- SafeMoon team failed to deliver on the promise of website buy and swap, analysts label the cryptocurrency "Ponzi."

- Report on SafeMoon circulating on Reddit highlights the centralized risk of a function, likely to be abused by the altcoin's developers.

- CertiK, a blockchain auditor, raised concerns regarding the transfer of $68.4 million from the liquidity pool to unidentified wallets.

- The SafeMoon community continues to deny the exploit and considers the audit a stunt to promote "Hyper Deflate Token."

Analysts have ridiculed SafeMoon's half-hearted launch of its wallet. In anticipation of the triple launch, altcoin's price had rallied over 50% but SAFEMOON has dropped almost 9% in the past 24 hours.

CertiK flagged withdrawals of $68.4 million from SafeMoon liquidity pool, community rejects news of exploit

The ongoing battle between experts that trust the authority of blockchain security firms and the SafeMoon community ensues. CertiK, a blockchain security firm founded in 2017 by Yale University and Columbia University professors, secures and monitors protocols and smart contracts, and has reported several shortcomings in this cryptocurrency.

CertiK audited SafeMoon in May 2021 and pointed out 13 vulnerabilities in the project. The team identified a significant security flaw, the centralized risk in the "addLiquidity" function of SafeMoon, and marked it as partially resolved.

In the audit, CertiK stated that over time the "owner" address would accumulate a significant portion of liquidity pool tokens in SafeMoon. Further, if the owner is an externally owned account, there is a possibility of mishandling private keys. This implies a full-blown exploit or rug pull.

Since then, the audit report has been doing the rounds on Reddit forums. When SafeMoon's launch event fell through, a Doxxlocker report including CertiK's audit and additional concerns started circulating within the community.

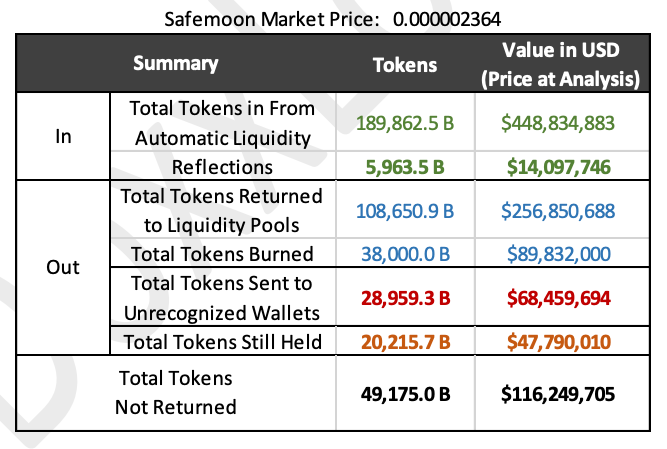

The Doxxlocker report analyzes the input and output transactions on SafeMoon liquidity pools. The analysts have identified that nearly 49,175 billion tokens that were supposed to be returned to liquidity pools in a specific transaction are currently being held in various wallets.

Of all the wallets holding the SAFEMOON tokens, only one is identified. It is a protocol wallet, and has transacted 0.1 billion tokens to itself. The report further delves into different withdrawal transactions, highlighting multiple tokens sold by unidentified wallets on the Binance Smart Chain (that hosts SafeMoon).

Summary of combined transactions of Protocol Deployer

DoxxLocker claims to provide multifunctional reports to BSC token holders, and posts that referred to their report on several Reddit forums were flagged and deleted. The SafeMoon community and proponents claim that Doxxlocker is promoting their project "Hyper Deflate." However, DoxxLocker has compiled a resourceful report with several questions that need to be answered by the SafeMoon development team.

It is interesting to note that SafeMoon has been criticized and labeled a scam since April 2021. Several experts and crypto Twitter influencers have slammed the project, calling it a "Ponzi scheme."

Lark Davis, a cryptocurrency analyst, and YouTuber, warned traders against SAFEMOON four months ago through a tweet.

Remember just because you make money off of a ponzi does not change the fact that it is a ponzi. #safemoon

— Lark Davis (@TheCryptoLark) April 21, 2021