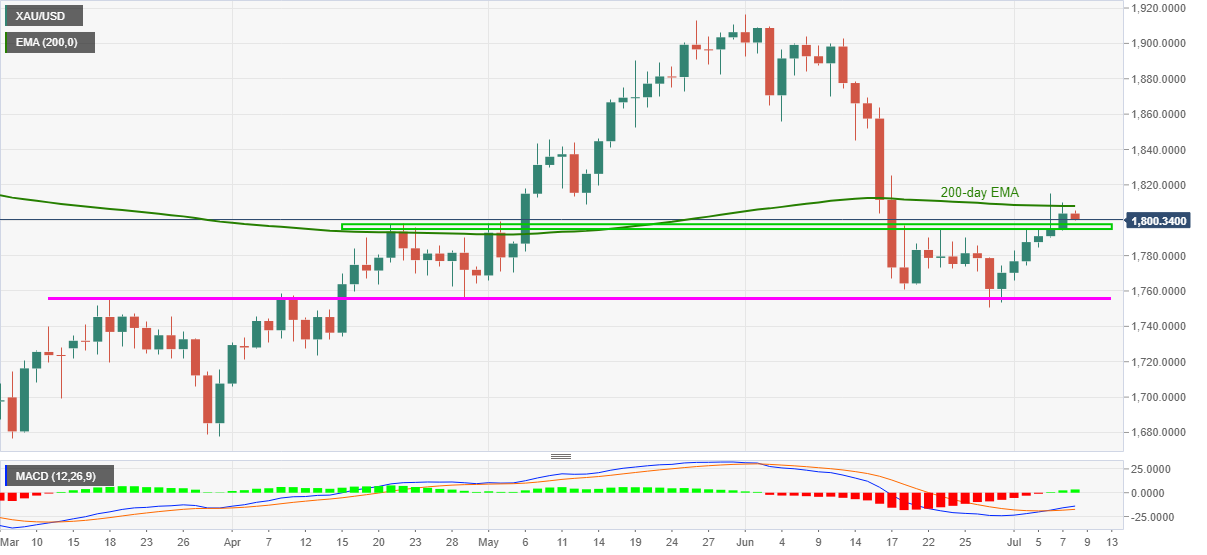

Gold justifies the early week failures to cross 200-day EMA with the latest drop. However, a clear downside break of $1,798-95 horizontal area, stretching from late April, becomes necessary for the bears to retake controls.

Following that, a horizontal from late March area around $1,756 will be in the spotlight.

Alternatively, a daily closing beyond the 200-day EMA level of $1,808 will need validation from May 13 low surrounding $1,809 to aim for May 10 top of $1,845.

Overall, gold bulls seem to have tired and hence sellers may return should the latest risk-off mood prevail for long.

Gold: Daily chart

Trend: Further weakness expected

Also read: Gold Price Forecast: XAU/USD teases $1,800 on steady USD, risk-off mood