- USD/CAD traders now await the Fed as the US dollar consolidates below 20-year highs.

- Bears have moved in and eye a significant correction towards 1.2720/50.

At the time of writing, USD/CAD is trading at 1.2805 and consolidated in resistance territories. The US dollar rose against most G10 currencies, tailing off towards the end of the day and offering some relief to the commodity complex. nevertheless, DXY, a measure of the greenback vs. a basket of currencies, rose to a 20-year high as investors price in a series of relatively bg interest rates from the Federal Reserve.

A bounce in risk appetite set in during the Wall Street session as investors observed evidence of strong consumer demand obscured by the unexpected decrease in Gross Domestic Product growth for the last quarter, the first since 2020. Nevertheless, the risk-off tones are well set and have sunk the S&P 500 more than 5% in April, on track to be the worst month since the 1987 bear market.

The worries over China's fight to curb COVID combined with the Ukraine crisis against a backdrop of hawkish central banks set on tightening monetary policy is feeding into recession concerns. Treasury Secretary Janet Yellen spoke up overnight and said that the global pandemic and Russia’s invasion of Ukraine highlight the possibility of big economic shocks in the future, adding that downturns are “likely to continue to challenge the economy.”

Meanwhile, supportive of CAD, the price of crude oil price has advanced to USD107/bbl amid the rising possibility of a European embargo on Russian oil. ''Germany is preparing to halt Russian oil imports in a phased manner, which would lead to a broader sanction by the region. Germany’s minister has already said that the country could manage without Russian oil,'' analysts at ANZ Bank explained.

''Investors are concerned about replacing the lost barrels due to the upcoming European sanctions. Oil product prices are rallying as well, lifting refiners’ margins. However, oil-product demand remains subdued in China due to rising COVID case numbers.''

All eyes on the Fed

All eyes will now turn to the Fed next week. Fed tightening expectations are robust. Markets are looking for at least a 50 bp hike at the May 3-4 meeting and again at the June 14-15 meeting. This is fully priced in, with nearly 25% odds of a possible 75 bp move in June. the surprise will come if there is anything short or above this consensus at next week's meeting.

''Looking ahead, swaps market is pricing in 275 bp of tightening over the next 12 months that would see the policy rate peak near 3.25%. While this almost meets our own call for a 3.5% terminal rate, we continue to see risks that the expected terminal rate moves even higher if inflation proves to be even more stubborn than expected,'' analysts at Brown Brothers Harriman said.

USD/CAD technical analysis

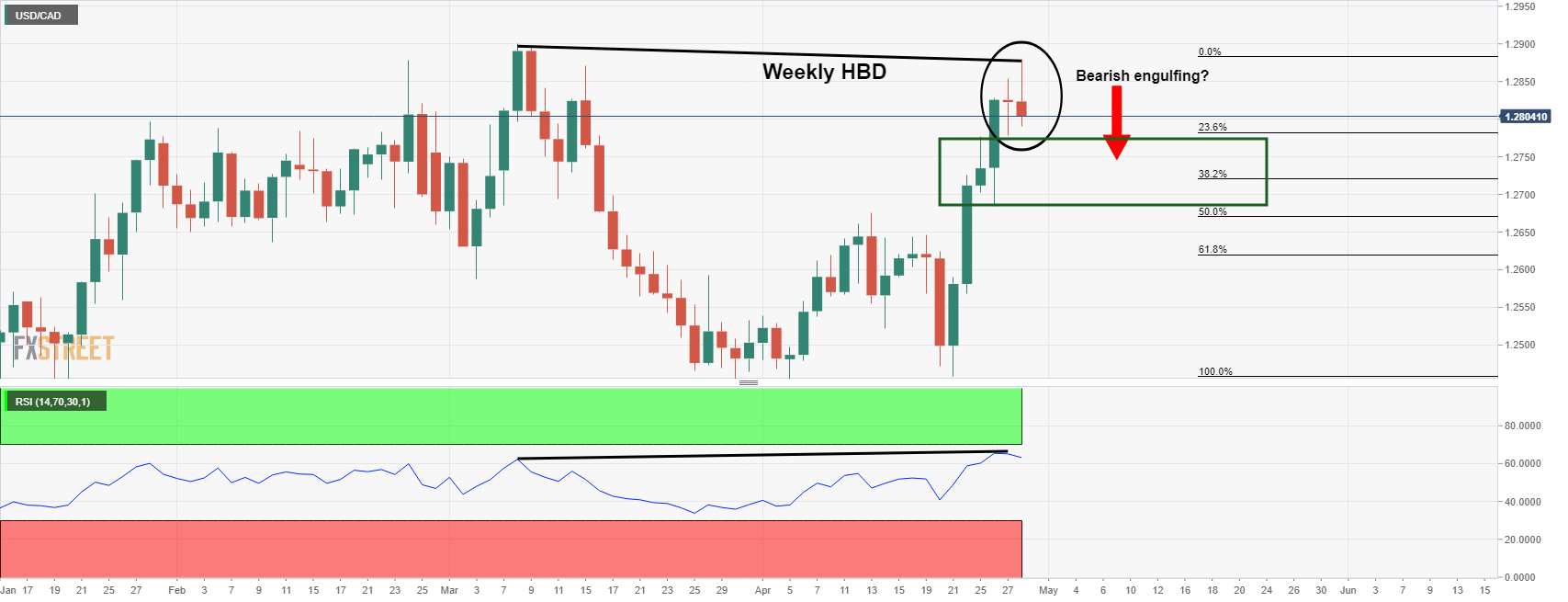

USD/CAD is consolidating in resistance territory and could be on the verge of a significant correction towards 1.2720/50 as per the following analysis:

-

Bears are growling back at the US dollar bulls

''The current price action is leaving the prospects of a bearish engulfing daily close following the prior day's doji. This is regarded as bearish and a prelude for the next days. There are expectations of a correction to test the 1.2770s, and then potentially as deep as a 38.2% Fibonacci retracement below 1.2750.''

''1.2650 comes thereafter but the point of control of where the majority of business was transacted for the month of April is much lower, down to the neckline of the W-formation at 1.2611.''