- Uniswap price hints at a rally as it bounces off a three-day demand zone, extending from $7.31 to $9.70.

- Transaction data suggests that UNI bulls could retest $15 before facing a stiff resistance barrier.

- A four-hour candlestick close below $7.31 will invalidate the bullish thesis.

Uniswap price has reached the surface of a vital support area after piercing it a while ago. This upswing is likely to be the trigger that propels UNI to higher highs.

Uniswap price eyes full-blown uptrend

Uniswap price pierced the three-day demand zone, extending from $7.31 to $9.70 and stayed in there for more than a week. The recent bullishness propelled it higher and is currently contemplating a minor retracement before it triggers a new uptrend.

UNI will most likely shatter the immediate hurdles at $10.31 to $11.78 and focus primarily on breaching through the weekly resistance barriers at $13.88 to $14.97. There is a good chance the next leg up will slice through these barriers and hit $15.

Investors should note that a move beyond $15 will be an arduous journey for UNI and is likely where a local top will form.

UNI/USDT 4-hour chart

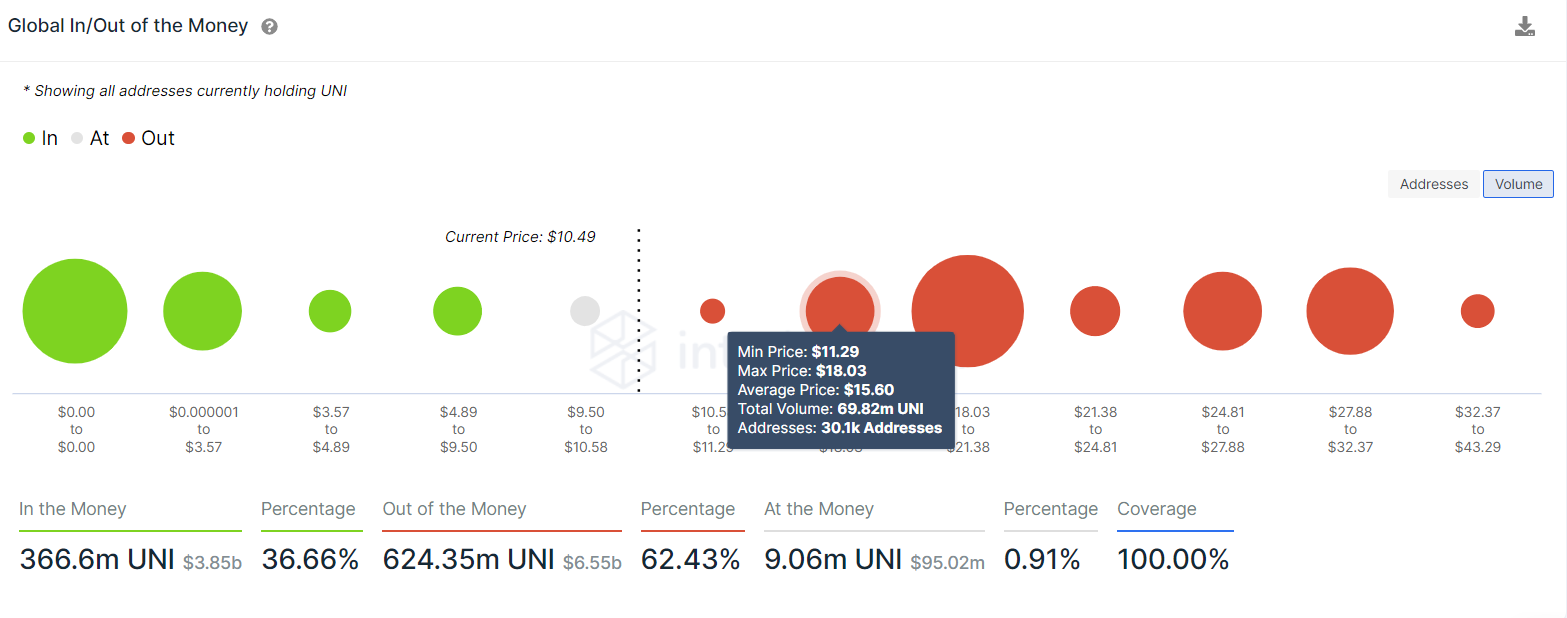

Supporting this 53% ambitious run-up for Uniswap price is IntoTheBlock’s Global In/Out of the Money (GIOM) model. This index shows that UNI will not face any significant hurdles up to $15.60, where roughly 30,100 addresses that purchased roughly 69.82 million UNI tokens are “Out of the Money.” Therefore, a move into this area will likely be met with underwater investors trying to break even.

UNI GIOM

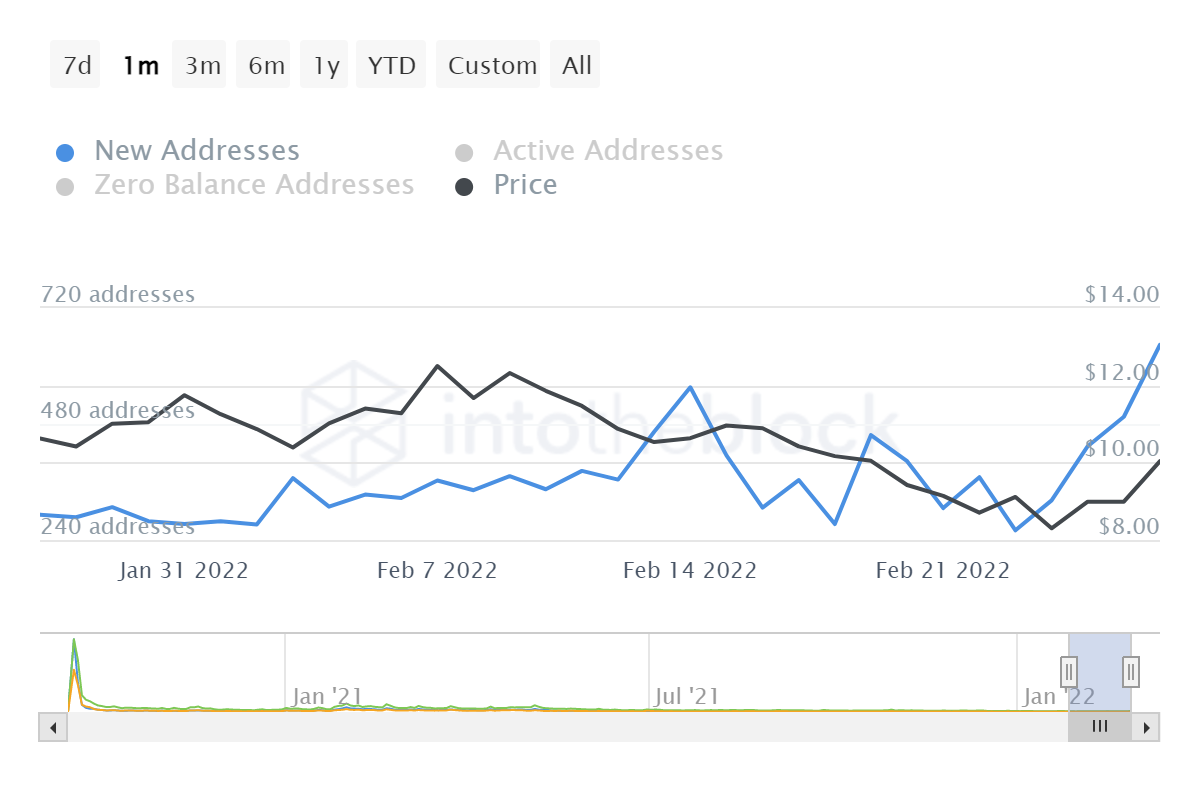

While the transaction data shows a clear path to $15, the increase in new addresses joining the UNI blockchain from 292 to 644 supports the bullish view. This 130% spike indicates that investors are interested in Uniswap at the current price levels.

UNI new addresses

The bullish outlook for Uniswap price is obviously due to the recent spike in Bitcoin price. Therefore, a sudden U-turn for the big crypto could also translate to the altcoin. In this case, if UNI produces a four-hour candlestick close below the three-day demand zone’s lower limit at $7.31, it will create a lower low and invalidate the bullish thesis.