UK Jobs report overview

Early Tuesday, the UK’s Office for National Statistics (ONS) will release the April month Claimant Count figures together with the Unemployment Rate in the three months to March at 06:00 AM GMT.

Given the expectations of sustained rate hikes by the Bank of England (BOE), coupled with the latest testimony from BOE Governor Andrew Bailey confirming fears of inflation, today’s jobs report becomes crucial to recall the GBP/USD pair buyers. Also highlighting today’s employment numbers is the cable’s recent corrective pullback from a two-year low.

The UK labor market report is expected to show that the average weekly earnings, including bonuses, in the three months to March, may remain unchanged at 5.4% while ex-bonuses, the wages are seen rising to 4.2%, from 4.0% prior, during the stated period.

Further, the ILO Unemployment Rate is likely to remain intact for the three months ending in March. It’s worth noting that the Claimant Count Change figures are expected to improve to -38.8K versus -46.9K previous readouts.

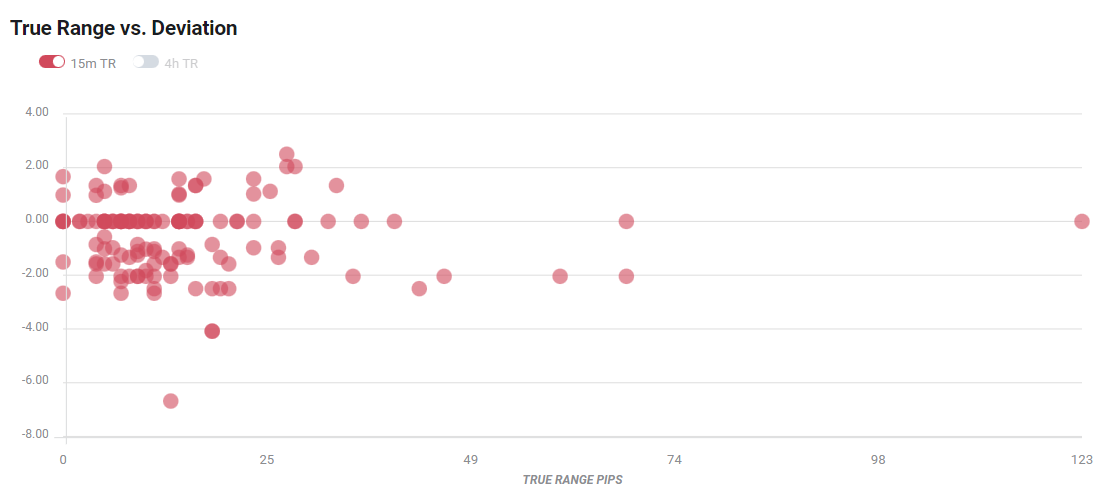

Deviation impact on GBP/USD

Readers can find FXStreet's proprietary deviation impact map of the event below. As observed the reaction is likely to remain confined around 20-pips in deviations up to + or -2, although in some cases, if notable enough, a deviation can fuel movements over 60-70 pips.

How could they affect GBP/USD?

GBP/USD cheers softer USD, as well as cautious optimism in the market, to print a three-day uptrend surrounding 1.2350 heading into Tuesday’s London open.

While the recent improvement in British economic growth and firmer inflation data keeps pushing the BOE towards more rate hikes, today’s employment data need to stay in line to keep the GBP/USD buyers hopeful. Also suggesting an initially positive reaction to the likely upbeat data are the latest comments from BOE Governor Andrew Bailey during his testimony to House Finance Committee.

As a result, FXStreet’s Yohjay Elam said, “All in all, UK job figures may boost GBP/USD temporarily, but fail to trigger a more-pronounced upside turn for the currency pair.”

Even so, major attention is given to the Fed’s rate hike and hence today’s US Retail Sales for April and Fed Chairman Jerome Powell’s speech will be more important for the cable traders.

Technically, GBP/USD recently confirmed a falling wedge bullish chart pattern with a clear break above 1.2300, suggesting further advances towards the monthly high surrounding 1.2640. The recovery moves also gain support from the MACD line’s impending bull cross and nearly oversold RSI.

Alternatively, a downside break of 1.2280 will negate the bullish breakout and can drag the quote back to the latest lows surrounding 1.2155.

Key notes

GBP/USD marches towards 1.2350 ahead of UK Employment data

GBP/USD Price Analysis: Bears waiting to take a bite out of bullish correction

GBP/USD regains 1.2300 despite Brexit woes, BOE’s Bailey, focus on UK jobs, US Retail Sales

UK Jobs Preview: Why GBP/USD may offer an early selling opportunity, and when

About UK jobs

The UK Average Earnings released by the Office for National Statistics (ONS) is a key short-term indicator of how levels of pay are changing within the UK economy. Generally speaking, the positive earnings growth anticipates positive (or bullish) for the GBP, whereas a low reading is seen as negative (or bearish).