- USD/JPY bears are lurking but bulls are in control in a solid correction.

- The price could be on the verge of another downside extension.

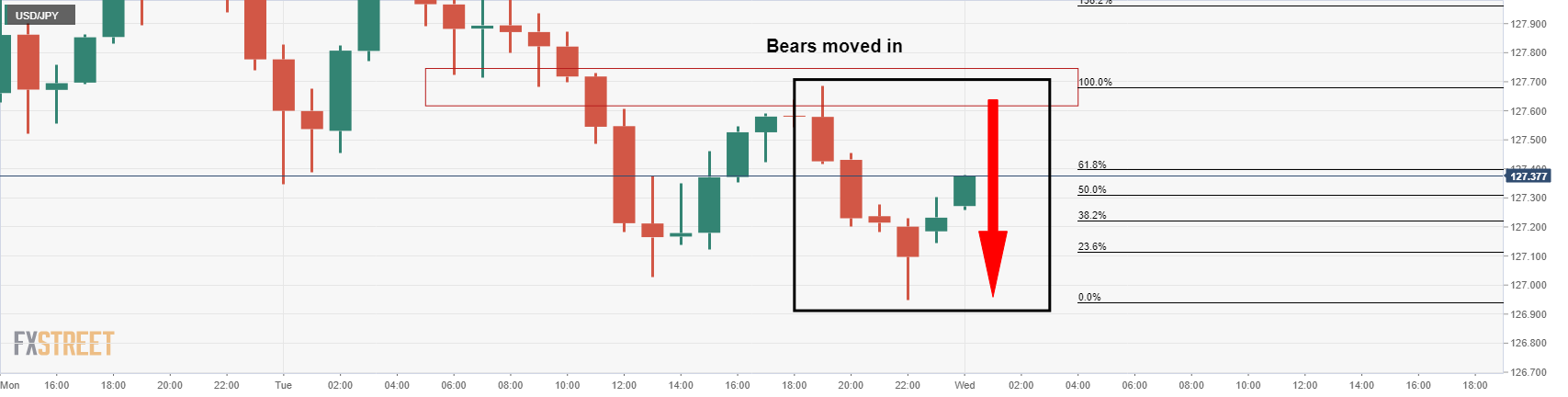

As per the prior analysis from the New York session, USD/JPY runs into a wall of hourly resistance, will it hold?, the price did indeed melt from the resistance and the question now is how much further can it go?

USD/JPY prior analysis

''The M-formation is a reversion pattern that has drawn in the price to the neckline of the pattern. This is seeing the price start to decelerate in the correction near a 50% and 61.8% ratio area. Therefore, there has been a significant enough correction to attract the bears again at a discount that could lead to a downside continuation.''

USD/JPY, live market

The price was sold off from the M-formation's neckline but the downside extension is shallow yet the bulls have sprung into life early doos in Asia, so selling into such a strong rejection could be futile. The correction has also closed above the prior days closing price on an hourly basis which leaves bulls in control.

However, the price has also corrected to the 61.8% mean reversion level of the latest bearish impulse which gives some weight to the downside bias as this is considered to be enough of a discount to lure in the bears again. On the other hand, bears would be prudent in waiting for a bearish structure to form on the lower times, such as the 15 and 5-minute charts

From a daily perspective, the bears have already moved on on a 50% mean reversion of the prior daily bullish impulse and an M-formation is forming. Therefore, there is a risk of a bullish correction and one that could be imminent. The 61.8% ratio, however, is now far off and could be a reasonable target to the downside still: