Investing in the financial markets has become a global phenomenon. Large corporations and well-heeled investors have long been the only ones allowed to engage in currency trading. In comparison to this, the foreign exchange market (forex) has opened up the financial sector to the general public.

Multinational firms may do business in different countries thanks to the foreign currency (Forex) market. For this reason, bill payments in the local currency are more convenient. Investors may benefit from currency swings as a result.

There are several reasons why you should invest in the Forex market. We've mentioned a handful of the possible reasons for this below.

1. Availability

The Forex market is easier to access than other online trading platforms. As little as $100 is required to get started in foreign exchange trading. You don't need a lot of money to start trading. Begin small and work your way up if you're persistent, intelligent, and patient enough. Many people started with little and now have seven-figure businesses.

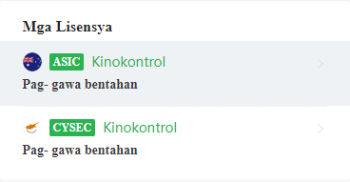

You may establish a Forex trading account from the comfort of your home or office using a laptop. There are a plethora of Forex brokers to choose from while doing your research online. After completing the necessary steps, you'll be able to start trading in no time. Exactly like Pepperstone Australia claims, the technique is as straightforward as described.

The quality of the Forex market is unaffected by its ease of use. Forex trading shows the advantages of this market, despite its flaws. If you're a new trader, you may establish a free demo account to get practice before diving into live trading on paper.

2. Time Adaptability

Trading in the Forex market is available 24 hours a day, almost every day of the week. Trading may begin immediately, without having to wait for the sound of the opening bell.

For this reason, it comprises currencies from across the world that are traded on a global scale Taking part in or leaving a transaction is completely up to you at any given moment. Whether you're a student, a business owner, or an employee, you may still trade half-time.

3. Earnings potential

Most investors are looking for an explanation like this. Investing in Forex may return more than tenfold your original investment in one day.

Even though the value of your currency declines, you may still profit from Forex. Like in the stock market, you only profit if your stock price goes up. If you believe the value of a currency will rise, you could consider purchasing it. When you think a currency's value may plummet, it's advisable to sell it. There's nothing more to say.

The Forex market is a two-way market where you trade in pairs. To put it another way, as one currency falls in value, the other rises in value. It's not uncommon for part-time Forex traders to leave their day jobs when they've amassed a tidy profit.

The goal is to boost profit margins by investing more. There is, however, a complication. Learn at your speed so that you can make smart business choices and come out on top.

4. Equality

Everyone is equal when it comes to investing in the Forex market because of its enormous size.

It's not uncommon for only one or a few persons or groups to control most markets. With Forex trading, ordinary investors are on an equal footing as banks and other institutions. Any attempt to manipulate or corrupt the Forex market would be futile.

In other words, your demand-supply model is likely to be true after all.

5. Availability of liquidity

Because of the scale of the market, forex trading is very liquid. An estimated $2 trillion is exchanged each day on the largest financial market in the world. Investors may readily enter or exit a position without concern that the price will rise too much before the transaction is completed.

You can buy or sell anything with a single click in a typical market since the other side of the market is always willing to accept your deal.

There will never be a situation where a trader is “held” hostage. A trade might be automatically closed after you've achieved the necessary profit on your online trading platform. Limit orders are what they're called. The contract may also be closed if it moves against you. This kind of order is called a stop-loss.

Trading foreign currency, indices, and commodities on leverage entails a high degree of risk and is not appropriate for everyone. The great degree of leverage may operate both for and against you. Before investing in foreign currency or other markets, examine your investment goals, degree of expertise, and risk tolerance. There is a potential that you may lose part or all of your original investment. As a result, never invest money that you cannot afford to lose. It is possible to lose more than your original investment in certain situations since it is not always viable to quit a market at the price you expect to do so. There are further dangers connected with using an Internet-based trade execution software tool, such as hardware and software failure. You should be aware of all the dangers connected with investing in foreign currency, indices, and commodities, and you should seek the opinion of an independent financial adviser if you have any concerns. Smart Forex Learning's content is provided for general information and usage only and is not meant to meet your specific needs. The material, in particular, does not constitute advice or suggestion and is not meant to be relied on by users in making or abstaining from making any financial choices. Smart Forex Learning will not take responsibility for any loss or damage, including but not limited to financial loss, resulting directly or indirectly from the use or reliance on such information, whether given by him or those who engage in the services offered. Please use your best judgment and seek the opinion of a trained professional before accepting any information. Past performance is not always indicative of future performance.

Always remember to use the WikiFX app, which is also available for smartphones, as often as possible and to fully use the search bar to completely grasp how forex trading works and what the keys are to remember to enjoy the daily trading experience.

WikiFX has over 36,000 brokers listed and works closely with 30 financial agencies. WikiFX may assist traders in taking legal action to recover their funds. Follow the WikiFX expose the page to see the most recent complaints from traders all across the globe.

Last Word

Forex trading offers enormous returns if you take the time to study thoroughly and begin trading regularly. So many people are attracted to it because of the potential for large returns.

The average investor may trade tiny quantities of money at any time of day or night using this platform. Global corporations and individual investors alike trade on an equal footing. The market is unaffected by anybody or anything. Wishing you the happiest of holidays!