- Fed Chair Powell delivers remarks just before the bank enters its "blackout" period.

- Markets are pricing two double-dose rate hikes in May and in June.

- Relatively moderate core inflation may cause Powell to refrain from big commitments.

- The dollar is stretched and may suffer a correction.

Russia has retreated from the Kyiv area – and the Federal Reserve may now take a step back from its extremely hawkish stance on beating inflation. Or, at least, that is the potential perception that Federal Reserve Jerome Powell's speech could leave, triggering a slide in the dollar.

Investors have ramped up bets for aggressive policy from the Fed. This is a result of high inflation – 8.5% YoY as of March – and of comments by dovish officials at the Washington-based institution, including Vice-Chair Lael Brainard. The current time seems ripe for raising interest rates fast, as not only inflation is high, but the labor market is "extremely tight" according to Powell.

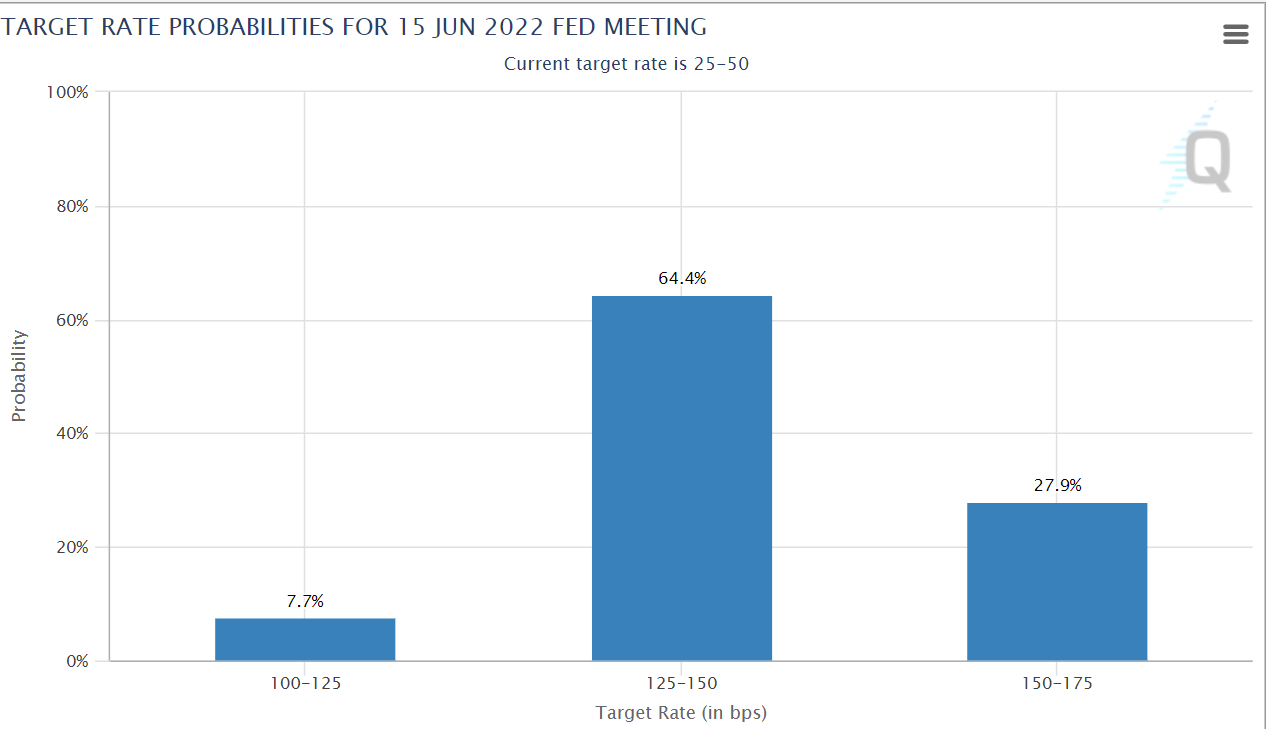

Nevertheless, bond markets have gone too far. It is pricing not only a double-dose rate hike in the upcoming May 3 meeting but also such a non-standard move in June. After increasing borrowing costs by 25 bps in March, they are set for another 100 bps increase within the next two months.

Over 94% chance of two double-dose hikes according to bond markets:

Source: CME Group

This near certainty that markets reflect may have gone too far. Circling back to the war, its consequences on the US and global economies are still to be seen. The Fed refrained from a 50 bps hike in March due to raging hostilities in Europe. That is not the only uncertainty.

A global food shortage may be eclipsed by China's strict covid zero policy, which is already hurting consumption in the world's second-largest economy. The lockdowns in Shanghai and elsewhere may not only curb the local economy but also cause additional supply-chain issues.

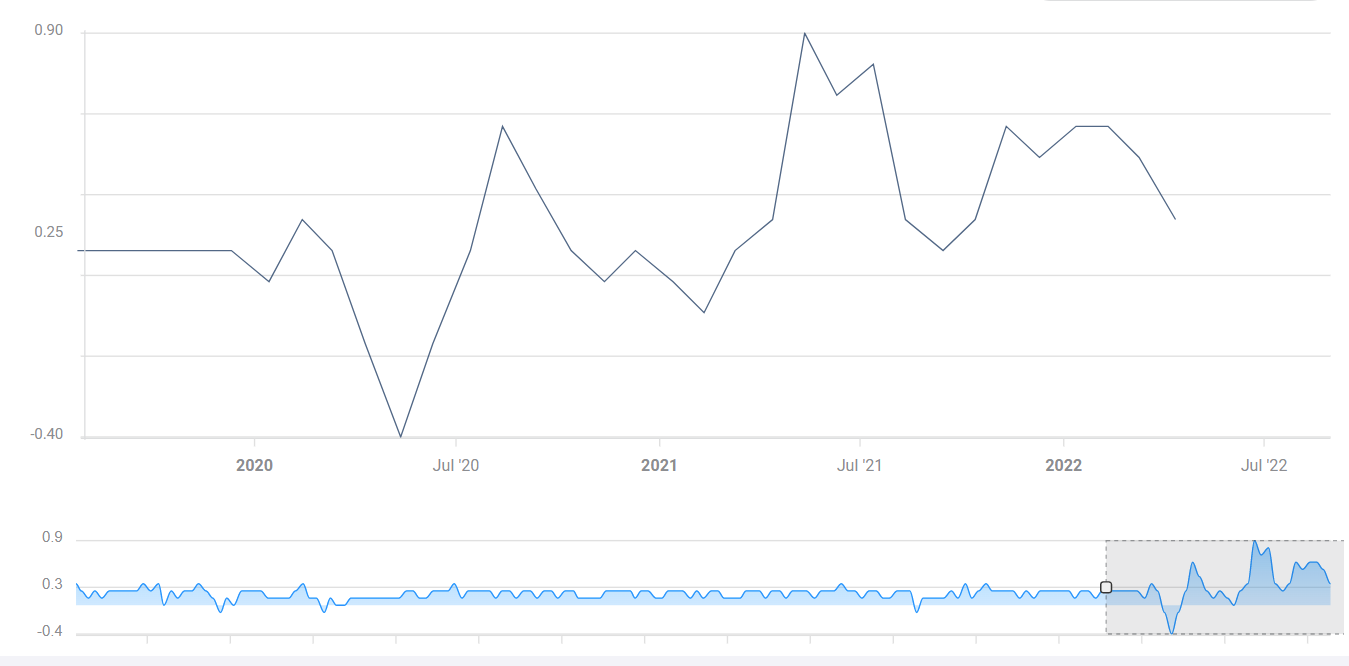

These twin non-US uncertainties are joined by a domestic one. Has inflation reached its peak? While the headline Consumer Price Index (CPI) has hit 8.5%, Core CPI is lagging at 6.5%. Perhaps more importantly, monthly underlying inflation surprised with an advance of only 0.3% – hardly inflationary. Is this a one-off or the beginning of a natural cooldown?

Monthly Core CPI slips:

Source: FXStreet

Powell promised to be "humble and nimble" in one of his latest appearances and saying an honest "I don't know" would make more sense than committing to 100 bps of hikes over the next two months right now. Bond market uncertainty is incompatible with real-world certainty.

The Fed Chair will likely signal an upcoming 50 bps rate hike, as the bank likes to pre-announce policy – hold markets' hands. However, he is highly likely to stress these uncertainties and refrain from any commitment about June. That would take some of the hot air out of hawkish bets – and out of the dollar.

Final Thoughts

In Powell's speech at the International Monetary Fund's gathering, close the Fed's headquarters in Washington, he will likely fall short of investors' hawkish expectations. Markets have to make certain bets on uncertain information, and their current hawkish assumption is likely over the top. The dollar could dip, correcting some of its previous gains.