- The pandemic-fostered explosion of working-from-home will be a permanent change.

- COVID-19 has reinforced trends that were remaking the business office before the pandemic.

- Property valuation and tax revenue will flow from cities to suburbs and high-cost to low-cost states.

- Economic realignment and deferred consumer spending to power equities in 2021.

My parents avoided investing in stocks their whole lives. No amount of statistics, logic or economics could convince them equities were worth the risk. Having been children at the time of the 1929 crash their skepticism was well justified, the Dow did not regain its high for 25 years in 1954.

One or two years of COVID-19 lockdowns and unemployment are hardly the unleavened trauma of the thirties. But then we are a much more protected and pampered generation.

The pandemic has often been represented as an existential threat, which it is not. Yet the immediate shock of mass unemployment, shuttered cities, the endless counting and recounting of deaths by the media and, what seemed to be part of the disaster, uncontrolled and unpunished riots and looting in many American cities, have left an indelible print on the culture. Whether it will be as long-lasting and formative as the Depression is open to debate, but its impact has already changed the way we live.

Dow, log chart

Source: Macrotrends.net

Many of the evolutions we have seen in the past year, the desertion of travel, the closure of public performing arts and the throttling of restaurants will gradually reverse once the pandemic is over. Enough people find the theater, the ballet, museums and conversation over dinner essential to ensure their return. Economic life in the country will resume in all its varied and ever-changing shapes.

But one aspect of the COVID-19 era, the explosion of working-from-home – it's not homework, perhaps 'home work' – is likely to be a permanent change.

The wholesale migration of work from the office to an employee's home that was forced by the pandemic lockdown orders will remain and expand because it is supported by powerful factors on both sides of the employment divide and because it builds on already existing economic trends.

Companies will not revert to their 2019 office staffing and locations because it is not in their financial interest to do so.

For many service jobs, the acceptance of home work as legitimate had been rising for a decade before the pandemic.

With the internet ubiquitous in most American homes and computers just another appliance, many service sector jobs can be performed as easily and effectively off-site as on. What might have been looked upon as disguised time off-ten years ago is now welcomed as additional flexibility by employees and employers alike.

There is a psychological aspect to working at home peculiar to the COVID-19 era. The long isolation and fear of crowded public spaces instilled by the pandemic have made working in a packed office five days a week distasteful for many people. In cities where getting to work means public transport, that is just another reason to stay home rather than getting up and going to the office.

Will the antipathy to crowds have the same formative effect on this generation that the Depression did? It is doubtful. Once the vaccines restore a semblance of normal life the fears of contact will gradually fade. That bodes well for restaurants, theaters, football games and eventually travel. People are far more willing to take an occasional risk, however small, for something they enjoy than for an obligation.

The aversion that many employees now have to offices would not prevent most executives from mandating, if delicately, a return to full-time staffing if home work did not coincide with strong financial and business incentives for employers to let their workers remain at home.

Business logic of homeworking

Letting employees work full or part-time from home assists several immediate and long-term goals for many businesses.

For large national and international firms that have a free choice of where to locate their operations, home work supplements a move away from expensive cities in high-tax coastal environs to dispersed operations in business-friendly and much lower tax, southern and western states.

For smaller local firms who may not be able to move home work permits a sizable reduction in office overhead and support staff.

The movement away from highly centralized operations has been underway for more than a decade. It is far less costly to run a business in Texas than it is in New York City and an office of 10 people is much cheaper than one for 25.

The success of decentralized work over the past ten months has given this shift additional impetus. Businesses are now sure that they can operate efficiently with a large portion of their employees at home. It is no longer conjecture or an experiment. It is factual.

Home work also eliminates the need for expensive office distancing and separation requirements which will likely remain mandated by governments for years, if not forever. These strictures on staffing vastly reduce the efficiency and raise the cost of offices, especially in expensive urban spaces, essentially destroying their advantage.

Home offices mitigate the possibility of lawsuits from employees, individually or in groups, alleging they were infected at work. The peculiarities of the American legal system almost insure that such suits will be filed once people return to their desks.

Why would firms pay for expensive, inefficient and underpopulated urban offices and assume the risk of liability when so many tasks and jobs can be performed as well from home?

Executives making these decisions will have to balance the remaining and genuine business efficiencies and benefits of personal interaction among employees against the costs of a fully-housed staff.

One probable solution is that many positions which would have been exclusively office work will be offered as part time or full time from home, with only occasional appearances warranted.

When the diffidence of workers and the financial incentives for companies to abandon high-cost cities, are combined with the success of having a large percentage of their employees working off-site, the shift to home work will become permanent and of deep consequence to local and state economies across the US.

Real Estate: National vs local economic impact of home work and relocation

The impact on the national economy of the move to home work will not necessarily be dramatic as faster-growing states and cities will balance those in decline. To the degree that many firms become more efficient by reducing costs, the overall effect on the national economy will be beneficial.

The reassignment of personnel and offices to lower-cost cities and states will in itself generate activity as the local economies expand to meet the needs of a rising population.

In general, less centralized office space will be needed across the country though there will be an immediate surplus in abandoned urban centers and a shortage in suburban and rural destinations.

Some states, Texas and much of the southwest, for example, will see their economies grow much faster than the average as they absorb relocations and others, New York, Illinois and California, will suffer ebbing growth and falling population.

For specific cities and states, particularly high-cost, high-tax urban centers, the danger of this trend to their economies and fiscal stability is serious.

The hollowing out of the commercial real estate tax base, the lowering of property values, the long-term reduction of tax revenues from departing businesses and individuals in deserted cities and states are long-term changes that are difficult to reverse.

Some states may have a partial offset as home work increases the demand and prices for suburban and rural real estate, raising the property tax revenue. However, most real estate taxes support local expenses, primarly schools, and not state or federal budgets.

City budgets are threatened by home work as people no longer commute to centralized offices and all of their attendant expenditures stay outside town. State budgets are under siege from the wholesale movement of firms to states that offer a better business environment.

New York and California: Revenue follows the moving vans

New York City and state, San Francisco and California have already seen several high-profile companies depart. These corporate relocations must have been long contemplated by management but the success of decentralized home work has made them easier to accomplish and far less disruptive to business and staff.

In the past few months, Oracle, HP Enterprise and Tesla have said they will leave California, citing the tax burden and the state's anti-business and regulatory legislation.

JP Morgan Chase has been moving large numbers of personnel and operations to Plano, Texas for several years, even as the company builds a new building on Park Avenue in Manhattan to consolidate remaining employees.

For those companies, the knowledge that moving headquarters does not mean that all employees must shift or lose their jobs has made the decision much more palatable.

In the most surprising and short-sighted instance brought on by anti-business agitation, Amazon cancelled plans to build one of its two proposed headquarters in Long Island City, New York in February 2019, after opposition led by New York City Congresswoman, Alexandria Ocasio-Cortez.

The $2.5 billion project would have provided at least 25,000 thousand jobs and $30 billion in revenue. The subsequent pandemic lockdowns that have devastated the city and state economies have dramatically underlined the self-inflicted damage of the Amazon rejection.

Raising taxes to replace lost revenue, whether at the local or state level – in New York State which gets a large portion of its budget from the City's financial industry, they are essentially the same thing – would be enormously counterproductive, accelerating the departure of companies and people.

In New York, Governor Andrew Cuomo has said that without large bailouts from the Federal government New York taxes are sure to rise.

It is hard to think of a better exit advertisement for New York's business community.

The US consumer and the move to home work

The changes in consumer spending habits that have roiled the retail and business sectors since the advent of the internet were dramatically accelerated by the lockdowns. Suddenly, everything that could be bought on the web was in short supply.

Food delivery, a specialty service before COVID-19 for apartment living Manhattan, went mainstream. Ordering roasting chickens from Oregon for New York became normal.

Demand for Amazon's products became so vigorous that the company had to abandon its vaunted two-day delivery promise. United Parcel Service and FedEx, the two main private shipping services in the United States, along with the postal service were inundated as the lockdowns spread across the country.

The general rule for any businesses that are not strictly retail and local is now quite simple, survival without a web presence is impossible. Many new companies have done little more than offering internet purchase for products that were formerly bought exclusively in stores.

Home work has added specific products like desks, office furnishing and the like to the ever-growing list of items now routinely bought on the web but the working-from home did not drive people from the malls and retail stores. The lockdowns of March and April forced desperate consumers to the web, necessity removed any inhibitions that remained from habit or caution.

Purchasing habits that shifted to the internet in the fearful days of the spring will not revert to their earlier patterns when the pandemic is over. A large part of that change is permanent hastening the collapse of the generalized store-based retail trade.

The advent of home work is but a small addition to the general volume of digital commerce but it has played a major role in changing people's attitudes about what they are willing to buy on their computer.

Conclusion: Home work, stock market and the pandemic recovery

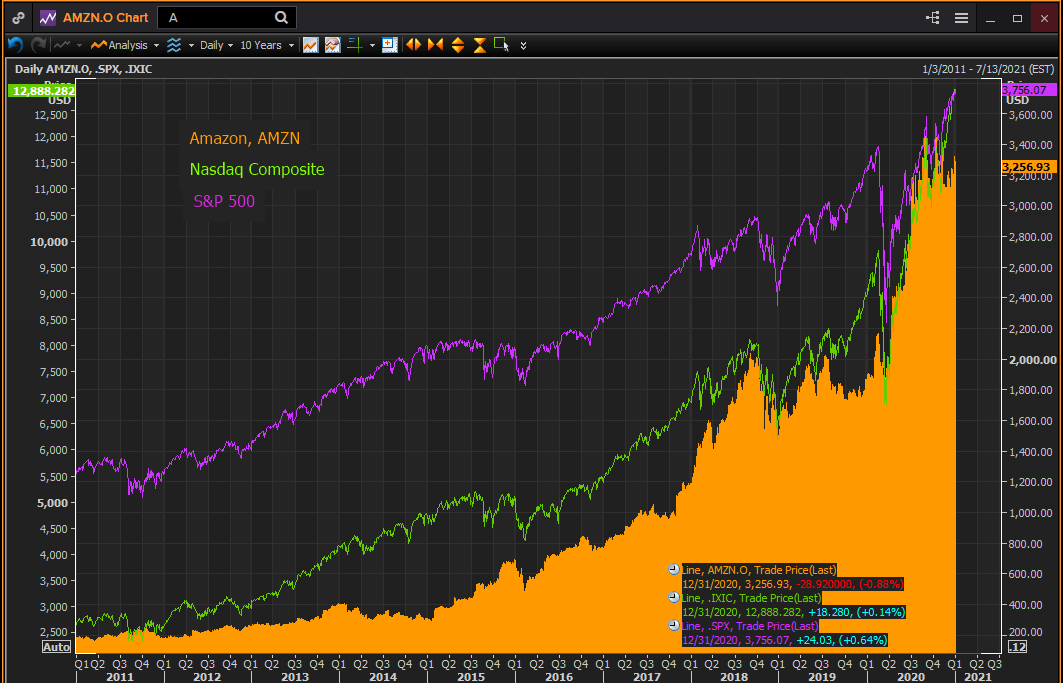

American equities closed 2020 near record highs as markets anticipate a global recovery after the pandemic relents. From the peak in mid-February, just before the pandemic, the Nasdaq has gained 33% and the S&P 500 has added 11%.

Amazon is the best known and most emblematic company for commerce in the internet era. Since the second week of February, its price has jumped 51%. What began with books more than two decades ago in Jeff Bezos' garage now covers the universe of consumption.

Reuters

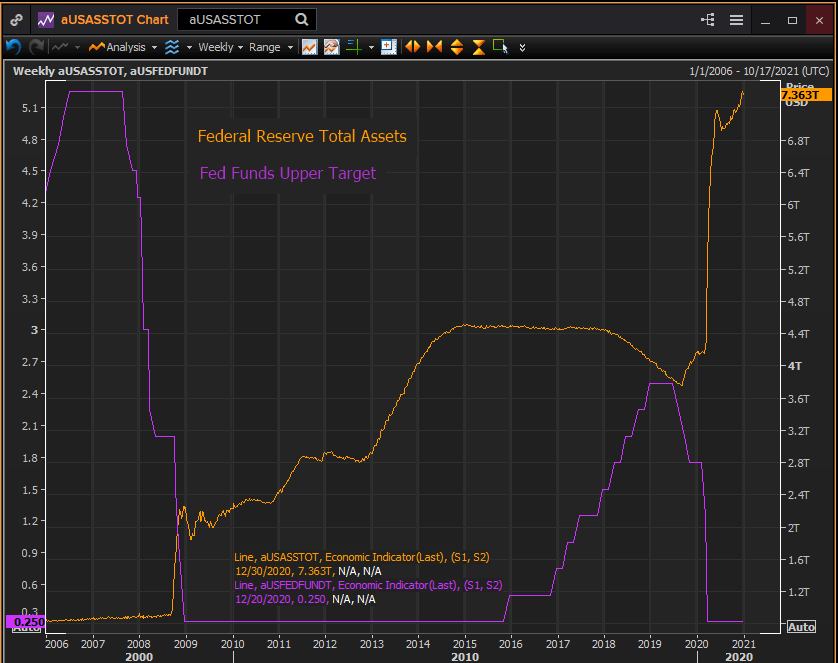

Deferred consumer and business spending, general emotional relief and the accelerating realignment of business from traditional selling modes to the internet should, along with the vast liquidity provisions from central banks, will keep stocks on an upward path for most of 2021. The expansion of new businesses rather than the decline of old models will dominate equity valuations.

Home work is a minor part of the internet retail picture but it is a major source of the changing attitudes about work and the office that will make the new world of commerce permanent.

Once normal life returns the alterations in consumer spending habits will persist and ramify. The gravitation of commerce to the web has been evolving for two decades, COVID-19 has completed the revolution.

Even the Federal Reserve will relent, though likely well after a sell-off in the Treasury market has obviated its bond purchase restrictions on interest rates and the US dollar.

Reuters

The pandemic is a shared experience. If it is not as profound as the Great Depression, it will be, at least for this generation, a marker between eras. The digital evolution of the last fifty years is complete, computers are the ruling mediators of human society.