- Ethereum Classic price is contemplating testing a confluence of resistance level around $61.84.

- Grayscale Investment offloads 28,382 ETC over the past month, suggesting shifting goalposts.

- A decisive 12-hour candlestick close above $61.84 could lead to a 35% upswing to $83.88.

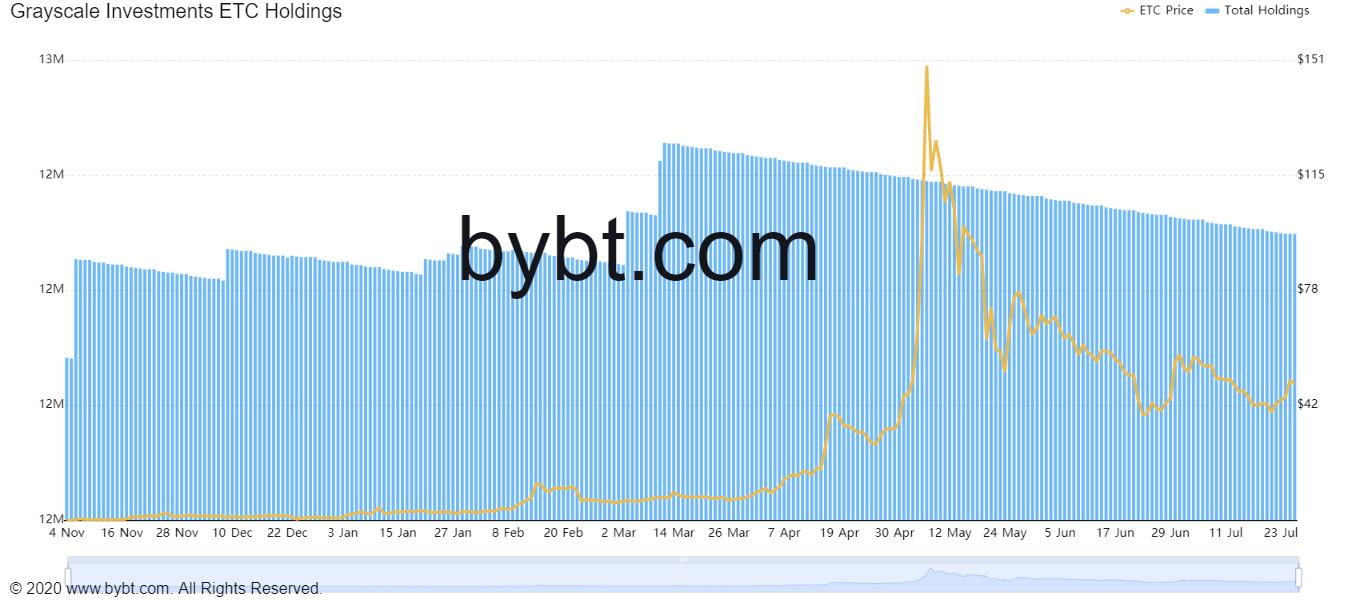

Grayscale, one of the largest cryptocurrency investment companies, have been selling their Ethereum Classic holdings for over four months. This rapid decline in their ETC holdings paints a bearish picture. However, from a technical point of view, Ethereum Classic price displays a potential bullish outlook.

Grayscale changes its view on Ethereum Classic

Grayscale’s thesis on ETC banks on various aspects like the team behind the projects, ranging from ETC Labs Core, IOHK to ETC Cooperative, and fundamental elements like scarcity, divisibility, decentralization and so on.

However, the most crucial consideration is that their assumption mentions that ETC can capture a portion of the “digital store of value” market.

Based on this and other industries that ETC could potentially affect, the investment thesis written in May 2018 projected that it might grow eight-fold in the coming days, which puts it at $125.40 per coin.

However, Grayscale has offloaded 28,382 ETC over the past month, reducing their holdings from 12.54 million to 12.32 million. While this paints a bearish picture, one can assume that this decision comes as Ethereum Classic more than surpassed the projections made in the investment thesis since ETC hit an all-time high of $179.83 during the recent bull run.

ETC Grayscale holdings chart

Despite this bearish backdrop of news, Ethereum Classic price shows a bullish bias from a technical standpoint.

Ethereum Classic price eyes retest of range high

ETC price rallied 48% after dipping below the range low at $39.69 on July 20. The upswing that followed came extremely close to testing a crucial resistance level at $59.46.

However, investors seem to have started booking profits, which has led to a minor pullback. This retracement could extend up to the July 25 swing low at $45.85, leading to the formation of an equal low.

Such a development could trigger a massive uptick in buying pressure that catapults Ethereum Classic price to produce a decisive 12-hour candlestick close above the 50% Fibonacci retracement level at $61.84. This move will confirm the presence of buyers and set the stage for a further uptrend.

If this were to happen, ETC might likely run up to retest the range high at $83.88, roughly a 60% climb from the current position – $52.16.

ETC/USDT 12-hour chart

Supporting this uptrend is the recent Magneto hard fork that was implemented on the main chain on July 24. This update brings Ethereum Classic blockchain the much-needed boost to increase network security, reduce costs and cut energy consumption, among other upgrades.

The hard fork comes after months of beta testing on the Morder and Kotti testnets.

Interestingly, ETC price has rallied 24% since July 24 and the magneto hard fork seems to have had a hand in this surge.

The #EthereumClassic #MagnetoHF hard-fork activated successfully.

– hash-rate stable

– majority nodes updated

– major service providers updated

Please update your #ETC nodes if you have not done so already as Magneto contains an important security patch. Good work #ETCArmy! pic.twitter.com/JY0ipn1wx6— Ethereum Classic (@eth_classic) July 24, 2021