The New Zealand dollar has fallen hard during the Monday session to break down through the 0.7650 level, an area that has been important more than once. By doing that, the market is likely to go looking to reach the 0.67 handle, followed by the 0.66 level. Keep in mind that the New Zealand dollar has been underperforming the Australian dollar as of late, so it does make a certain amount of sense that we would see this happen.

Breaking down the way we have suggests that there is more of a “risk-off” type of situation going on. The US dollar strengthening is a huge sign of concern. At this point, the market could drift as low as the 0.65 handle, which is where we had a major bounce happen. It is also worth noting that the commodity markets will have an outsized effect on this market, especially softs.

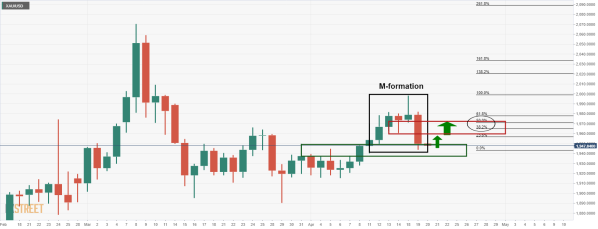

Looking at this chart, the market is also closing towards the bottom of the candlestick, and that does suggest that there should be a bit of follow-through. Because of this, the market is likely to see a lot of negative pressure and perhaps will continue to see a lot of follow-throughs.

The alternate scenario of course is that we turn around and take out the inverted hammer from the Friday session, opening up the possibility of a move to the 50 Day EMA, and then perhaps the 200 Day EMA after that. There is a lot of noise between here and there, so it does suggest that it will be much harder to rally than will be to fall. Because of this, I like the idea of fading short-term rallies that show signs of exhaustion if we get those opportunities. However, if we break down below the 0.67 handle, then I think it is only a matter of time before we continue to go much further to the downside.

The US dollar will have an outsized effect on this market as the New Zealand dollar does tend to be a little less liquid. That being said, it will more likely than not follow the AUD/USD pair, the EUR/USD pair, and all of the other major dollar-related markets. At this point, the market certainly looks threatened, and I just do not see that changing anytime soon.