- Bond yields drop again, growth stocks rally after Fed soothes inflation fears

- China’s crackdown on commodity speculators also eases inflation worries

- Dollar slumps to near 5-month low, euro surges above $1.2250

Fed relaxed on inflation risks, markets like it

Fed speakers came out in droves on Monday to reinforce the central bank’s position on the flare-up in inflation that’s driven markets into speculation overdrive about the timing of when all the stimulus will be withdrawn. Rising concerns that a lot of the transitory factors pushing up prices will become permanent have been weighing on sentiment as investors fear the Fed may have to tighten policy much more aggressively later in order to bring inflation back under control.

However, even after the latest CPI numbers and record PMI readings, nothing much appears to have changed at the Fed.

Fed Governor Lael Brainard said she expected price pressures associated with supply chain and bottleneck issues to “subside over time”, while St. Louis Fed President James Bullard didn’t think it was the time to talk about changing monetary policy when the pandemic is still raging. One of the Fed’s more hawkish voices, Esther George, was a little more cryptic, however, saying she “does not dismiss” the risk of higher inflation and that “there will come a time” to talk about reducing the pace of bond purchases.

On balance, though, markets are now even more convinced that the Fed will stick to its current policy path no matter how shocking the inflation data is over the coming months. The Fed’s renewed campaign to talk down the inflation threat just days before the core PCE price index is expected to show a jump in America’s most important inflation metric has dampened the chances of a big market overreaction to the data on Friday.

Dollar sinks along with Treasury yields, euro shines

US Treasury yields extended their decline on Tuesday as easing inflation fears reduced the need to dump low-yielding government bonds. The yield on 10-year Treasuries has fallen below 1.60% and yields globally slipped as well, including in the Eurozone.

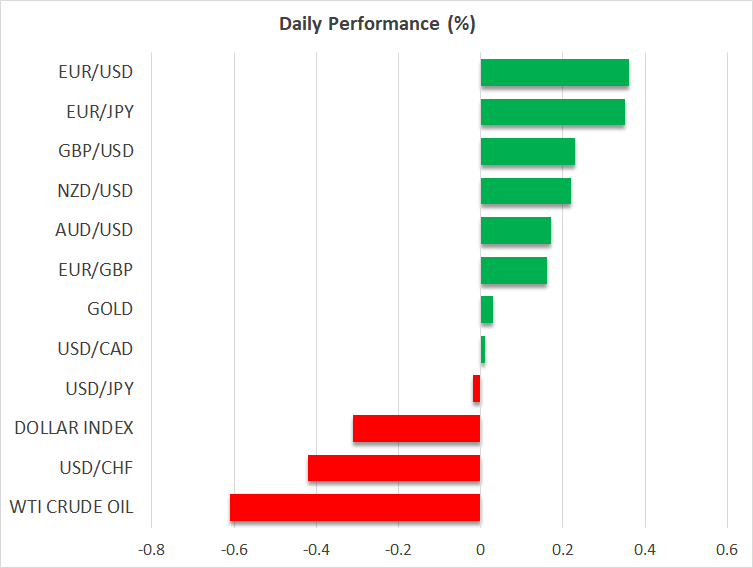

Nevertheless, it was the US dollar that bore the brunt of the slump in yields in FX markets as the positive mood favoured riskier currencies. The dollar index slid to its lowest in nearly five months, driven mainly by a surging euro. The single currency was the biggest gainer today, climbing to around $1.2250, as investors continued to up their outlook for the Eurozone economy following the acceleration in vaccinations and the gradual lifting of lockdown rules.

The pound was up too but struggled to reclaim the $1.42 handle. Worries about how the spread of the Indian Covid variant could disrupt the UK’s reopening roadmap may be weighing on sterling, as well as comments by BoE Governor Andrew Bailey yesterday who played down inflation concerns.

The risk-sensitive Australian and New Zealand dollars lagged slightly amid a drop in key commodity prices. China warned on Monday it will not tolerate “excess speculation” by commodity traders, which is being blamed for fuelling the price of raw materials such as iron ore, copper and steel.

Equities boosted on several fronts, tech outperforms

It’s unclear if the measures taken by Chinese authorities to curtail soaring commodity prices will bring about a sustained pullback or only short-term relief but it does appear to have buoyed equity markets. China’s CSI 300 index jumped by over 3% today and shares in Europe opened sharply higher.

On Wall Street, the prospect of lower raw material prices and no end in sight to the Fed’s ultra-easy monetary policy boosted growth and tech stocks. The tech-heavy Nasdaq Composite gained the most, rising 1.4%, while the Dow Jones closed up just 0.5%. Lower bond yields increase the present value of future cash flows and so tend to favour growth stocks whose valuations are mostly determined by expectations of future revenue.

US stock futures were last up between 0.25-0.50%.

XM.COM Review

Tuesday, 25 May, 2021 / 10:05