If you have a system that can generate $10,000 in profits in 1 year, then you are probably paying more than $10,000 in transaction costs. Assuming you can somehow save $3,000 in transaction costs, this is equivalent to a 30% increase in your profitability – now you see how impactful such invisible costs are to your trading results?

The spread is the difference between the selling price and the buy price. Simply put, suppose a retailer buys a product at wholesale and then sells it at a higher price. Some brokers adjust the spread between the ask and bid prices based on volatility, which means that if the market is volatile, the spread will be different each time you trade during this period.

What are the factors that affect spreads?

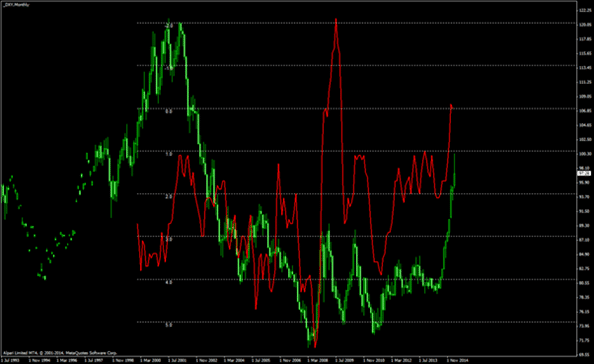

While fixed spreads do not change, spreads vary between instruments. Variable spreads can indicate the liquidity of the market.

This is due to specific factors such as the supply and demand for a particular security, the overall trading activity of the underlying asset, etc.

In forex trading, there are two types of spreads: variable spreads and fixed spreads.

Variable spreads or floating spreads are the constantly changing values between the ask and bid prices. In other words, the spreads you pay to buy a currency pair fluctuate due to things like supply and demand and overall trading activity.

On the other hand, fixed spreads allow you to know the cost of the spread in advance and simply work out your strategy (long-term or daily strategy). This allows for greater price transparency and, ultimately, a more accurate cost assessment before starting to trade.

Brokers that promise narrower spreads usually offer variable spreads. While the actual spreads you pay may not be what the broker advertises, this is not always the case. In general, active trading sessions are the most liquid and spreads are usually narrower. A typical example of this situation is the London-New York overlapping session.

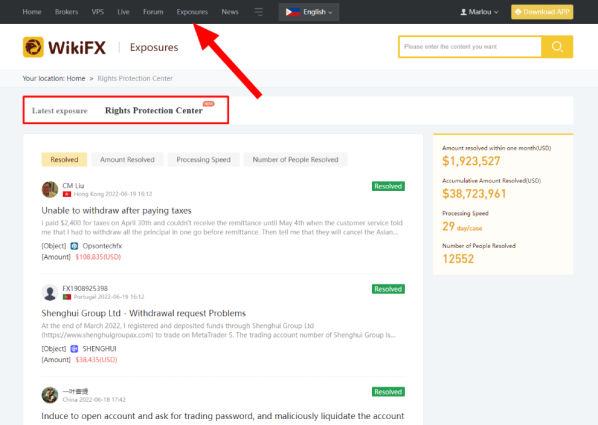

To find a broker that is not only reliable but also offers a low spread, may be time-consuming and tricky as well. WikiFX is here to help you kill two birds with one stone.

WikiFX is an established global forex broker regulatory query platform. Available on both web (www.wikifx.com) and mobile app (free download from Google Play/App Store), WikiFX stores forex broker-related verified information.

In conjunction with the importance of comparing spreads offered by forex brokers, this article aims to highlight the usefulness of the WikiFX comparison tool – so you can compare across several forex brokers at ease, without having to go back and forth between their individual websites.

This is a straight-forward step that can be done with just a few clicks at WikiFXs Broker Comparison page: https://compare.wikifx.com/en/compare/.

Simply add in the names that you would like to compare across the table.

Two examples can be used to illustrate how can spreads impact ones trading results:

Suppose a trader trades 20 days a month and makes $50 a day, this $50 is gained through 5 trades, i.e., $10 profit each time. So how much does it cost to make $1,000 in 20 days of trading?

I. Assuming that each of these transactions is 0.1 lots, the average spread is 2 pips, that is, the cost of each trade is $4 (buy $2; close $2), totaling $20 a day in transaction cost. That will be $400 in transaction cost per month.

II. Suppose the average spread now is 1.5 pips, how much does the transaction cost become in a month? Each transaction of 0.1 lots, costs $3 (buy $1.5; close $1.5), totalling $15 a day in transaction cost. That will be $300 in transaction cost per month.

The average spread is reduced by 0.5 points, saving $100 ($400-$300) per month in transaction costs. Therefore, in the same situation, choose the trading platform with lower spreads as much as possible.