What are the various forex calculators, and how are they used? You must have seen various forex calculators on the sites of forex brokers but perhaps have ignored them, failed to look at them closely, or you may feel they are an unnecessary distraction. However, you will find after reading this article that forex calculators serve a powerful purpose in the financial markets, and their proper usage can save you a lot of time and money.

Forex calculators are tools used to perform several Mathematical functions on aspects of forex trading that deal with numbers.

Forex is a game of numbers. Whenever you talk about money, you talk about numbers. How much of it are you committing to a trade? How much money are you making or losing? By how much has the market gone in your favor or against you? The answers to these questions all have a numerical basis, and when you are dealing with many numbers, you will surely need some help with some essential calculations.

What are forex calculators used for?

Some of the brokers listed on this website have various forex calculators to assist you with whatever calculations you need to make regarding how to trade your money. But precisely what do forex calculators do for you as a trader?

A) Position Sizing

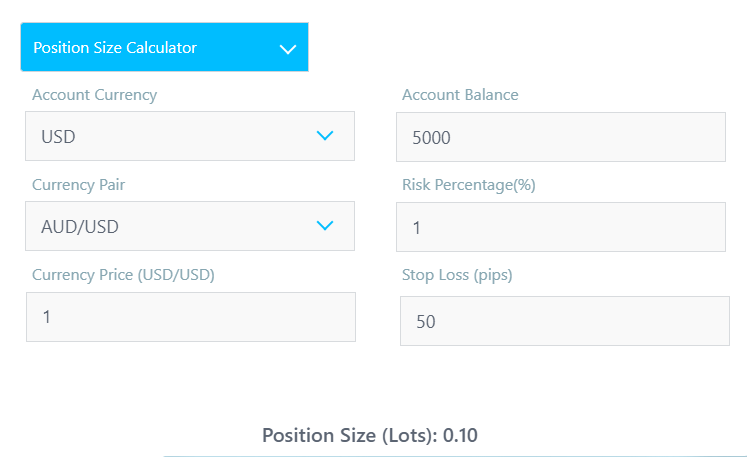

The Position Sizing tool is one of the essential forex calculators. Forex calculators designed for position sizing are used to calculate the appropriate amount of capital to commit to the trade relative to your account capital in a manner that conforms to acceptable risk management principles. Various factors are used to perform the calculation. These are the risk percentage, account balance, and the stop loss. Some position size calculators also give the trader the choice of selecting a currency pair on which the tradable position size would be applied.

How the Position Size Calculator Works

The position size calculator features 6 elements:

- the account currency

- the currency pair

- the account balance

- the market price

- risk percentage

- stop loss

The essential elements are the account balance, risk percentage, and stop loss. Enter your account size and the risk percentage into the calculator. The risk percentage is the % of your account capital you intend to commit to the trade. Experts advise you to commit at most 2% of your account balance. In fact, the lower this amount, the less likely you are to suffer a debilitating loss. The last element to set is your preferred stop loss. After entering these parameters, the calculator automatically indicates your position size.

Here, we can see that the position size for a $5,000 account for a trader wanting to risk 1% of the account with a 50-pip stop loss in a trade involving the AUD/USD was 0.1 lots. Anything higher would be risking too much as far as the trader’s settings are concerned.

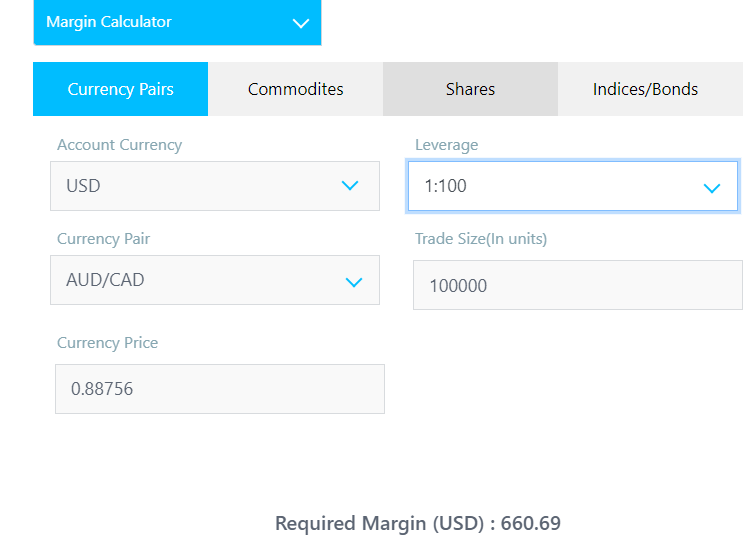

B) Margin Calculator

Trades in the forex and CFD markets are leveraged and therefore require the trader to put up collateral for the extra buying power provided by the broker. How much margin is required for the size of the leverage provided by the broker? The margin calculator lets the trader determine how much margin is needed to collateralize the forex or CFD trade.

How the Margin Calculator Works

The margin calculator has five elements. In addition to the account currency (which many traders maintain in US Dollars), the following elements are used to determine the margin required for a trade:

- the asset to be traded (a currency pair, commodity, stock or index)

- the leverage position

- market price

- size of the trade (trade volume)

Assuming the trader wants to trade a standard lot on the AUD/CAD, on an account denominated in US Dollars, with leverage of 1:100 (100 times buying power), what would be the required margin on this trade?

From the calculator, the required margin for this trade would be $660.69. Similar margin calculations can be done for other assets, such as commodities, stock CFDs, and indices. For instance, trading the Nasdaq 100 index asset using leverage of 1:200 and a lot size of 1.0 would require $72.81 in the margin. The Margin Calculator should not be used alone but in conjunction with the Position Sizing calculator to ensure that the margin required to set up the trade stays within the allowable limits or risk management.

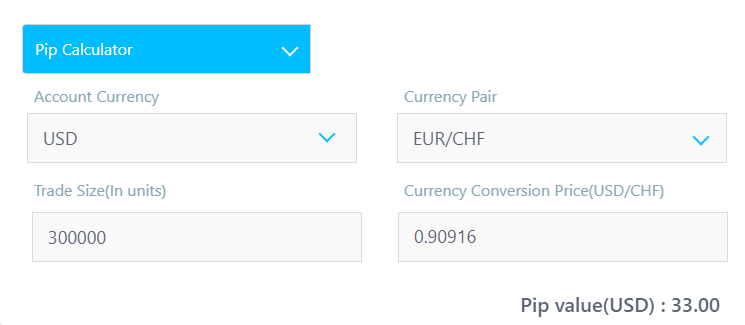

C) Pip Calculator

Have you ever wondered about the value of a single tick, pip or point movement for the trade volume you want to assume on an asset? This is the function of the Pip Calculator. This tool automatically determines the tick value for the asset you want to trade.

How the Pip Calculator Works

This tool has four elements:

- the account currency

- the trade size (in units and not lot size)

- the currency pair

- the current price

Please note that you can only use the Pip Calculator to calculate your trade sizes for currency pairs. The price move for indices and commodities is measured in points and not pips, which is why they are excluded from this calculation.

Supposing your account is denominated in US Dollars, and you want to trade three standard lots on the EUR/CHF currency pair. What would be the value of a single pip move on this currency? The Pip Calculator shows that every pip move in the EUR/CHF currency pair with a lot size of 3.0 lots (or $300,000 trade size) is worth $33.00.

It is important to note that this calculator tells you what the value of a pip is. The trade can go in your favour and work against you. So it is crucial to know how much you will stand to gain or lose, primarily if the trade works against you. Knowing what you stand to lose is vital to avoid taking on a huge position that jeopardizes your account if the trade goes steeply against you. Therefore, this tool should be used along with the Position Sizing tool and the Margin Calculator.

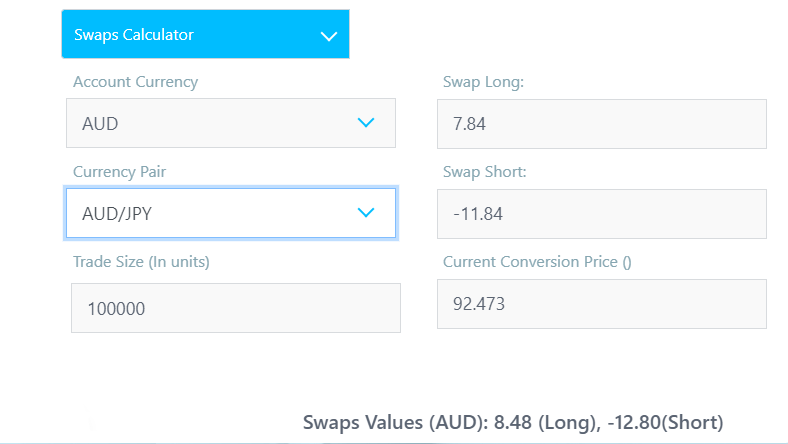

D) Swaps Calculator

Have you ever wondered about the value of a single tick, pip or point movement for the trade volume you want to assume on an asset? This is the function of the Pip Calculator. This tool automatically determines the tick value for the asset you want to trade.

How the Swaps Calculator Works

The Swaps Calculator is a tool used to calculate the rollover fees on active positions held overnight. Typically, a trader's account will receive an interest payment or be surcharged a rollover fee if positions are held open until the next day. This fee is the interest rate differential between two currencies in a pair. Typically, a trader will be paid the rollover swap fee for holding a long position on the higher-yielding currency or will be deducted the same if the trader holds a short position on the higher-yielding currency.

Trading the interest rate differentials is the basis of the carry trade. The carry trade typically comes alive when there is a global high-interest-rate environment, such as what has played out in 2022 and is ongoing in 2023.

The Japanese Yen is typically used in rollover trades because it carries an interest rate of zero. If you want to know how much you will earn or will pay for rollover fees, then the Swaps Calculator is for you. Please note that Shariah laws forbid the earning of interest on investments, so brokers also have swap-free accounts to cater to Muslim traders. This category of traders will not need the Swaps Calculator.

The Swaps Calculator has 6 elements:

- the currency of the account

- the currency pair to be traded

- trade size

- swap long value (the swap fee the trader receives for holding a long position on the currency with the greater yield)

- swap short value (the swap fee charged to the trader for holding a short position on the higher-yielding currency)

- market price

Look at the snapshot above. The account currency is in Australian Dollars, and the asset to be traded is the AUD/JPY. The Aussie Dollar has a much higher interest rate than the Japanese Yen. For a trade size of $100,000 (equivalent to 1 Standard Lot), the interest paid to the trader for holding a long position on the AUD/JPY is 8.48 AUD, while an interest of AUD 12.80 is deducted for every day the position is held open. You must factor in the rollover swap fees, especially if you are a swing or a position trader who holds trades for an extended period. If there is an interest charge on your position, you must make an allowance for this in your profit targets. If you hold overnight positions on Bitcoin, the charges may pile up so much that they have eroded any profits made on the position. This is why this tool is an indispensable tool for every trader.

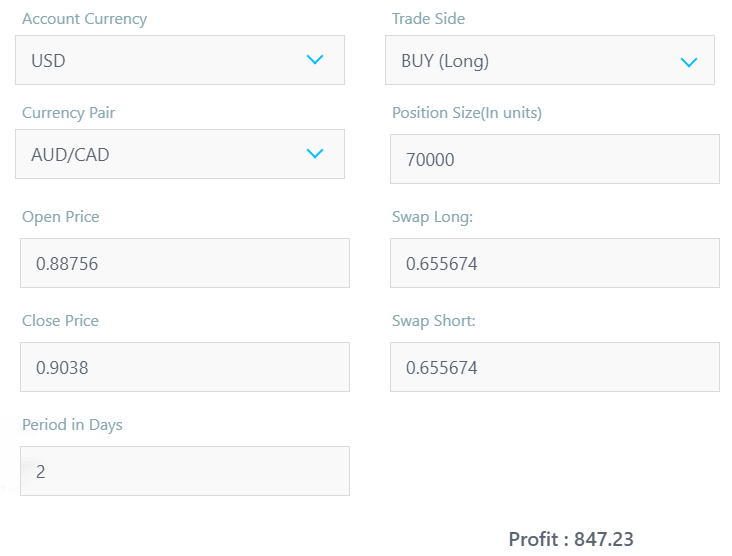

E) Profit Calculator

Some may be wondering why there should be a profit calculator. After all, the MT4 or MT5 platforms display unrealized profits while trades are ongoing. But you must understand that calculators are typically used before setting up trades. You would want to know what you stand to gain after all the trade costs (swap fees, spread, commissions, etc.) have been factored in. This is where the Profit Calculator comes into play.

This tool has several elements.

- account currency

- the currency pair being traded

- your expected entry price

- your expected exit price

- number of days you expect the position to stay open

- type of order (buy or sell)

- position size

- swap long/swap short

Assuming you want to trade 0.7 lots (70,000 units of currency) of the AUD/CAD, and your account currency is in US Dollars. You would enter your entry price and possible exit price. You only fill the swap long if you are executing a BUY, and fill the swap short if you are executing a SELL entry. The calculator will derive your expected profit when all parameters are filled.

Ideally, you would set different parameters to mimic the different potential scenarios that could occur so you have an idea of how the trades will go.