- NZD/USD bears target downside structures failing at daily resistance.

- The monthly chart is otherwise strongly bullish.

The New Zealand dollar is tiring and while the fundamentals might stack up on a longer-term view, the immediate future might test weak hands at this juncture.

The following is an analysis of the monthly and daily chart that offers prospects of anear term correction before higher levels, while the hourly chart illustrates where the downside opportunity could come from a restest of an old support structure.

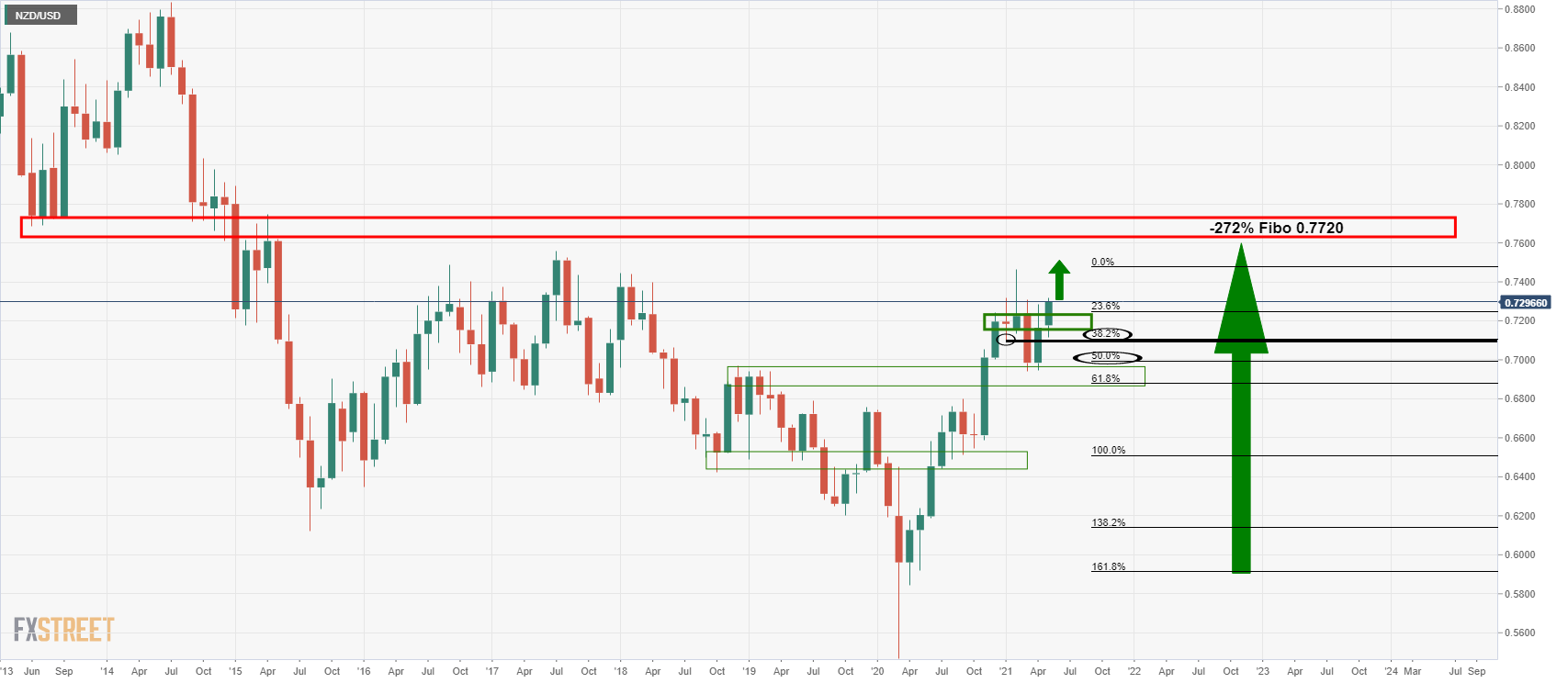

Monthly chart

As noted in the prior analysis, where fundamentals can be read, ''an upward extension would be expected following the correction of the prior bullish impulse.

We are in the throws of this fresh bullish impulse and according to the -272 Fibonacci of the correction, there are prospects of it extending to at least 0.7720.''

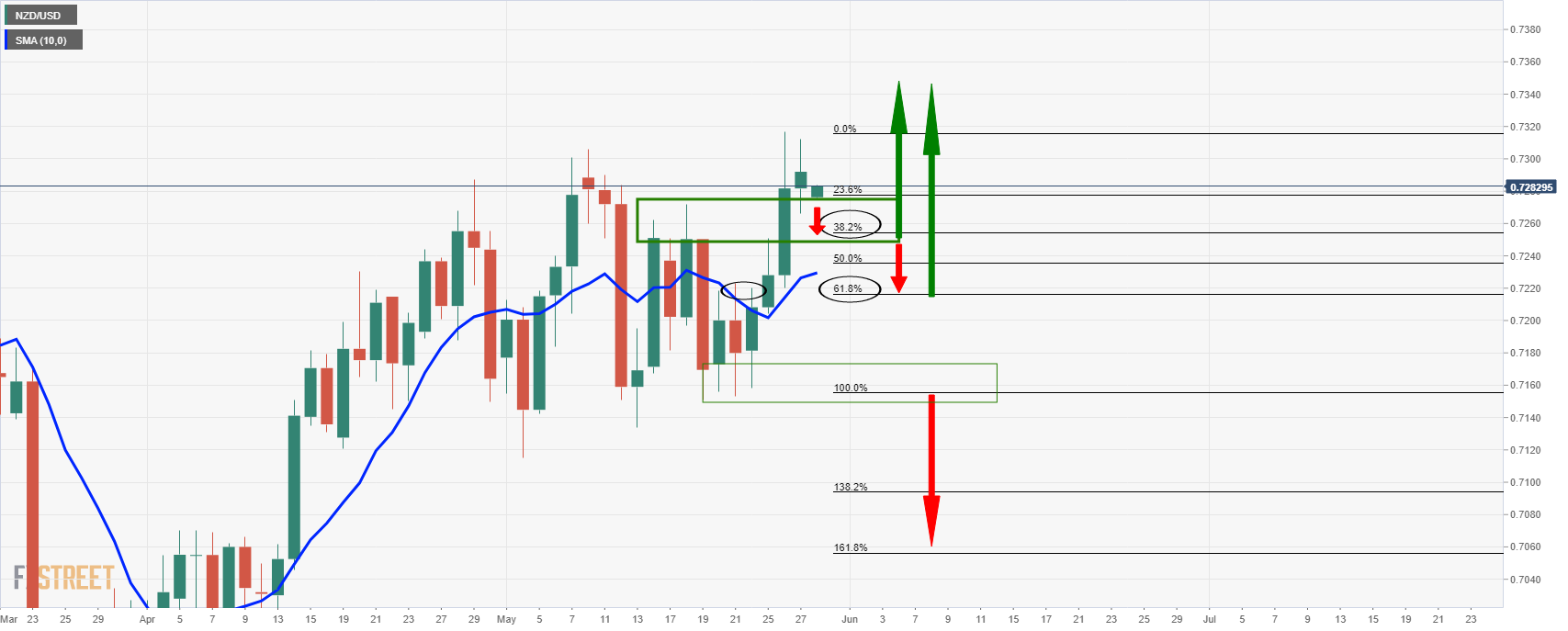

Daily chart

Meanwhile, there are two compelling levels that the price might test before an upward extension.

The first is the 38.2% Fibonacci the second is the 61.8% Fibonacci that has a confluence of prior resistance structure that would be expected to offer support.

Hourly chart

On a retest of old support and prior lows, the bears could be willing to enter in droves and target the aforementioned downside confluence of Fibos and structures.