- USD/CAD holds in a bullish territory in Tokyo.

- Bulls eye a run to the 1.26 area on US dollar strength and weakness in demand for oil.

USD/CAD is trading at 1.2574 at the time of writing and flat in the Tpokyp sessions so far. The pair moved between a low of 1.2517 and a high of 1.2583.

The price of the Loonie is being weighed down a touch by the price of oil, but in the main, the US dollar is picking up the market's demand as it prices in a more hawkish Federal Reserve.

First and foremost, the commodity complex is feeling concerns over the new coronavirus-related restrictions in Asia, especially China, that could slow a global recovery in demand.

Notably, China's export growth slowed more than expected in July after outbreaks of COVID-19 cases and floods, while import growth was also weaker than expected.

Secondly, the greenback is testing the 93 areas in the DXY index and a break of which would likely fuel further demand and weigh on the commodity complex.

On Monday, US Atlanta Fed President Bostic argued that should data comes out this strong “for the next month or two” then “substantial progress” would have been made on the Fed’s goals.

His comments helped to lift US rates even further than when they had left off following Friday's impressive jobs data,

Bostic also noted that robust market functioning meant a relatively rapid taper of asset purchases could be achieved.

Long-end rates rose, with the US 10y yield rising 2.7bps, to 1.324%.

Meanwhile, net speculators’ long CAD positions edged a little higher having collapsed since the start of July.

''This had mirrored the softer tone of the loonie on the spot market on the back of softer economic data and slippage in oil prices,'' analysts at Rabobank explained.

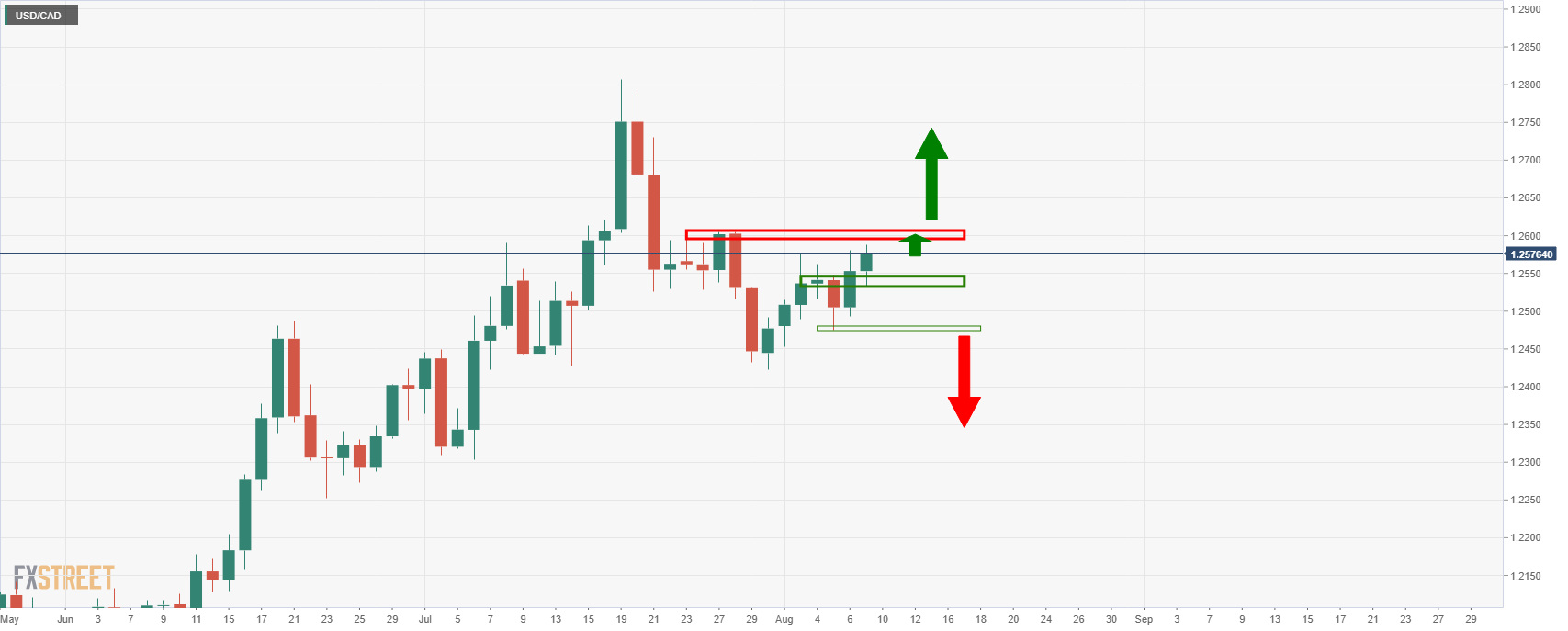

USD/CAD technical analysis

The bulls can target a test of the 1.2600 area and lean on support at the prior resistance near 1.2540.