- NZD/USD seesaws inside a small trading range following the U-turn from three-week top.

- Covid woes challenge economic recovery hopes but RBNZ hawks stay firm.

- FOMC Meeting Minutes, virus updates will direct short-term moves.

NZD/USD consolidates the previous day’s losses above 0.7000, up 0.08% around 0.7020, amid Wednesday’s Asian session. In doing so, the quote struggles between hawkish bets for the Reserve Bank of New Zealand’s (RBNZ) next move and the coronavirus (COVID-19). However, the bears are hopeful as technical details join market fears.

Be it Bank of New Zealand or the Australia and New Zealand Banking Group (ANZ), not to forget Westpac, all seem to be on the same page while expecting a rate hike from the RBNZ during late 2021. These banks portray the Pacific nation’s ability to tame covid spread at home and upbeat fundamentals to back their bullish view.

Even so, virus resurgence at the largest customer Australia and fears of the covid strain, which mostly signal resistance to the vaccines, keep weighing on the sentiment and Antipodeans. Furthermore, recently weak US data, ISM Services PMI was the latest, probe economic recovery hopes and adds to the risk-off mood.

That said, S&P 500 Futures drop 0.10% while the US 10-year Treasury yields remain pressured around the lowest since late February by the press time.

Considering the lack of data/events and the covid woes’ dominance, not to forget the cautious sentiment ahead of the FOMC minutes, NZD/USD prices may remain pressured.

Technical analysis

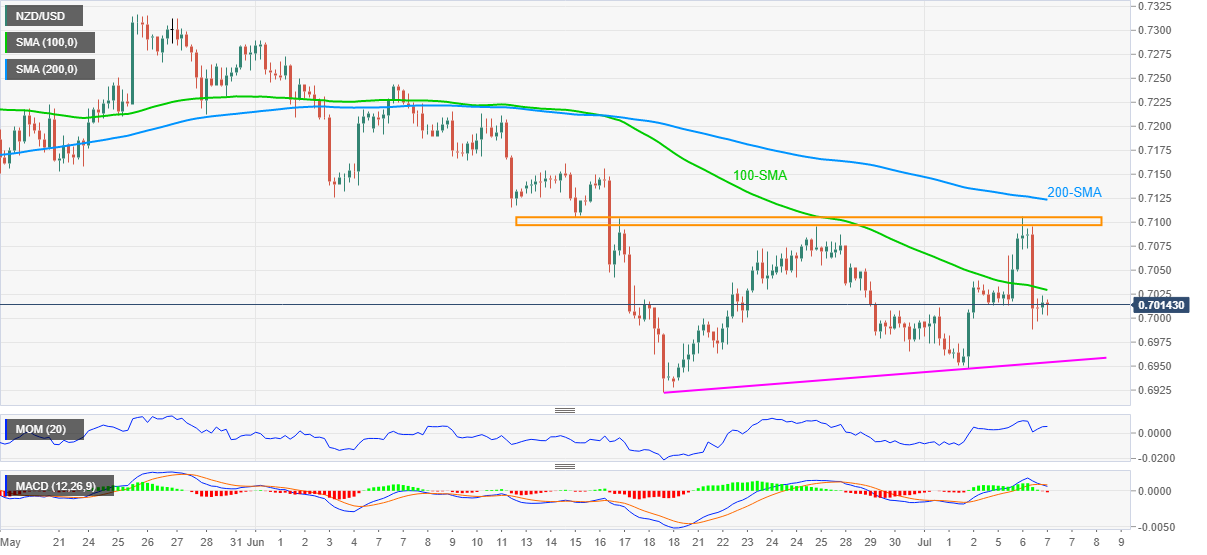

NZD/USD remains below the key horizontal hurdle from mid-June, not to forget 100 and 200-SMAs, by the press time. The bears can also observe, as well as cheer, the MACD conditions that recently flashed a sell signal and the Momentum line having a notable room to the south.

That said, the kiwi pair is on the way to test an ascending support line from June 18, around 0.6955. However, the 0.7000 threshold tests intraday sellers.

Meanwhile, 100-SMA guards the quote’s corrective pullback near 0.7030, a break of which could recall NZD/USD buyers aiming for the stated horizontal hurdle surrounding 0.7095–0.7105.

It should be noted that the 200-SMA level of 0.7125 can offer an extra check for the NZD/USD bulls beyond the key horizontal area.

NZD/USD: Four-hour chart

Trend: Bearish