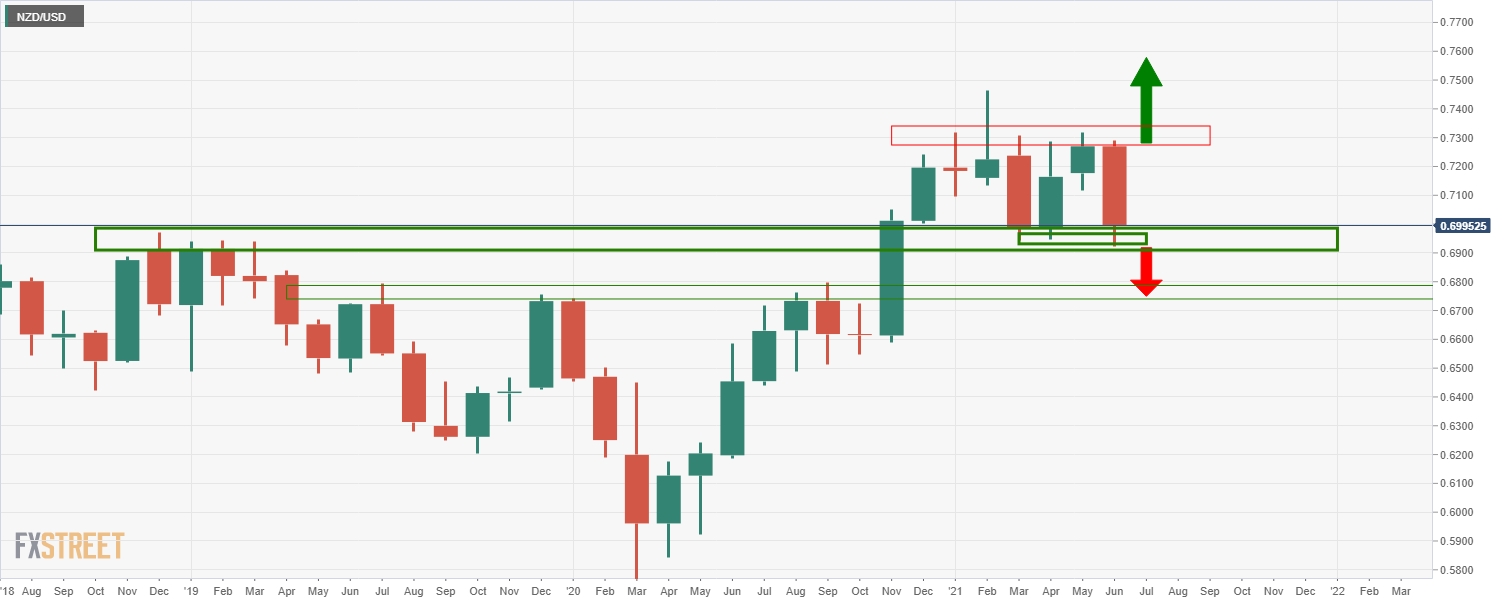

- NZD/USD bears n the verge of a downside extension to challenge the bulls at monthly support.

- Covid spread is sending a bid into the US dollar at month-end.

NZD/USD is flat in Tokyo as markets consolidate the latest bout of US dollar strength in the wake of renewed fears over the spread of the coronavirus in some countries.

At the time of writing, NZD/USD is trading at 0.6993 and has stuck to a very narrow range of between 0.6984 and 0.6997.

The price of the bird was capped recently in the correction of the latest bearish impulse from the 0.7150s and has shown little signs of a commitment from the bulls.

Both the Aussie and kiwi have underperformed G10 peers overnight reflecting Australias COVID situation.

In the past fortnight, the Delta variant has managed to breach Sydney's defences and in just one week, positive cases have ballooned to more than 100.

By Friday 25 June, officials conceded the need to put Sydney into lockdown. However, by Monday, the crisis had become a national one with outbreaks in four states and territories.

Consequently, the US dollar has picked up a safe haven bid and month-end rebalancing could also be playing its role.

''Locally, Wellington’s return to Level 1 is a good news story, as are higher short-end rates. But we are likely to range-trade ahead of key US data Friday,'' analysts at ANZ Bank argued.

NZD/USD technical analysis

While there are prospects of a downside extension from a daily perspective, the monthly support should be noted also.

Daily chart

The daily chart shows that the price could be on the verge of a downside extension following the correction of the last bearish impulse.

However, the price is testing a critical monthly support in the 0.6920s that would easily see the price reverse to the upside and selling at support is not ideal.