- Tezos price on a knife’s edge and approaches levels that could trigger a flash crash.

- Conversion to bear market conditions likey in the Relative Strength Index.

- Buyers are likely waiting for a discount before adding to their positions.

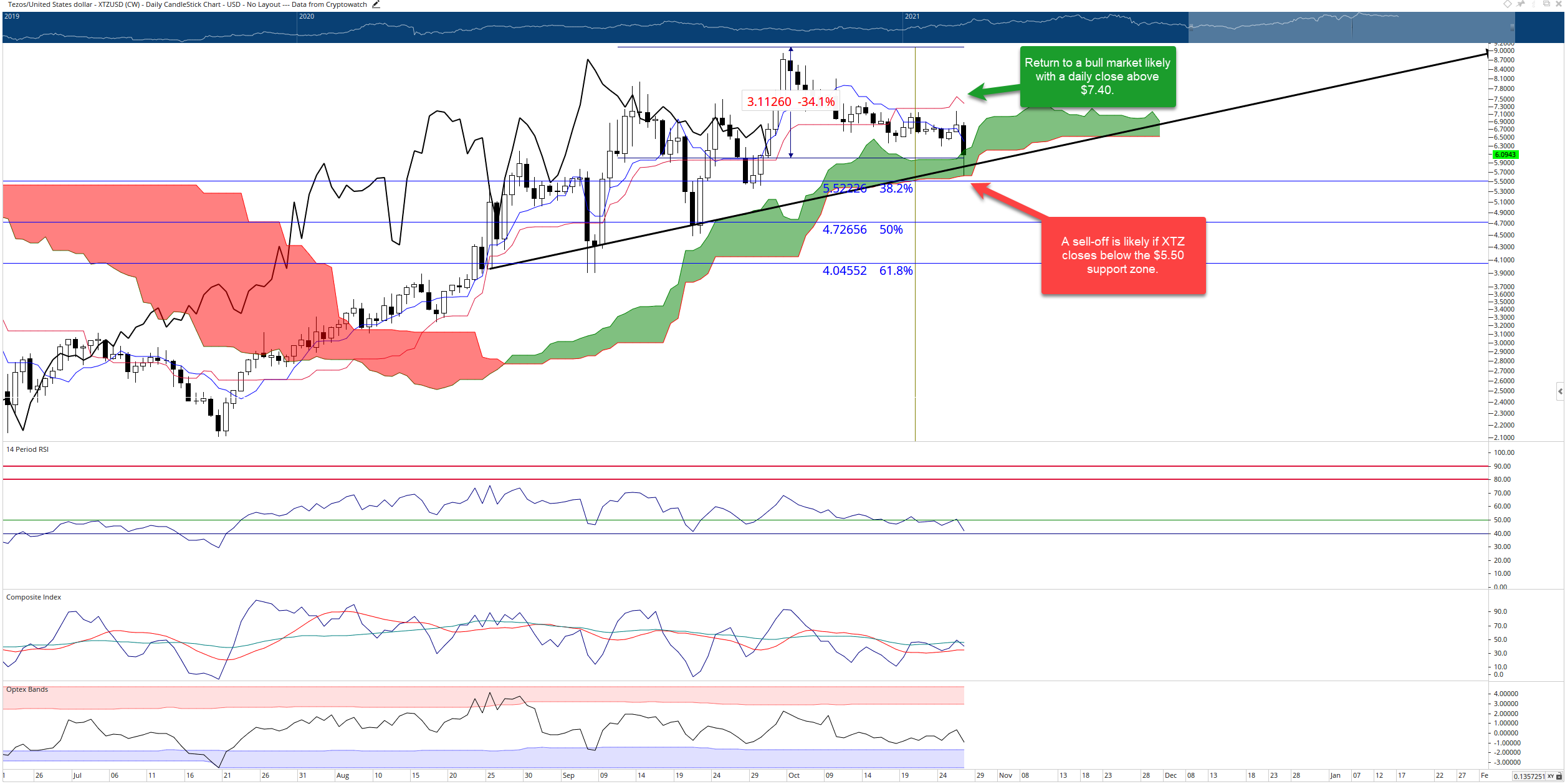

Tezos price is currently trading more the 34% below the new all-time high it set on October 4th. However, despite the significant percentage drop, Tezos remains up over 200% for 2021. Therefore, support must hold if Tezos bulls want to make new all-time highs.

Tezos price is under an impressive amount of bearish warning signs

Tezos price is trading at a level where a major decision regarding the future trend is likely to be made. Tezos was not immune to the selling pressure in the early US AM trading session. For the first time since May 16th, Tezos tested the Senkou Span B ($5.65) as a final support level after posting new all-time highs.

The black trendline on the chart below is the dominant uptrend angle for Tezos. The recent breach below that trendline shows significant support at $5.56 – the 38.2% Fibonacci retracement, Senkou Span B, and a high volume node in the 2021 volume profile share the same value area. A daily close below these support levels could trigger intense selling pressure.

Another and significant, bearish warning sign for Tezos is the status of the Relative Strength Index. The RSI is currently set up with bull market overbought and oversold levels. The Relative Strength Index has struggled to maintain a close above the first oversold level of 50 and is now hooking sharply at an angle that suggests the final oversold level at 40 will fail as support. Likewise, the Composite Index shows a bear flag and an imminent bearish cross below its slow-moving average.

Short sellers are likely to target the 50% Fibonacci retracement at $4.73 as the first target, followed by the 61.8% Fibonacci retracement at $4.05.

XTZ/USDT Daily Ichimoku Chart

However, bulls shouldn’t lose heart. Tezos has been an outstanding leader and outperformer for 2021. The bearish bias would be invalidated if Tezos can close above the daily Kijun-Sen, currently at $7.40. From there, new all-time highs are likely as a significant amount of short-sellers would be trapped.