- Inflation worries spark US tech selloff, prompting caution ahead of Fed minutes

- US futures slip further but dollar slide eases on slight risk averse mood

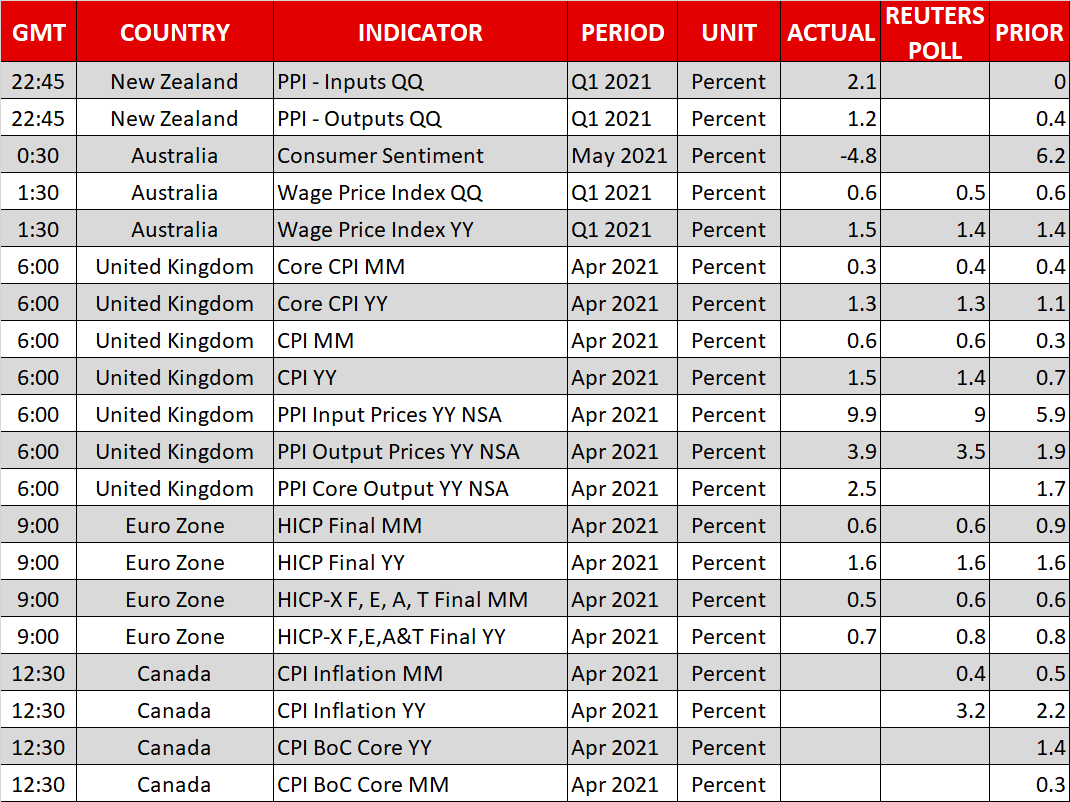

- Loonie pulls back from highs on lower oil prices, eyes CPI data

Inflation concerns won’t go away

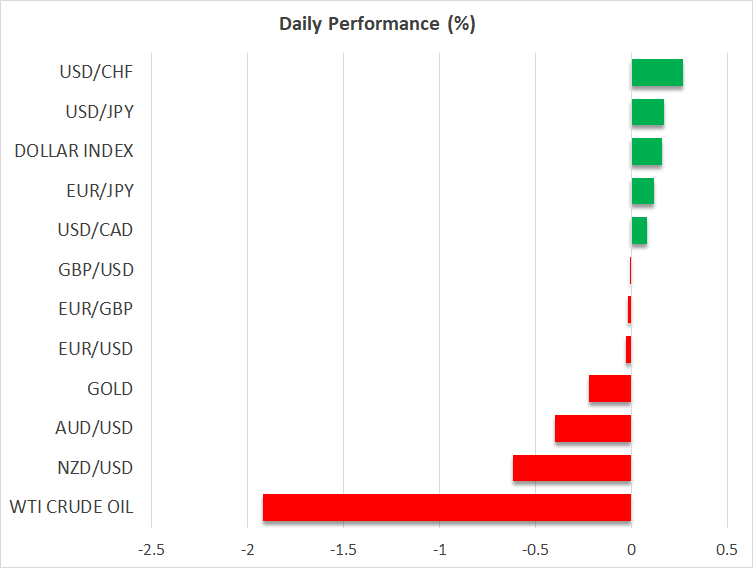

Market jitters about higher inflation resurfaced late on Tuesday, weighing on equities, as investors reassessed the outlook for earnings growth against a backdrop of higher costs and supply constraints. Big tech stocks with sky-high valuations were the biggest casualties on Wall Street but there was a broader selloff as well, affecting energy, financials and industrials, which pulled the S&P 500 down by about 0.9%.

European shares opened sharply lower today as US stock futures indicated Wall Street will extend its losses in the US session.

Disappointing housing data out of America weighed on sentiment yesterday as shortages of building materials and rising costs such as from soaring lumber prices underlined the narrative of how higher inflation is becoming the number one concern for many businesses.

The latest fears about runaway inflation are adding prominence to the FOMC minutes of the Fed’s April policy meeting that are scheduled to be published at 18:00 GMT.

Despite all the evidence pointing to escalating price pressures, there have been no hints from Fed policymakers that the inflation scare is significant enough to warrant a policy shift. However, any indication that some FOMC members are getting uneasy about the faster-than-expected pickup in price growth could be interpreted by markets as a sign that the Fed’s current dovish stance won’t be tenable for long.

Dollar stabilizes, euro supported by rising yields

US Treasury yields edged higher on Wednesday as investors grew more nervous about the growing threat of higher inflation. But while this helped the US dollar stabilize from a three-day tumble, there was little to suggest yields are about to jump out of their recent range.

The same cannot be said about Eurozone yields, however, which continued to rally. The yield on 10-year German bunds climbed to fresh two-year highs today and Italy’s 10-year yield hit 1.16%, having recently crossed above 1%.

The ECB’s half-hearted pledge to boost bond purchases in the short term has backfired as it was soon followed up by policymakers flagging a review of the PEPP programme in June. Although it is still possible for the ECB to deliver a dovish surprise in June, the mixed messages won’t do the ECB any favours in bond markets.

Rising yields are supporting the euro’s rebound against the dollar. The single currency has been on a roll since April as a faster vaccine rollout and a gradual lifting of virus restrictions have brightened the previous gloomier outlook for the Eurozone.

The euro was last trading just above $1.22, while the pound hovered around $1.4170, both easing slightly from yesterday’s highs.

Commodity currencies underperform, oil down on Iran nuclear talks

There was a sharper pullback for commodity-linked currencies, however, as commodity prices came under pressure. The Australian dollar fell 0.5% and the New Zealand dollar skidded 0.65%. The loonie fared somewhat better and there could be a potential boost from domestic CPI numbers later today, but in the meantime, it is struggling after failing to clear the C$1.20 per dollar hurdle.

Oil, copper and iron ore prices were all on the decline on Wednesday. WTI futures slipped by almost 2% and Brent crude was down 1.8%, adding to yesterday’s losses. Reports that talks between the US and Iran on renewing the nuclear deal are going well have been weighing on oil prices in recent sessions as an agreement would unleash significant supply onto the markets.

Wednesday, 19 May, 2021 / 10:01